Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A34

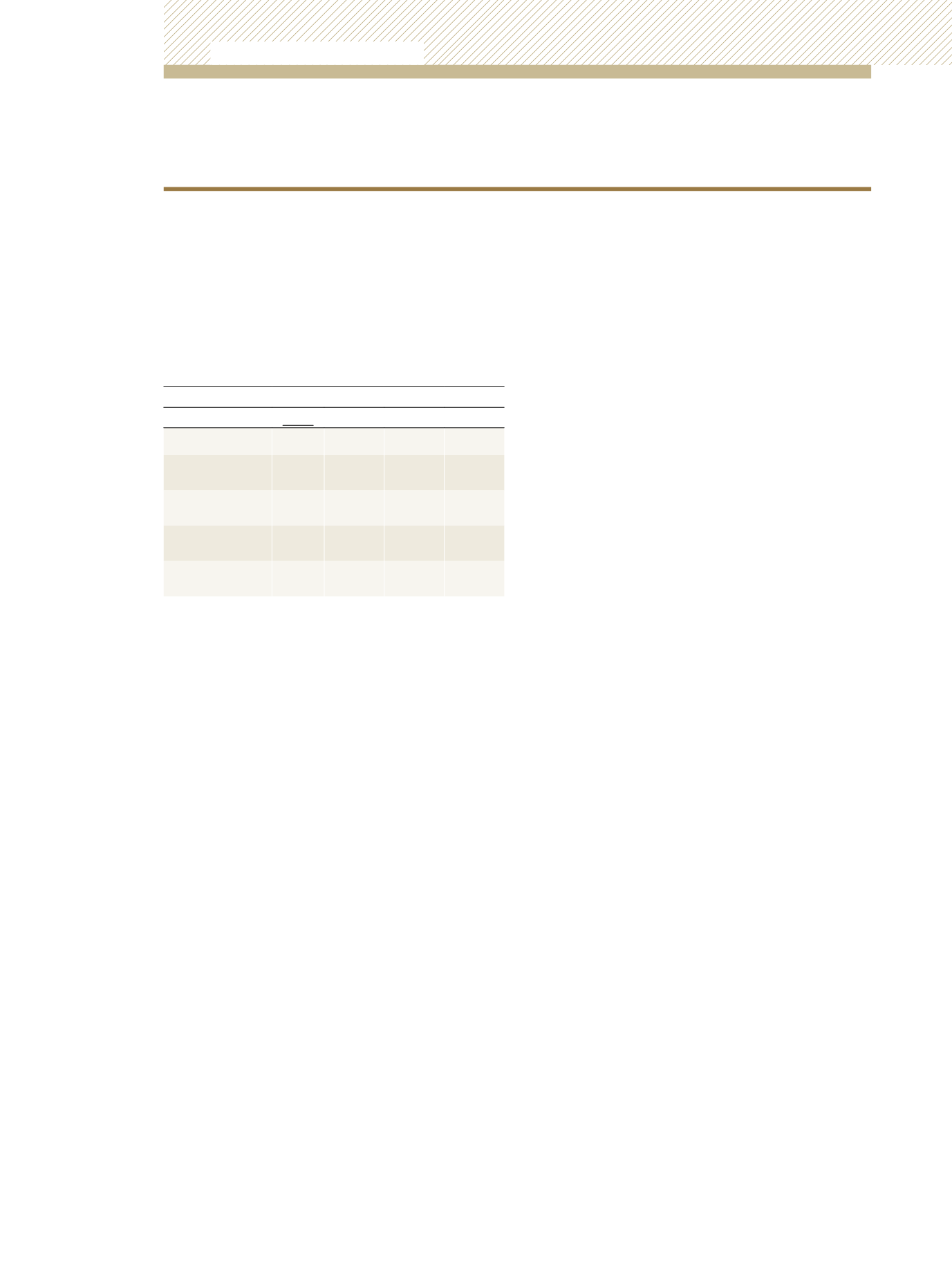

As at 31 December 2012 and 31 December 2011, using the S&P

500 Index, had US equity securities prices changed as a whole by

5% (with all other variables held constant), the respective net asset

values would have changed in both dollar and percentage terms

as follows:

2012

2011

$’000

%

$’000

%

UTC Energy Fund 1,656

5.6

1,540

6.1

UTC European

Fund

257

4.2

292

5.5

UTC Asia Pacific

Fund

506

4.6

484

4.5

UTC Latin

American Fund

341

5.1

353

5.3

UTC North

American Fund

5,781

1.9

859

3.8

The Global Bond Fund does not hold equity positions.

Proprietary Investments

The Corporation holds shares/units in the Collective Investment

Schemes that it has registered as overseas investment companies.

This aggregate shareholding was valued at the equivalent of

TT$260.9 million and as such the exposure to equity price risk is

proportionate to that disclosed in the preceding section.

In addition, the Corporation holds strategic positions in eight (8)

unquoted equities with a total book value equivalent to TT$73.3

million. These positions are assumed to be uncorrelated with

recognised stock exchanges and as such equity price risk is deemed

immaterial for these positions.

Interest rate risk

Collective Investment Schemes – Registered locally as

unit trusts

The Collective Investment Schemes’ holdings of listed and unlisted

debt instruments are exposed to movements in market rates of

interest. In general, rising interest rates expose the portfolios to

deterioration in net assets arising out of lower carrying values for

bonds (fair value interest rate risk). Conversely, falling interest rates

can expose the portfolios to potential diminution in earnings on

variable rate instruments (cash flow interest rate risk).

29) FINANCIAL RISK MANAGEMENT

(continued)

Equity price risk

(continued)

Unit Trust Corporation

Annual Report 2012