Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A39

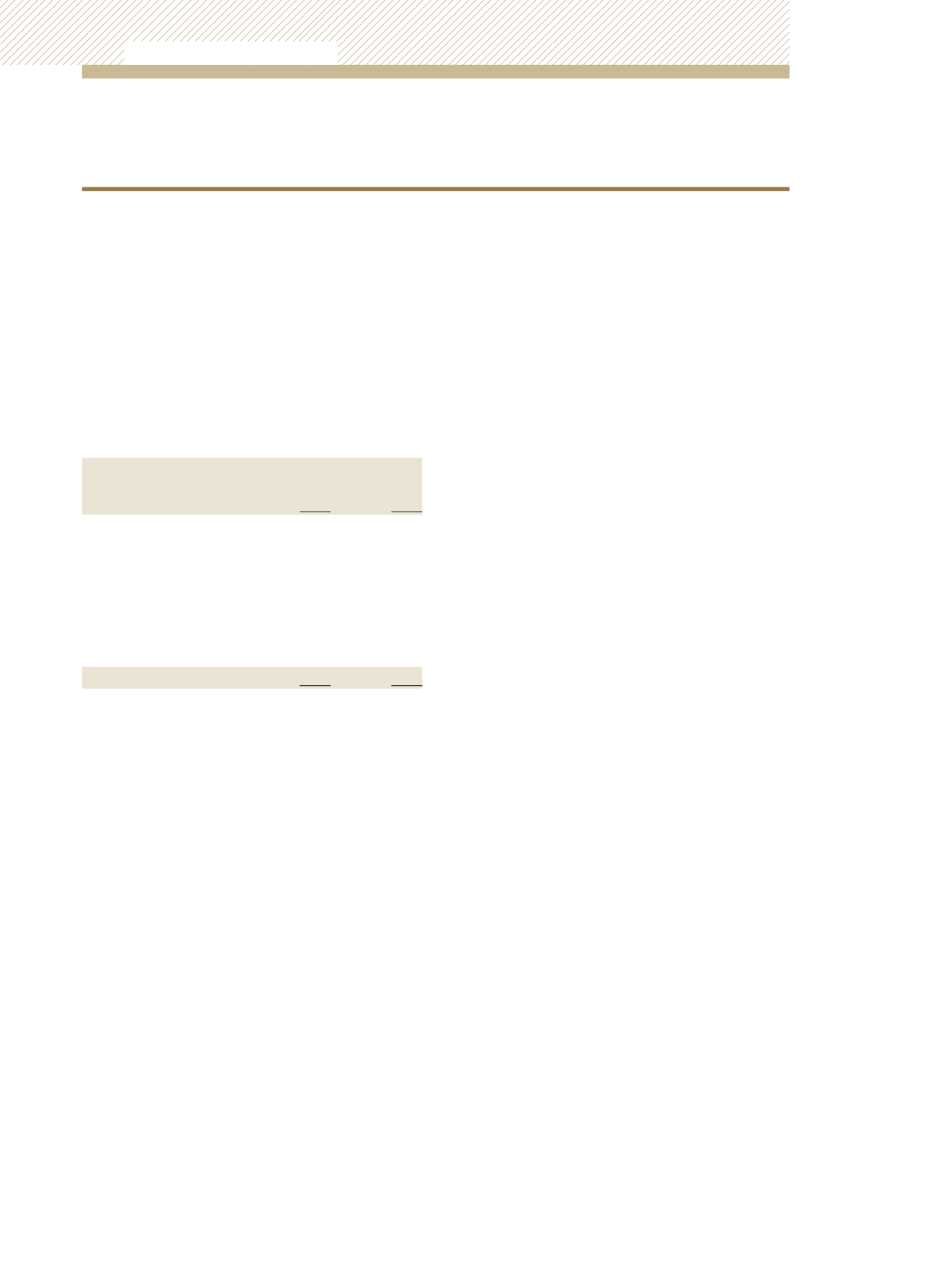

Sensitivity analysis was conducted to determine the effect had

US interest rates changed by 1%. With all other variables held

constant, net assets attributable to unit holders and equity would

have decreased or increased as at 31 December, 2012 and 31

December, 2011 as follows:

100 basis point increase

31 December,

2012

31 December,

2011

$’000

$’000

UTC Energy Fund

-

-

UTC European Fund

(1)

(7)

UTC Asia Pacific Fund

-

-

UTC Latin American Fund

-

-

UTC Global Bond Fund

(61)

(62)

UTC North American Fund

(231)

(1,685)

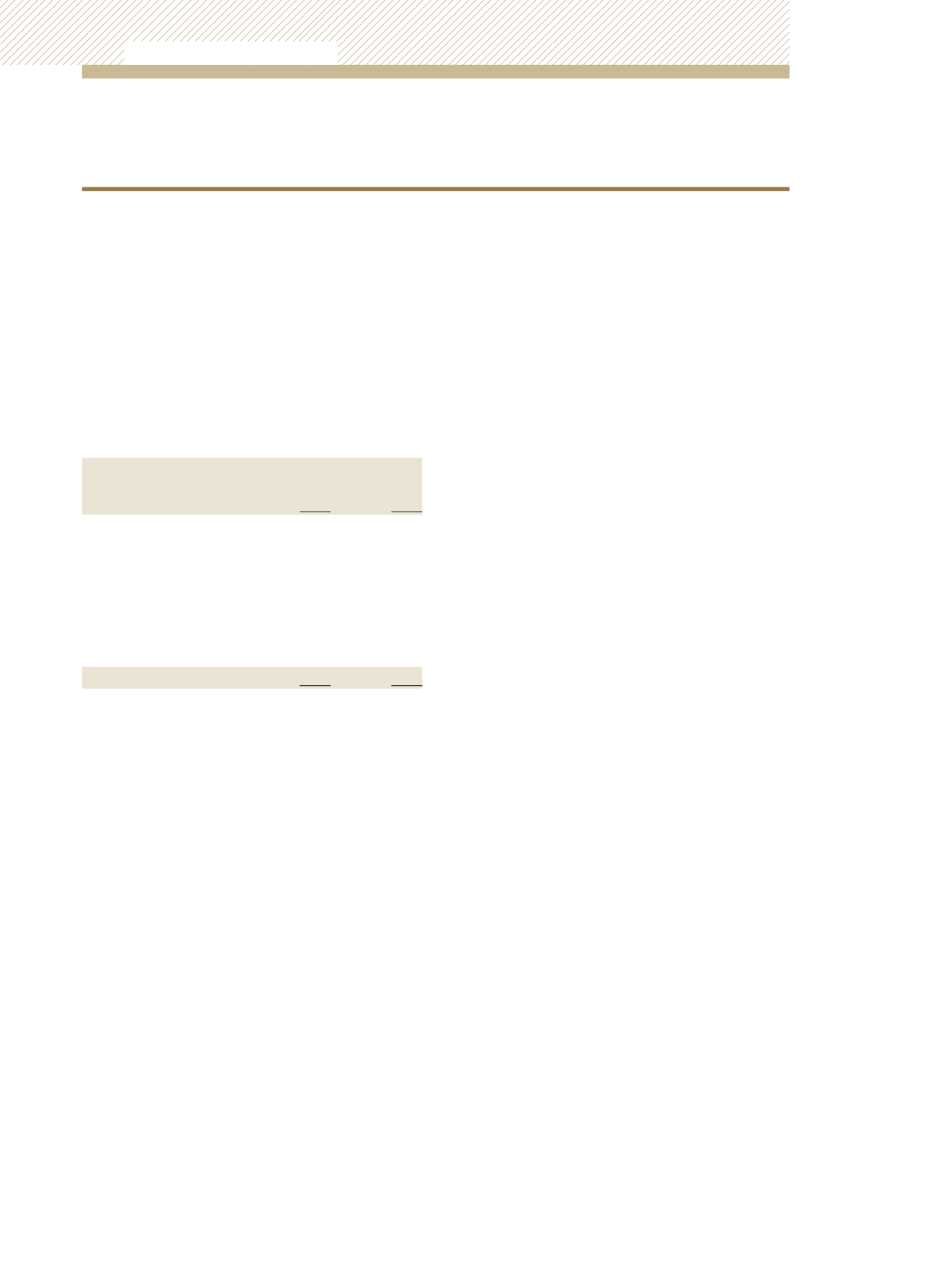

100 basis point decrease

$’000

$’000

UTC Energy Fund

-

-

UTC European Fund

1

7

UTC Asia Pacific Fund

-

-

UTC Latin American Fund

-

-

UTC Global Bond Fund

65

66

UTC North American Fund

243

1,806

Proprietary Investments

The Corporation’s proprietary interest bearing asset and liability

positions are exposed to movements in market rates of interest.

A surplus of interest bearing assets in relation to interest bearing

liabilities exposes intermediation earnings to declines in market

interest rates. Conversely, a deficit of interest bearing assets in

relation to interest bearing liabilities exposes intermediation

earnings to increases in market interest rates.

In general, the Corporation focuses on controlling the rate re-

pricing mis-match between assets and liabilities so as to maintain

a stable, consistent spread over its cost of funds. This is achieved by

maintaining a reasonably substantial variable rate asset portfolio, by

active management of the maturity profile of funding instruments

and by holding a minimum level of readily tradable assets.

29) FINANCIAL RISK MANAGEMENT

(continued)

Interest rate risk

(continued)

Unit Trust Corporation

Annual Report 2012