Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A36

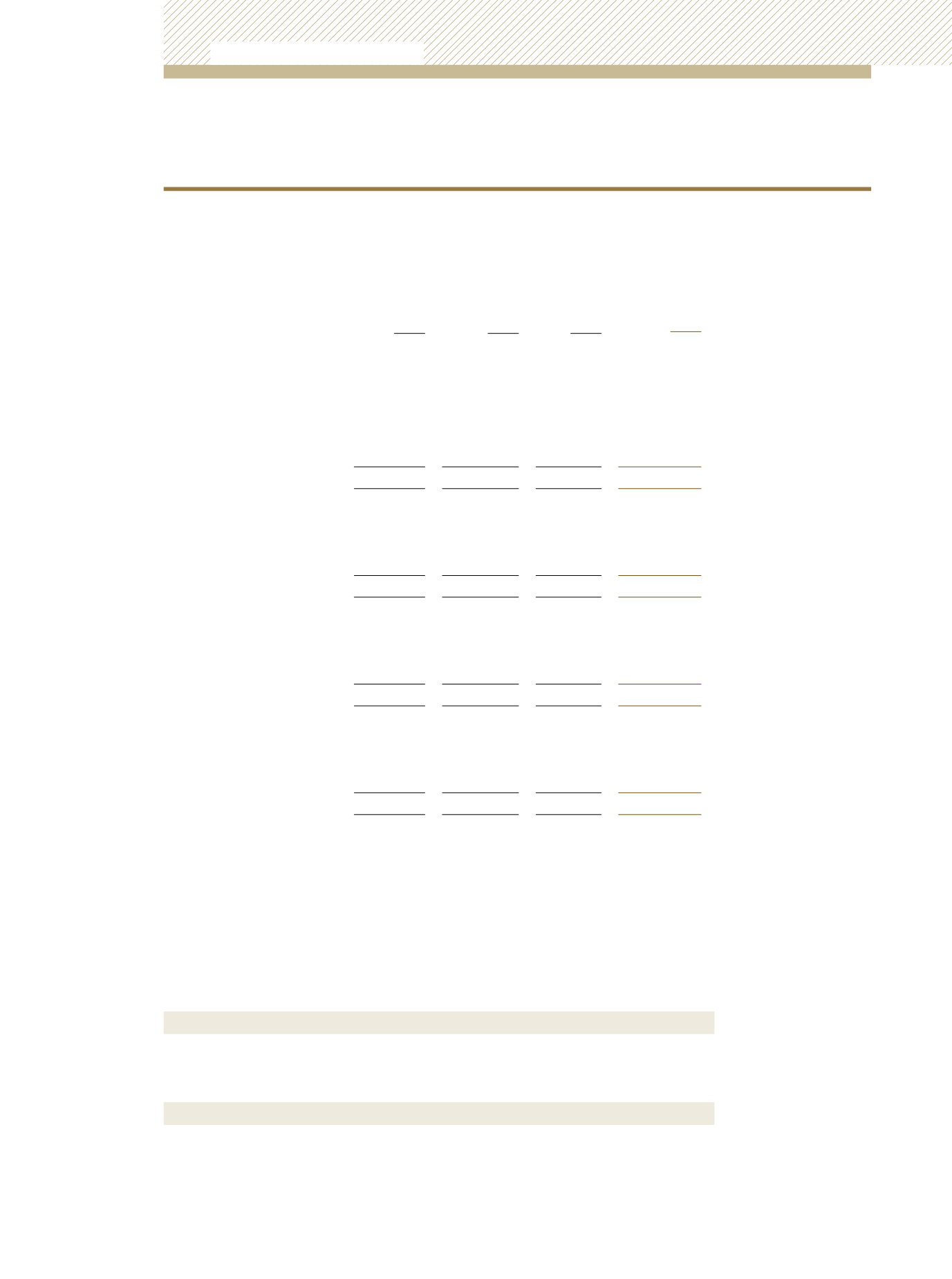

Less than

1 year

Between 1

and 5 years

Over 5

years

Total

$’000

$’000

$’000

$’000

At 31 December, 2011

Growth and Income Fund

Debt instruments – traded

-

-

8,614

8,614

Debt instruments – non-traded

310,134

103,532

291,246

704,912

Cash & other net assets

324,574

-

-

324,574

634,708

103,532

299,860

1,038,100

TT$ Income Fund

Debt instruments – traded

161,533

-

111,759

273,292

Debt instruments – non-traded

4,861,990

802,471

3,041,934

8,706,395

Cash & other net assets

1,577,090

-

-

1,577,090

6,600,613

802,471

3,153,693

10,556,777

Universal Retirement Fund

Debt instruments – traded

-

-

-

-

Debt instruments – non-traded

10,464

18,747

27,582

56,793

Cash & other net assets

15,586

-

-

15,586

26,050

18,747

27,582

72,379

US$ Income Fund

Debt instruments - traded

-

107,628

-

107,628

Debt instruments – non-traded

2,616,106

346,701

697,393

3,660,200

Cash & other net assets

573,643

-

-

573,643

3,189,749

454,329

697,393

4,341,471

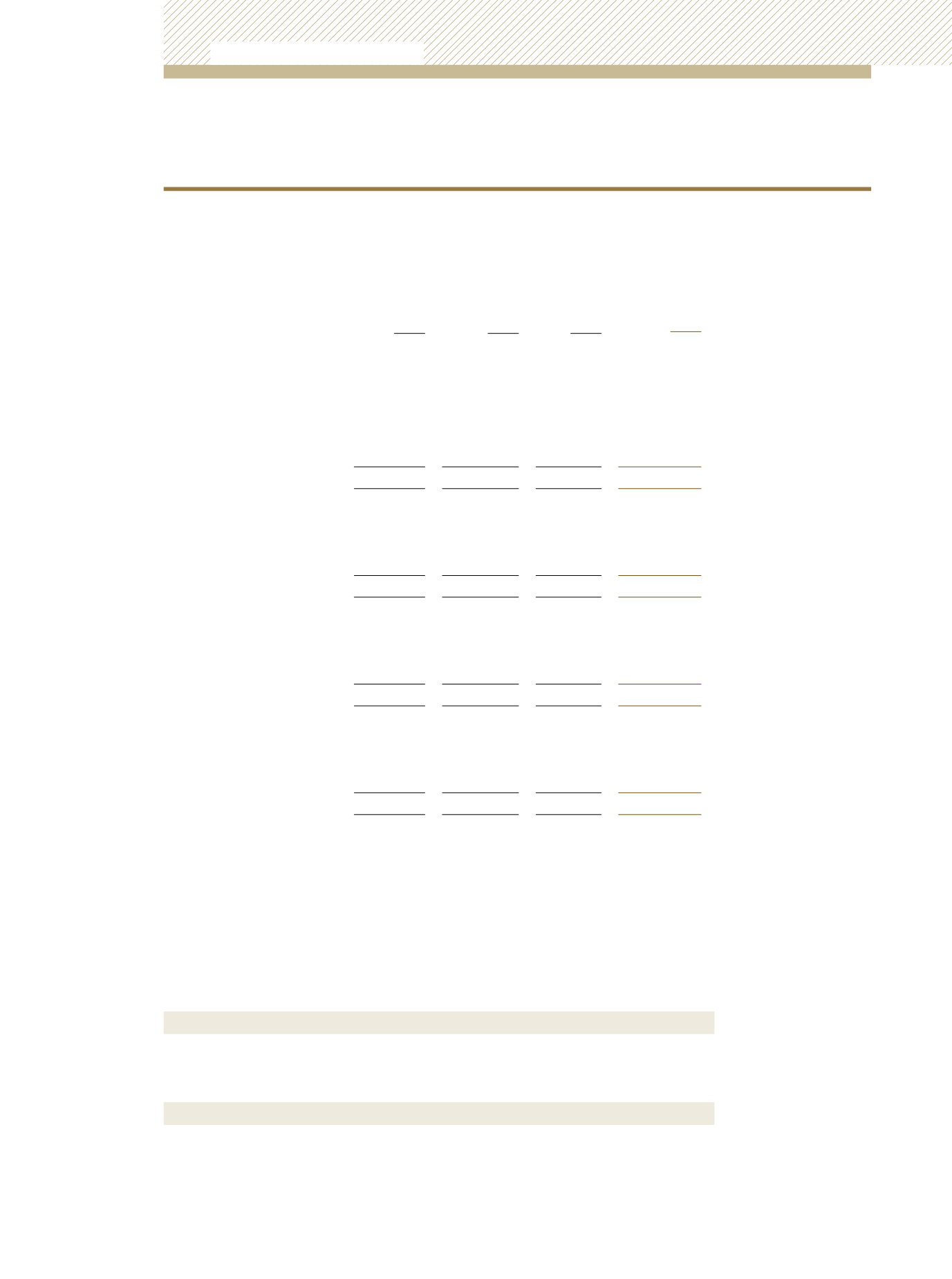

As at 31 December 2012, the Funds’TT dollar denominated fixed income positions were primarily categorized as held-to-maturity and as a

consequence changes in TT dollar interest rates would not have materially affected the net assets of the portfolios given that this category

of financial asset is always carried at amortized cost in accordance with IFRS.

On the other hand, a number of US dollar denominated fixed income positions held by the local TT domiciled Funds are categorized as

available-for-sale and as such changes in US dollar interest rates would affect the net assets of the portfolios given that this category of

financial asset is always carried at fair value in accordance with IFRS.

With all other variables held constant, sensitivity analysis performed for a 1% increase and decrease in US interest rates as at 31 December,

2012 and 31 December, 2011 would have had the following estimated impact on the net assets of the individual portfolios:

100 basis point increase

31 December, 2012

31 December, 2011

Growth & Income Fund

($1.40 million)

($1.58 million)

TT$ Income Fund

($3.27 million)

($18.22 million)

US$ Income Fund

($37.49 million)

($23.47 million)

100 basis point decrease

31 December, 2012

31 December, 2011

Growth & Income Fund

$1.50 million

$1.71 million

TT$ Income Fund

$3.47 million

$19.20 million

US$ Income Fund

$36.61 million

$24.95 million

The Universal Retirement Fund had no exposure to US interest rate movements as at 31 December, 2012 or as at 31 December, 2011.

29) FINANCIAL RISK MANAGEMENT

(continued)

Interest rate risk

(continued)

Unit Trust Corporation

Annual Report 2012