Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A16

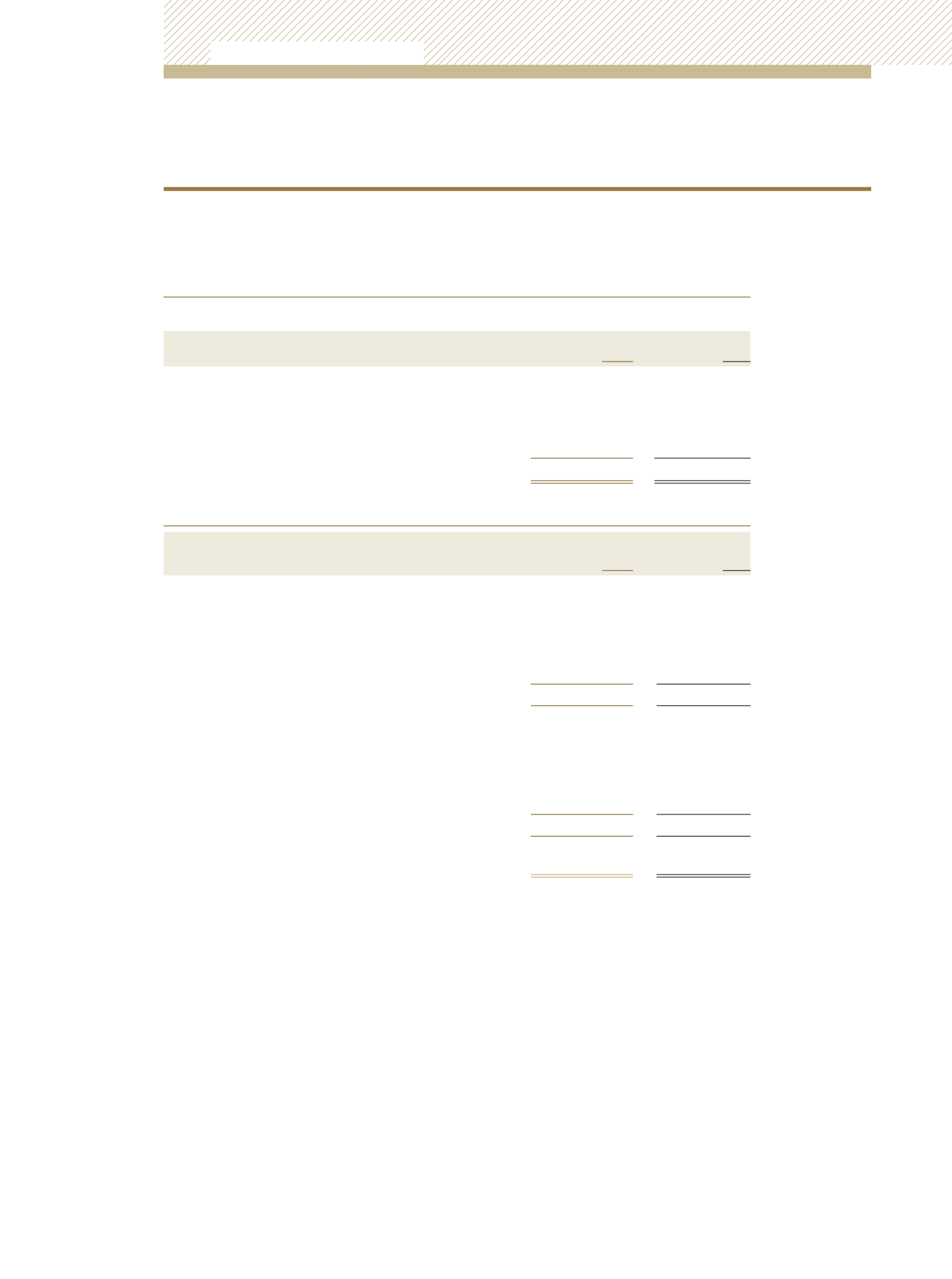

3) INVESTMENT FUNDS

The portfolio values of the locally based investment funds are as follows:

2012

$’000

2011

$’000

Growth and Income Fund

3,681,924

3,302,751

TT$ Income Fund

11,154,721

10,556,777

Universal Retirement Fund

212,709

186,917

US$ Income Fund

4,518,692

4,098,404

Total

19,568,046

18,144,849

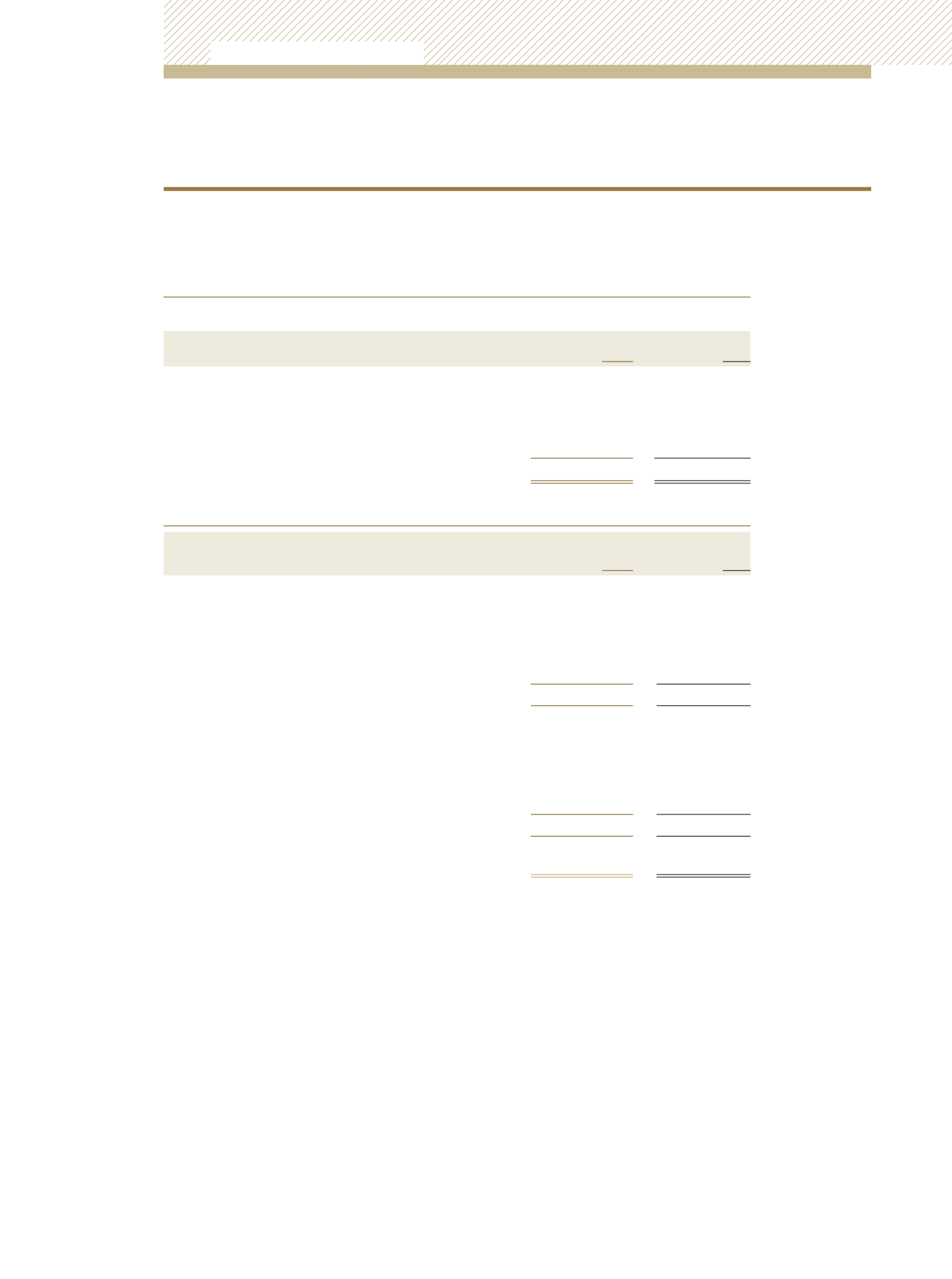

4) INVESTMENT SECURITIES

2012

2011

$’000

$’000

Held-to-maturity investments carried at amortized cost:

Bonds (i)

-

160

Equity

50,766

48,653

Mutual Funds

6

6

Short-term investments (ii)

88,732

91,150

139,504

139,969

Available-for-sale assets carried at fair value:

Bonds (i)

1,700,234

2,592,800

Equity

276,196

121,086

Mutual Funds

15,820

15,843

Short-term investments (ii)

13,500

12,757

2,005,750

2,742,486

2,145,254

2,882,455

(i)

The weighted average rate of interest on the bonds at 31 December, 2012 was 1.6% (2011: 1.5%).

(ii)

All short term securities had original maturities of more than three (3) months.

Unit Trust Corporation

Annual Report 2012