Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A32

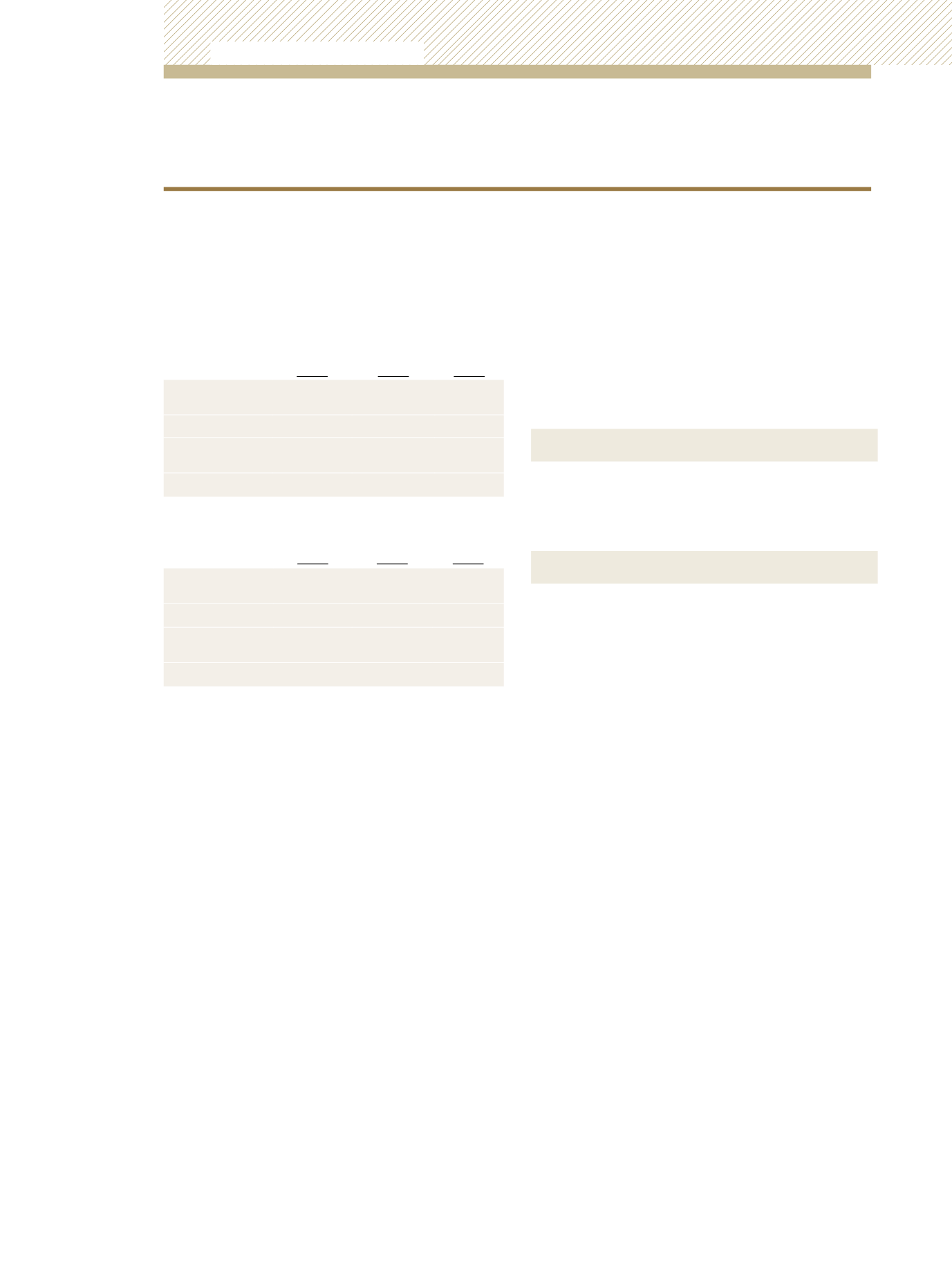

below both in dollar terms and as a percentage of total equity

holdings in the relevant Fund:

At 31 December, 2012

Lower than

market

Comparable

to market

Higher than

market

$’000

$’000

$’000

Growth and

Income Fund

1,322,528

826,752

306,320

53.8%

33.7%

12.5%

Universal

Retirement Fund

74,295

42,202

28,579

51.2%

29.1%

19.7%

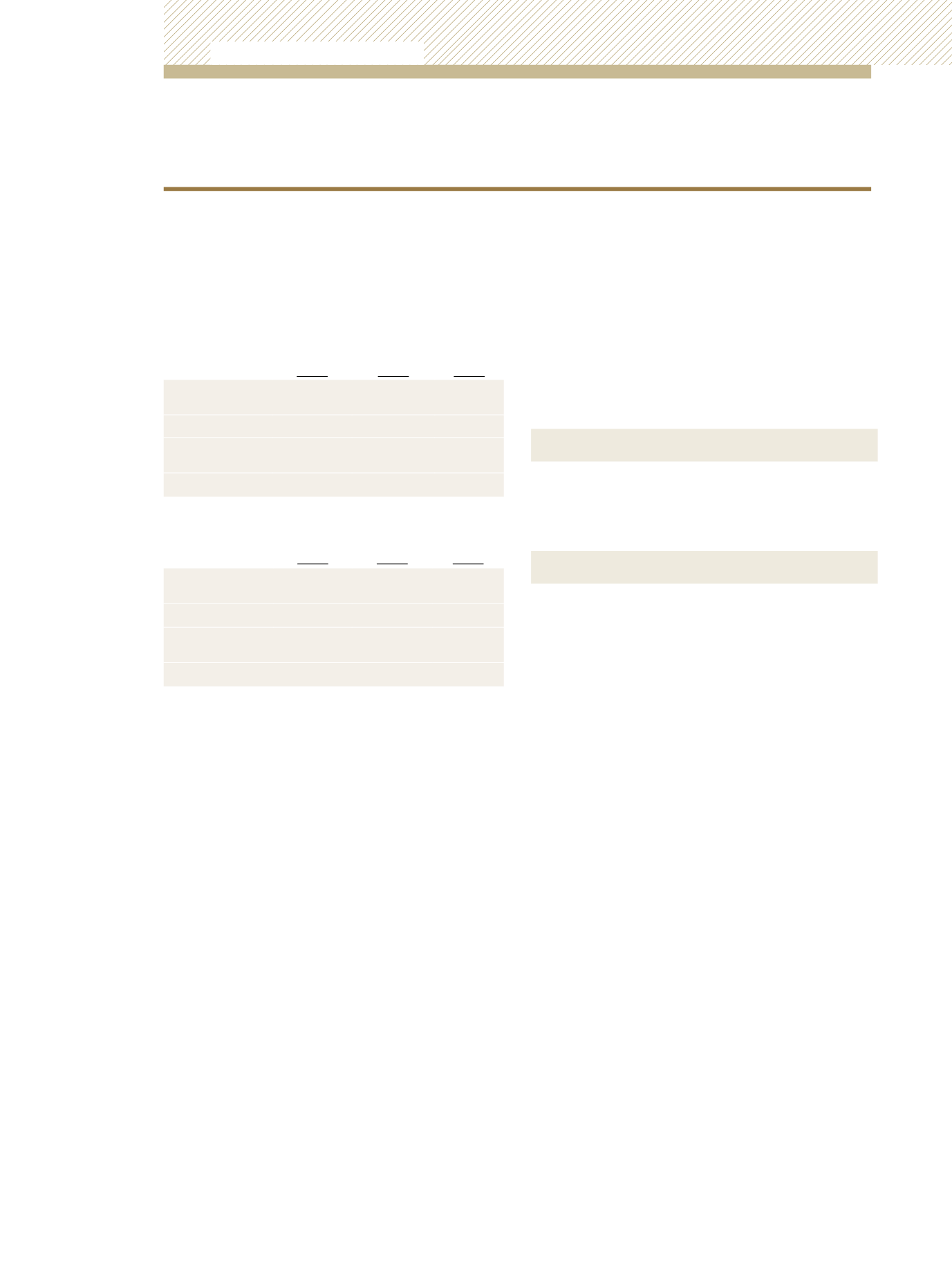

At 31 December, 2011

Lower than

market

Comparable

to market

Higher than

market

$’000

$’000

$’000

Growth and

Income Fund

1,181,108

686,758

404,223

52.0%

30.2%

17.8%

Universal

Retirement Fund

65,002

12,998

36,605

56.7%

11.3%

32.0%

29) FINANCIAL RISK MANAGEMENT

(continued)

Equity price risk

(continued)

The following table presents the approximate sensitivity of the

net asset value of the Growth & Income Fund and the Universal

Retirement Fund to a 5% change in the TTSE Composite Index and

the S&P 500 Composite Index respectively as at 31 December, 2012

and 31 December, 2011 with all other variables held constant. The

sensitivity is provided in dollar amounts and as a percentage of net

asset value:

TTSE Composite

Index

31 December, 2012 31 December, 2011

Growth and

Income Fund

$72.2 million (2.0%)

$67.2 million (2.0%)

Universal

Retirement Fund $3.9 million (1.9%)

$3.4 million (1.7%)

S&P 500 Composite

Index

31 December, 2012 31 December, 2011

Growth and

Income Fund

$35.3 million (1.0%)

$30.2 million (0.9%)

Universal

Retirement Fund $1.8 million (0.9%)

$0.8 million (0.4%)

Unit Trust Corporation

Annual Report 2012