Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A20

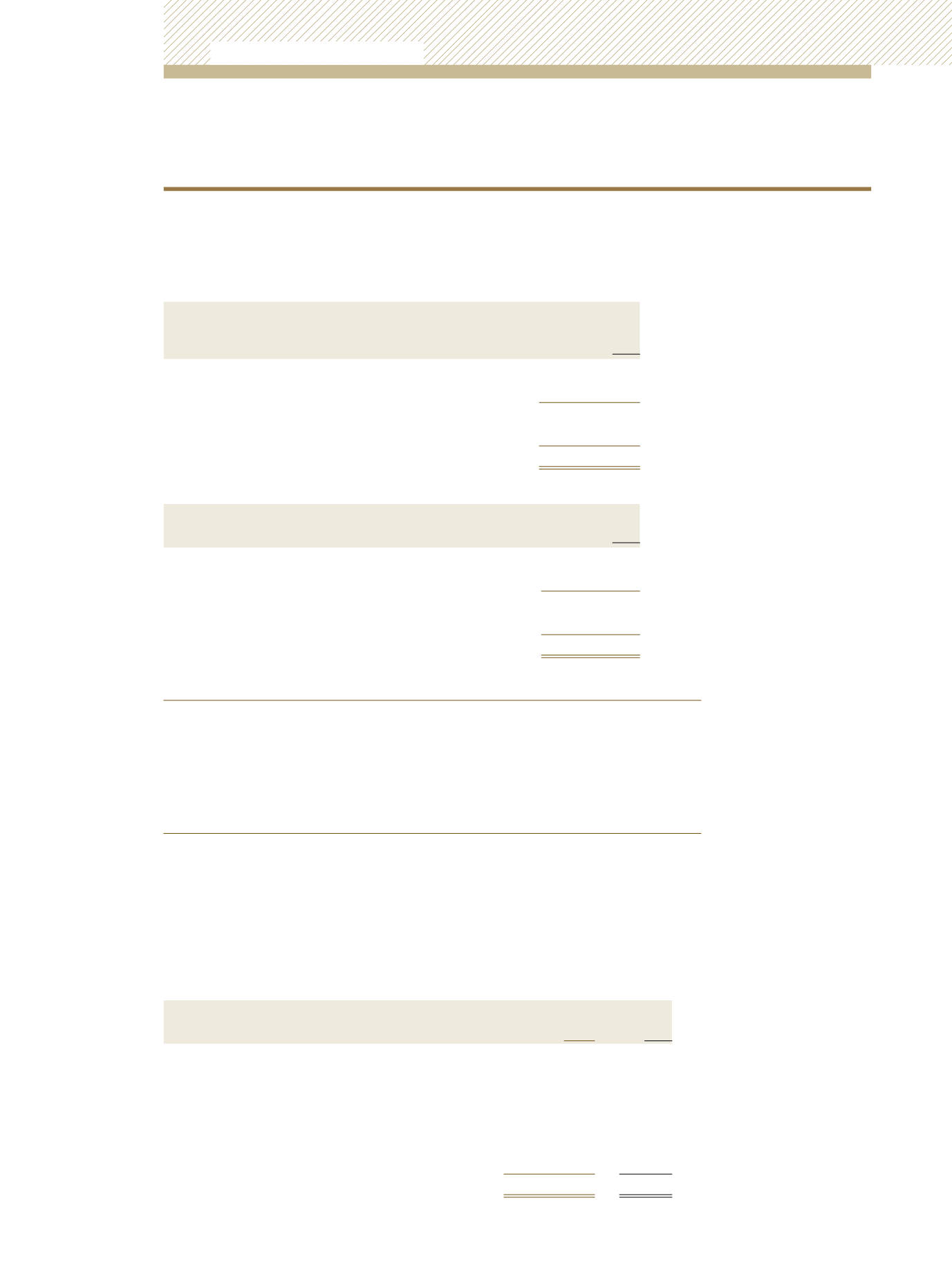

The movement in deferred tax assets and liabilities during the year was as follows:

Deferred Tax Liability

Accelerated Tax

Depreciation

$’000

Balance at 1 January 2011

5,253

Charged to the Consolidated Statement of Income 2011

664

Balance as at 31 December 2011

5,917

Charged to the Consolidated Statement of Income 2012

561

Balance as at 31 December 2012

6,478

Deferred Tax Asset

Tax Losses

$’000

Balance at 1 January 2011

(3,009)

Charged to the Consolidated Statement of Income 2011

241

Balance as at 31 December 2011

(2,768)

Charged to the Consolidated Statement of Income 2012

499

Balance as at 31 December 2012

(2,269)

10) SINKING FUND LIABILITY

The Corporation is contractually obligated to generate minimum returns on two (2) sinking funds that

it manages. The sum of $13.6 million represents the shortfall of the actual balances with respect to the

targeted balances as at 31 December, 2012 (2011 $7.8 million). The liability on one Sinking Fund ($5.7

million) crystallises in December 2013.

11) RETIREMENT BENEFITS

Prior to 1 January, 2001 the Unit Trust Corporation Pension Fund Plan (

the Plan

) had been a defined

benefit plan. The Plan received formal approval during 2002 for conversion to a defined contribution plan

with effect from 1 January, 2001 with pre 1 January, 2001 benefits guaranteed. Retirement benefits are

currently paid out of the Fund and are guaranteed for life. The defined benefits comprise a small portion

of Plan benefits.

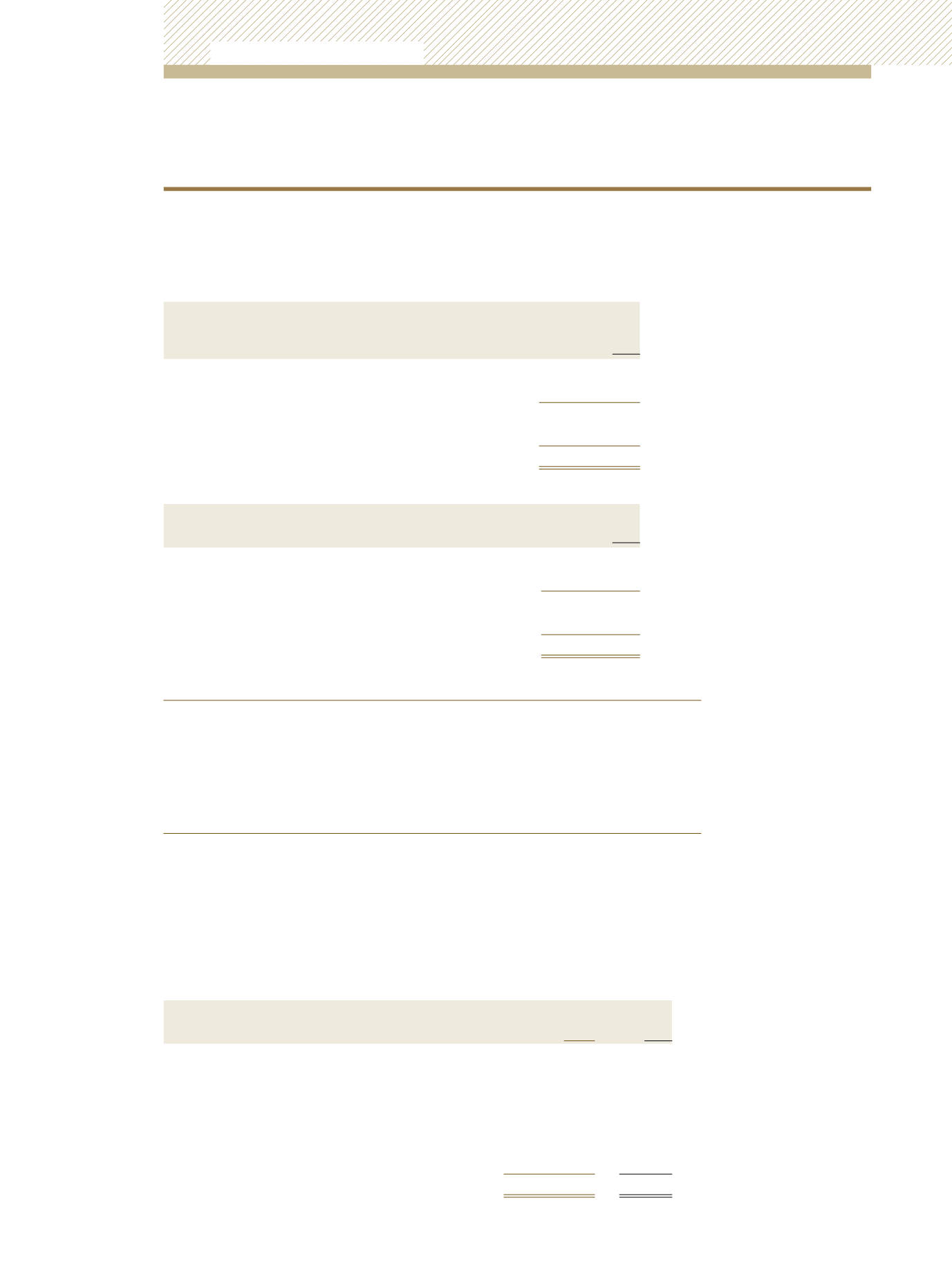

(a) Changes in the present value of the defined benefit obligations are as follows:

2012

2011

$’000

$’000

Opening present value of defined benefit obligation

109,100

-

Current service costs

7,865

-

Plan participant contributions

3,595

-

Interest cost

8,693

-

Actuarial Losses

10,618

-

Benefit paid

(3,573)

-

Closing present value of defined benefit obligation

136,298

-

9) DEFERRED TAX

(continued)

Unit Trust Corporation

Annual Report 2012