Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A26

19) INVESTMENT INCOME –

INVESTMENT FUNDS

The Investment Income of the Funds reported in the Consolidated

Statement of Income excludes transfers from the Corporation.

During 2012 the Corporation transferred Income in the amount of

$178 million to the US$ Income Fund.

20) NET INVESTMENT INCOME –

GROUP CONTINUING OPERATIONS

Net Investment Income – Group Continuing Operations - includes

the contribution to revenue of Treasury operations and the

subsidiaries. It comprises the following:

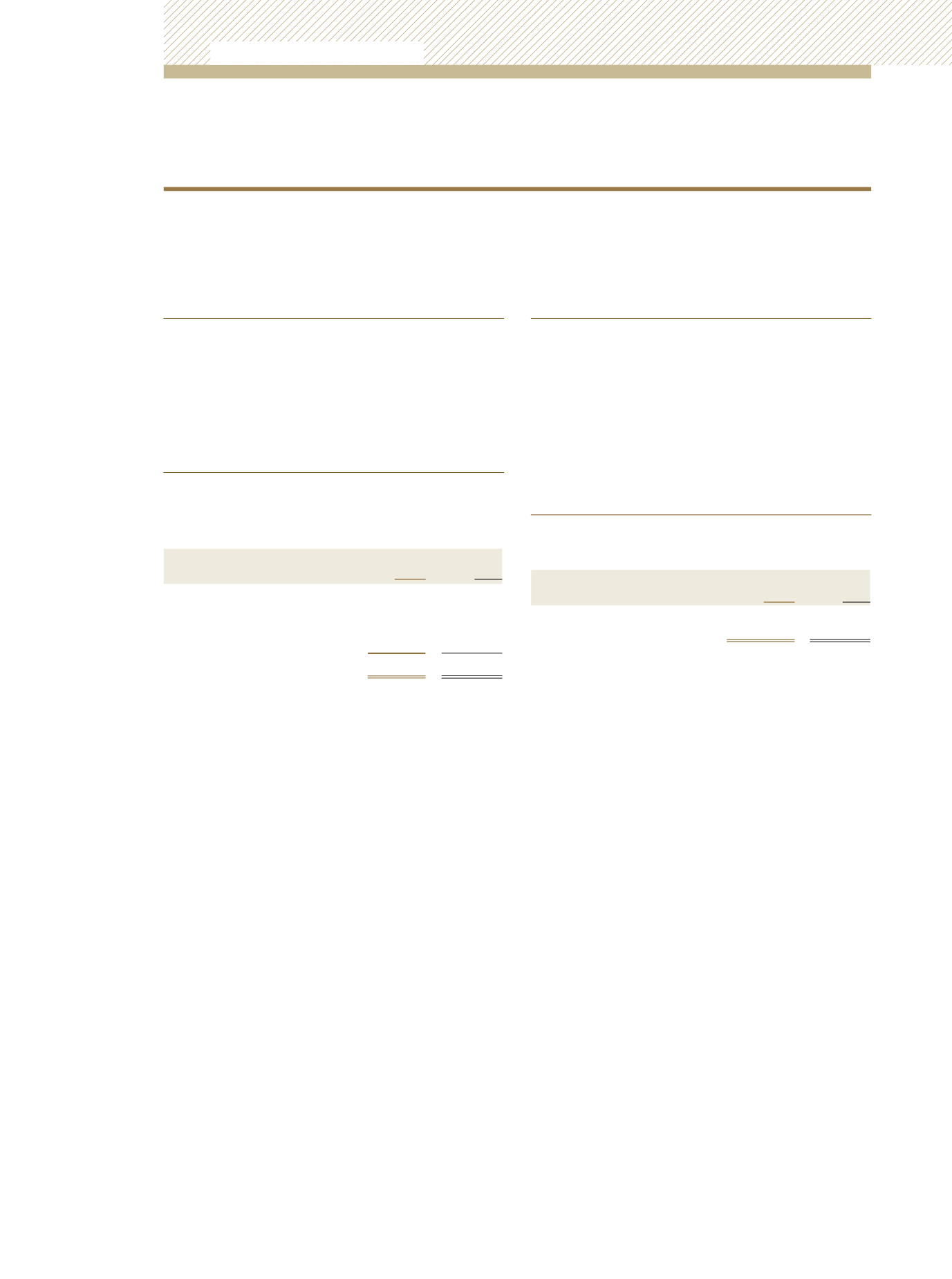

2012

$’000

2011

$’000

Net Investment Income

Interest and Other Fee Income

63,142

21,697

Interest Expense and Other Charges

(31,843)

(1,626)

Total

31,299

20,071

21) REALIZED GAINS RE-CLASSIFIED

FROM EQUITY

Un-realised gains in the amount of $392 million were recognised in

Equity on the revaluation of available-for-sale bonds during 2012.

On receipt of principal payments and on disposals with respect to

the bonds, the relevant portion of the un-realised gains in Equity

was re-classified to the Consolidated Statement of Income. The

total un-realised gains re-classified from Equity to the Consolidated

Statement of Income was $155 million.

22) FOREIGN EXCHANGE GAINS/(LOSSES)

The exchange differences credited to the Consolidated Statement

of Income are included in Other Income as follows:

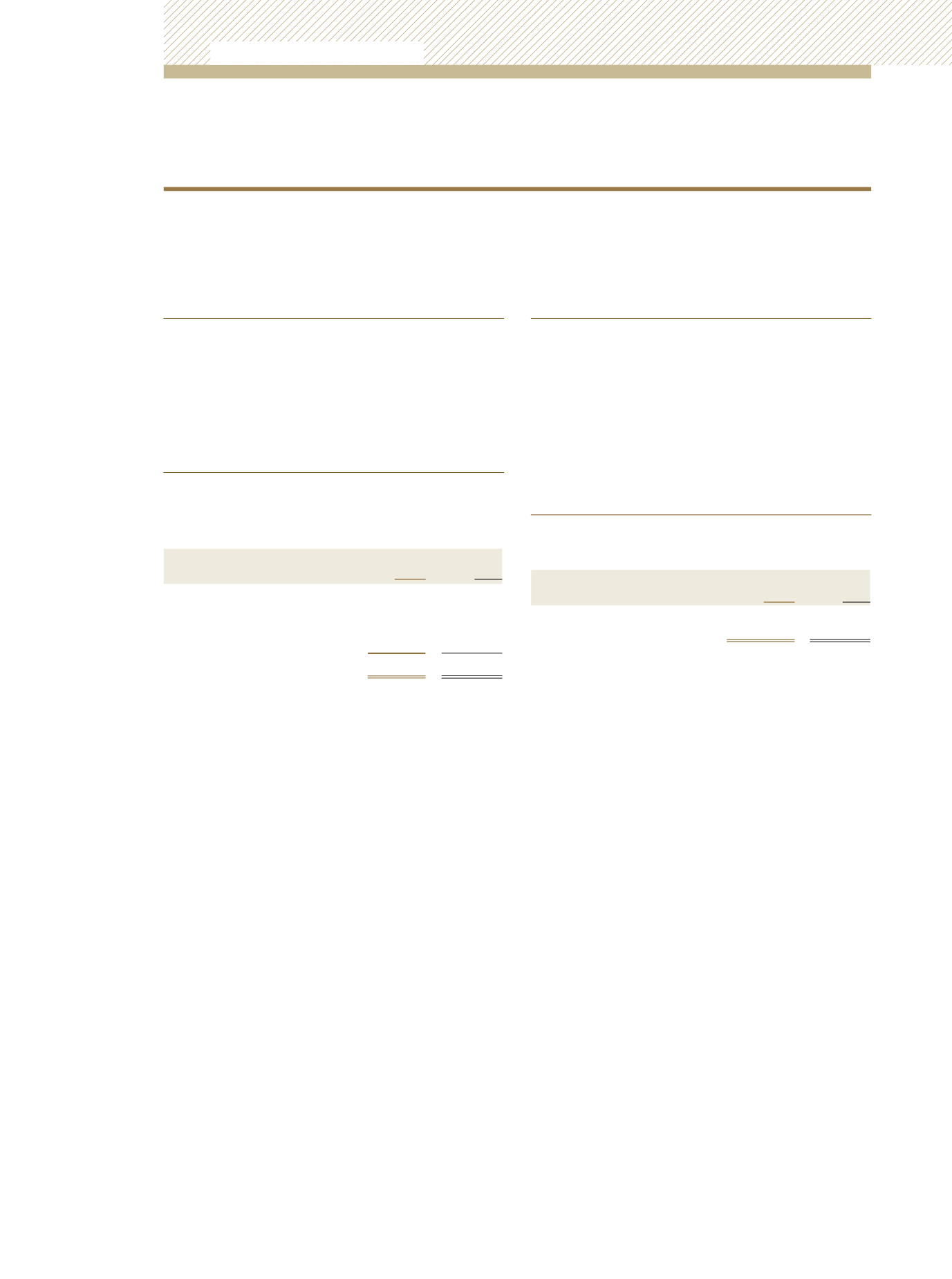

2012

$’000

2011

$’000

Foreign exchange gains –

continuing operations

1,618

1,823

Unit Trust Corporation

Annual Report 2012