Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A28

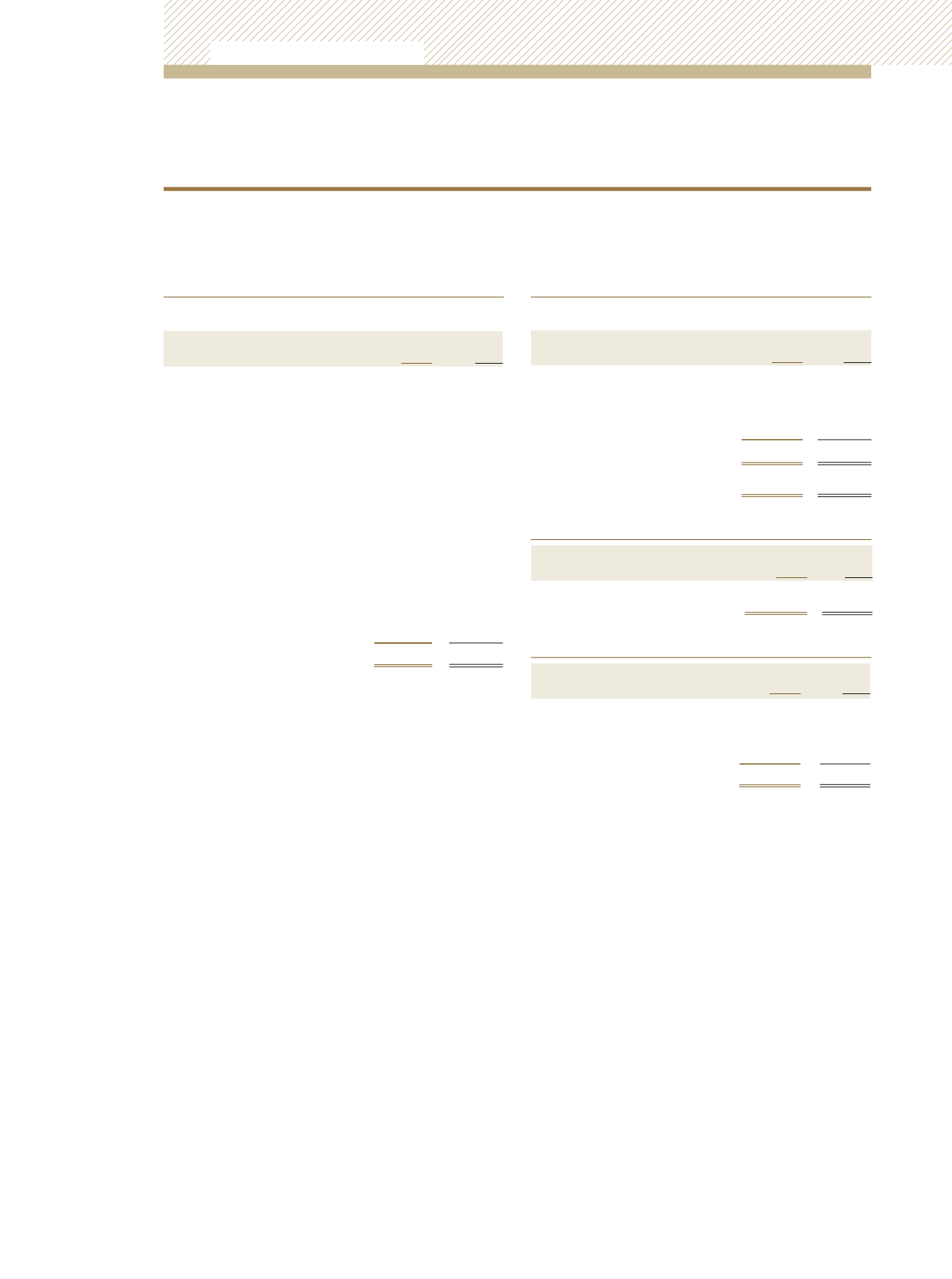

24) ADMINISTRATIVE EXPENSES

Administrative expenses comprised:

2012

$’000

2011

$’000

Audit fees

763

732

Bank charges

2,062

2,005

Building maintenance

4,522

4,704

Directors’ fees

2,037

1,939

General administration

45,277

45,833

Insurance

2,410

2,278

Impairment loss - non-financial assets

5,085

-

Marketing and advertising

12,640

11,940

Professional services

30,359

19,415

Rental of premises

5,702

5,885

Security

12,732

12,423

Staff costs (Note 25)

98,882

94,559

TOTAL

222,471

201,713

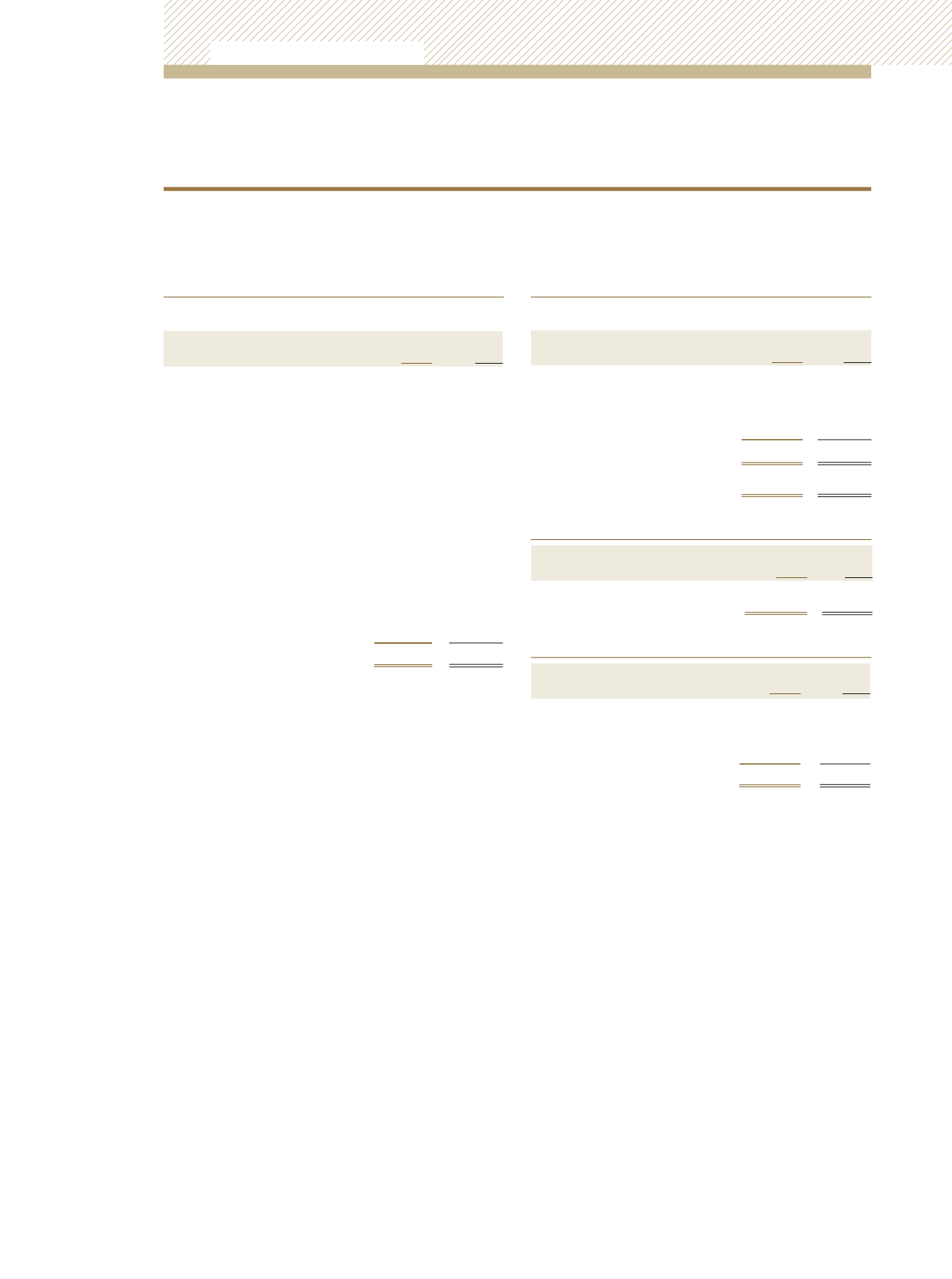

25) STAFF COSTS

2012

$’000

2011

$’000

Salaries and benefits

87,882

81,610

Pension costs

7,536

9,619

National insurance

3,464

3,330

Total

98,882

94,559

Number of employees

495

516

26) FINANCE CHARGES

2012

$’000

2011

$’000

Long-term bonds (Note 7)

235

324

27) DISTRIBUTIONS

2012

$’000

2011

$’000

Growth and Income Fund

73,758

88,896

TT$ Income Fund

143,848

188,313

US$ Income Fund

41,253

77,561

Total

258,859

354,770

a) Growth and Income Fund

The Growth and Income Fund paid $73.8 million to its unit holders

in respect of its June 2012 and December 2012 distributions

(2011: $88.9 million). Included in the $73.8 million, referred to, are

distributions to Initial Capital Contributors of $0.3 million (2011:

$0.4 million).

b) TT$ Income Fund

Distributions in the TT$ Income Fund are made quarterly in

February, May, August and November. Income accrued as at 31

December, 2012 for distribution in the quarter ending February

2013 amounted to $12.6 million (2011: $12.8 million).

c) US$ Income Fund

Distributions in the US$ Income Fund are paid by calendar quarters.

Unit Trust Corporation

Annual Report 2012