Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A19

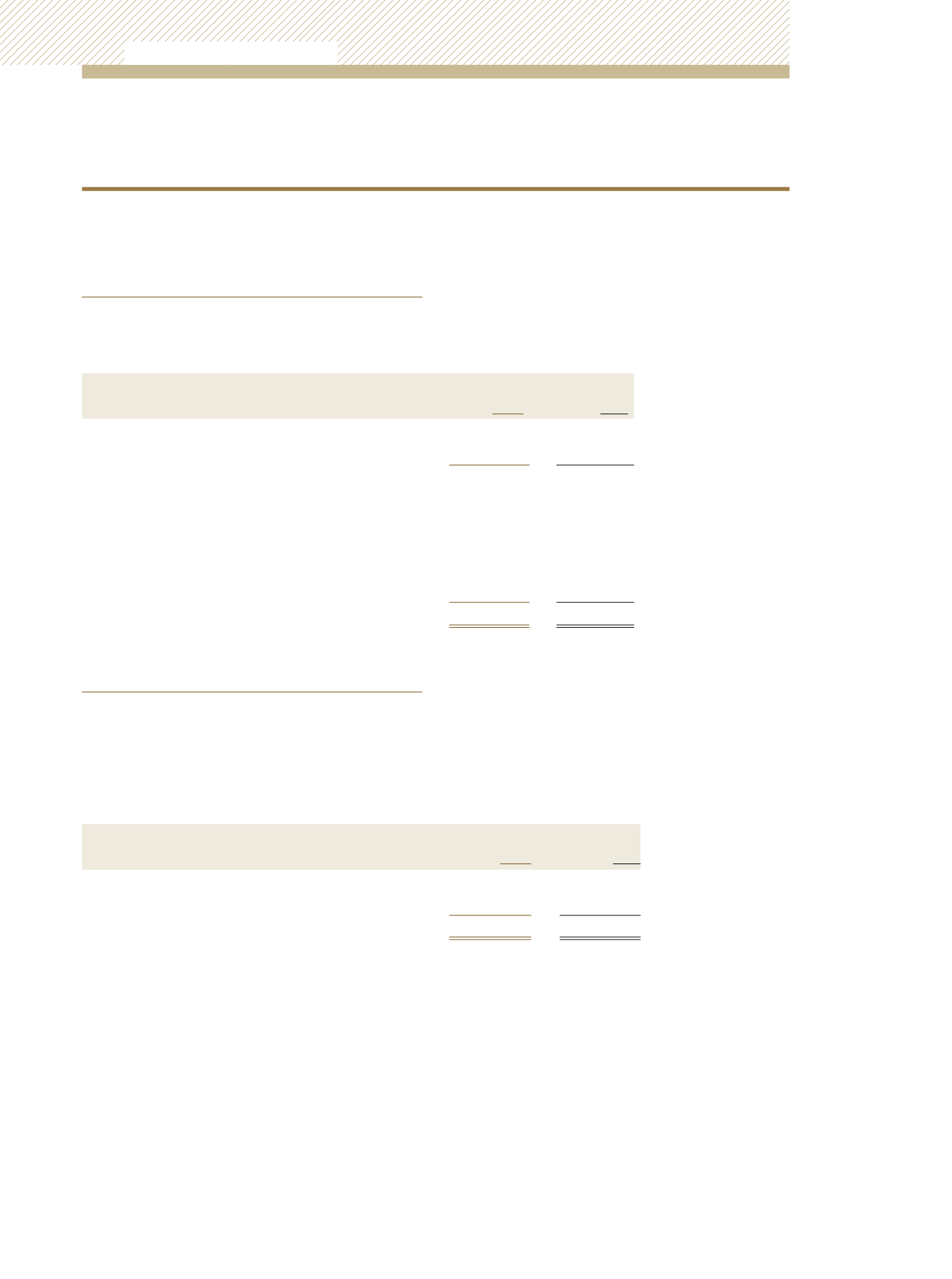

8) TAXATION

The local subsidiary companies are subject to Corporation Tax and

foreign subsidiaries are subject to taxation relevant to their country

of domicile.

2012

2011

$’000

$’000

Net income from continuing operations before taxation

102,992

101,460

Corporation tax rate 0% for the Corporation

-

-

Corporate tax at 25% for local subsidiaries

1,060

905

Corporate tax for foreign subsidiaries

349

232

Withholding tax

5,268

4,153

Business Levy payments

118

23

Green Fund Levy payments

492

489

Tax charge

7,287

5,802

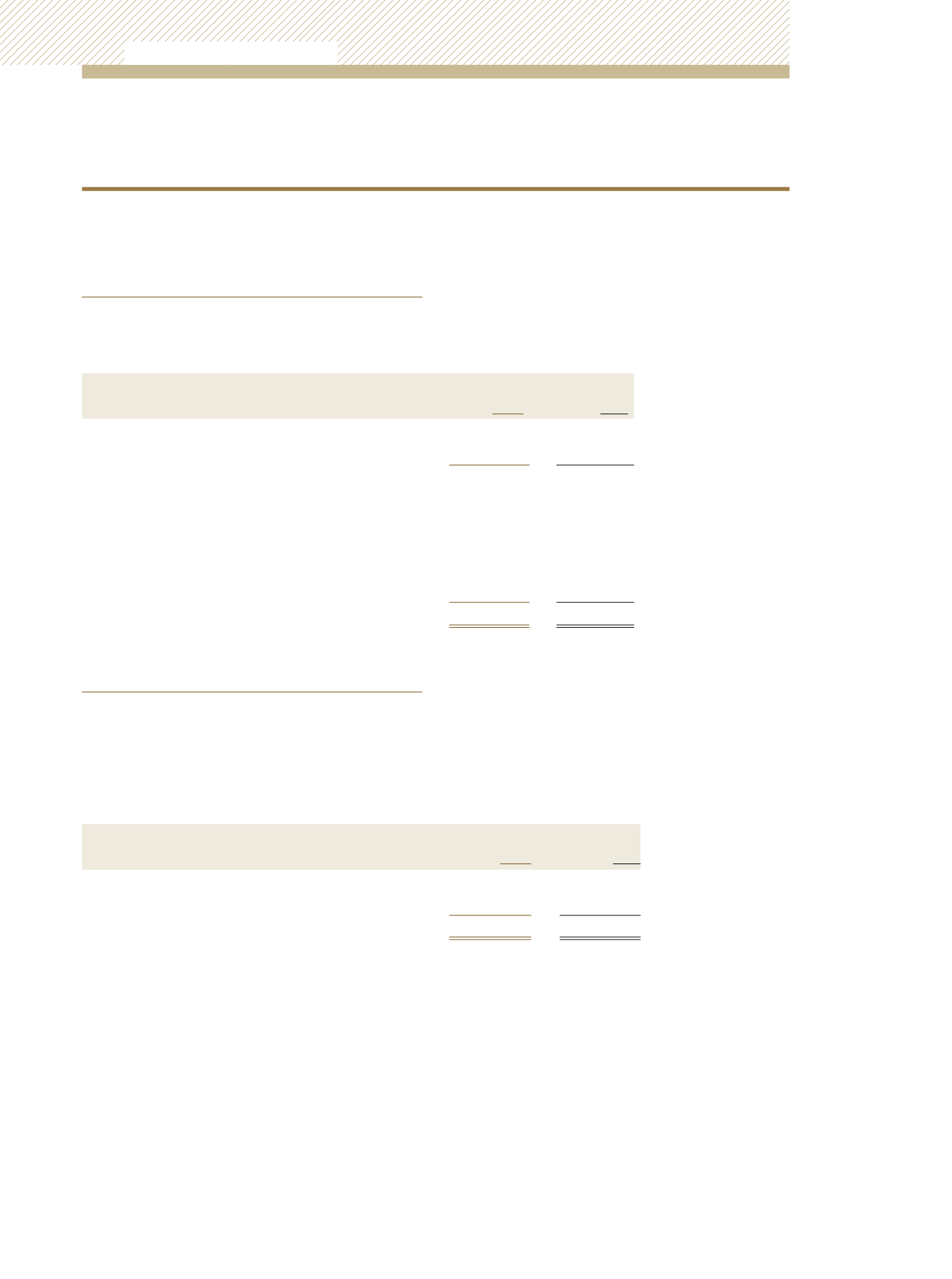

9) DEFERRED TAX

Deferred taxes are calculated on all temporary differences under

the liability method using the current rate of 25%.

Deferred tax assets and liabilities and deferred tax (credit)/charge in

the profit and loss account are attributable to the following items:

2012

2011

$’000

$’000

Tax losses carried forward

(2,269)

(2,768)

Accelerated tax depreciation

6,478

5,917

Net deferred liability

4,209

3,149

Unit Trust Corporation

Annual Report 2012