Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A42

Collective Investment Schemes – Registered as overseas

subsidiary companies

The reporting currency of the overseas subsidiaries is the US

dollar. Moreover, the portfolio assets of the Funds issued by these

subsidiaries are denominated exclusively in US dollars. As a result,

there is nomaterial exchange rate risk in those Funds. Moreover, the

translation effect of the subsidiaries on the Group’s Consolidated

Financial Statements is considered minimal.

Proprietary Investments

The proprietary foreign currency assets and liabilities of the

Corporation as at 31 December, 2012 and as at 31 December, 2011

are provided below.

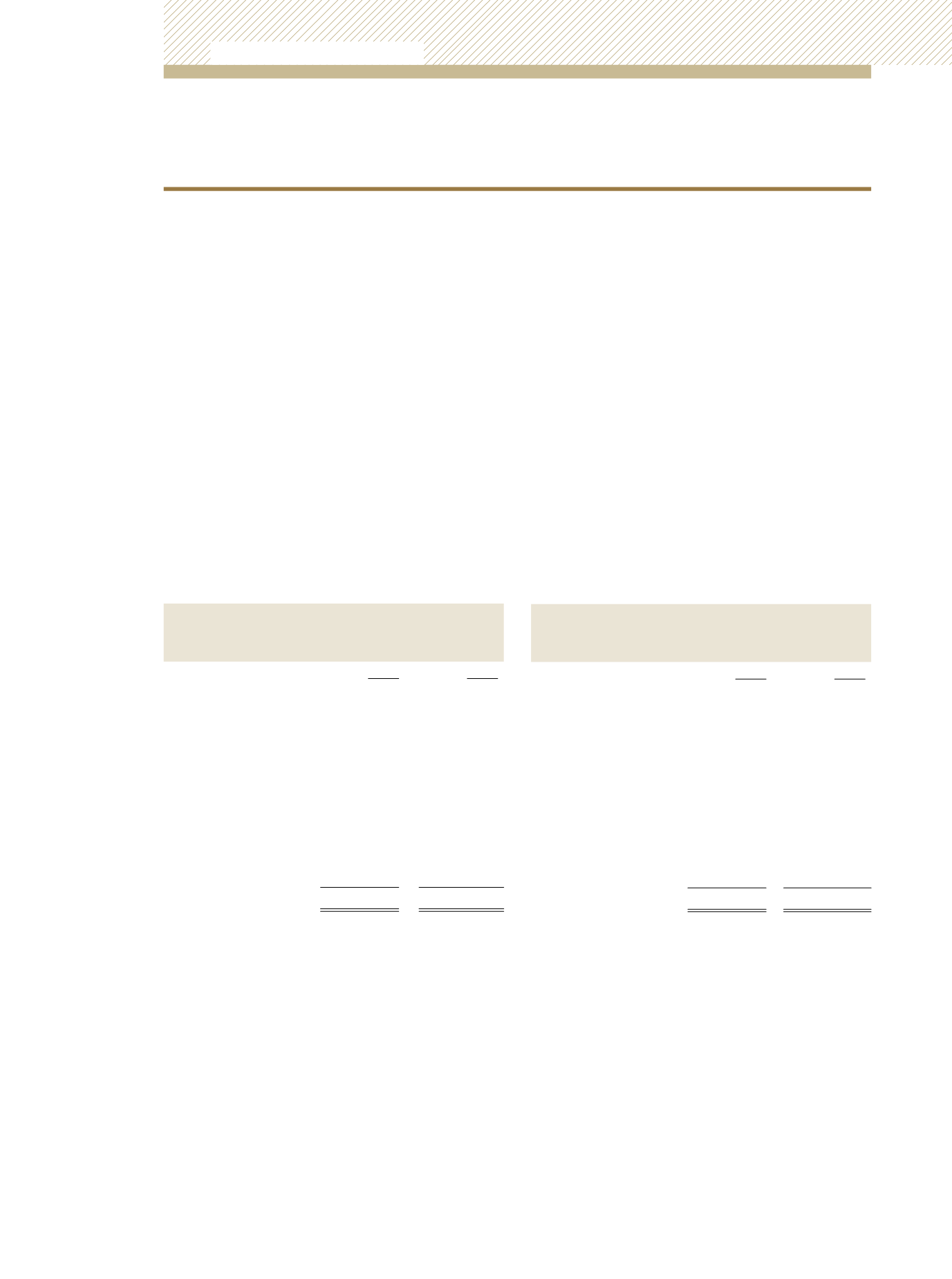

At 31 December, 2012

US$

Other

(Presented

in TT$)

(Presented

in TT$)

$’000

$’000

Assets

Cash & Cash Equivalents

374,400

-

Money Market Instruments

995

-

Fixed Income Securities

941,637

-

Equities & Mutual Funds

334,208

-

Liabilities

Financial Instruments

(912,678)

-

Other liabilities

(13,587)

-

Total

724,975

-

29) FINANCIAL RISK MANAGEMENT

(continued)

Exchange rate risk

(continued)

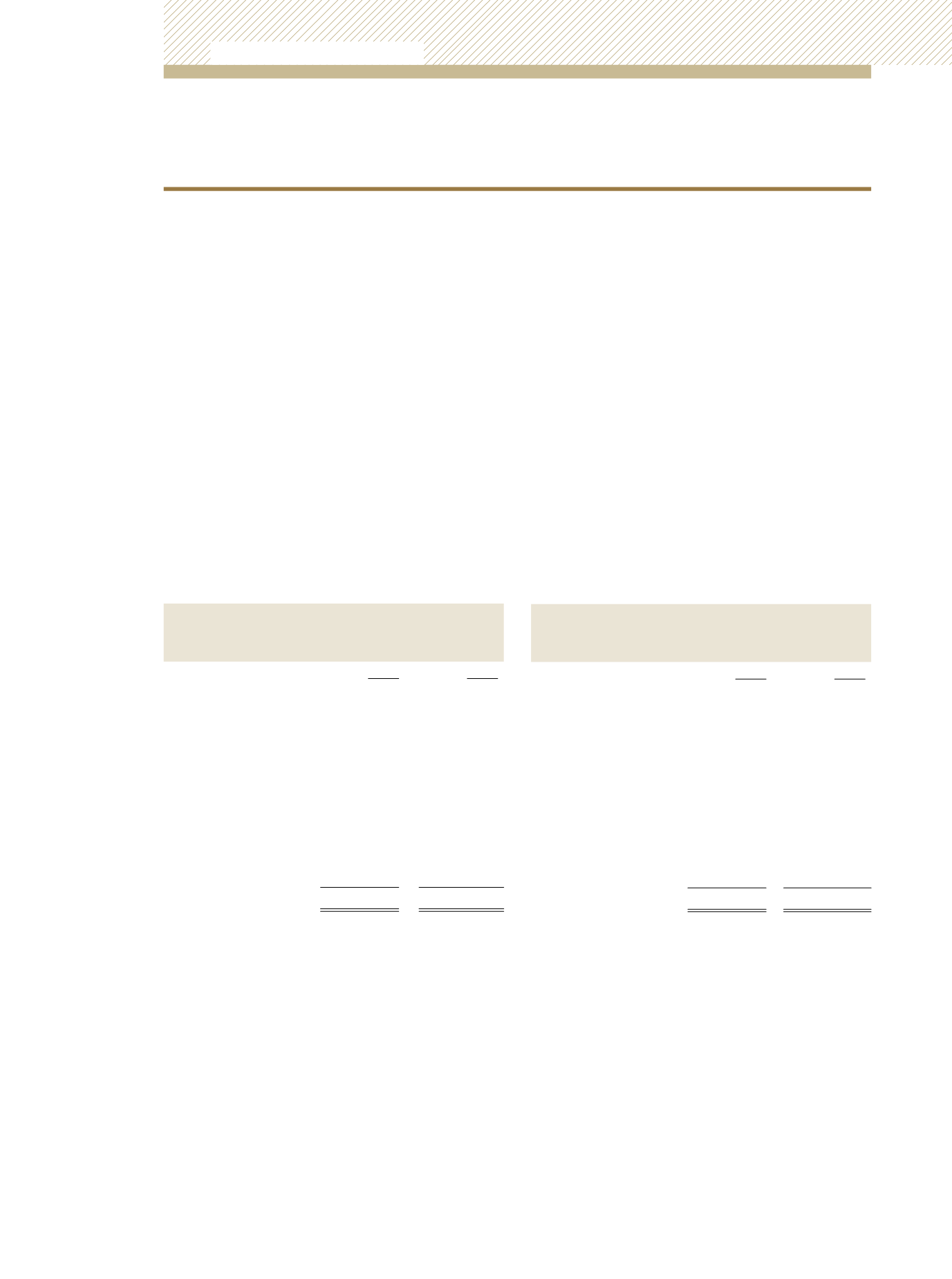

At 31 December, 2011

US$

Other

(Presented

in TT$)

(Presented

in TT$)

$’000

$’000

Assets

Cash & Cash Equivalents

86,096

-

Money Market Instruments

52,510

-

Fixed Income Securities

1,700,569

-

Equities

248,950

-

Liabilities

Financial Instruments

(1,802,843)

-

Other liabilities

(7,805)

-

Total

277,477

-

A 1% change in the TT dollar relative to the US dollar as at that date

would have affected the net income position of the Corporation by

TT$7.25 million as at 31 December, 2012 and by TT$2.77 million as

at 31 December, 2011.

Unit Trust Corporation

Annual Report 2012