Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A40

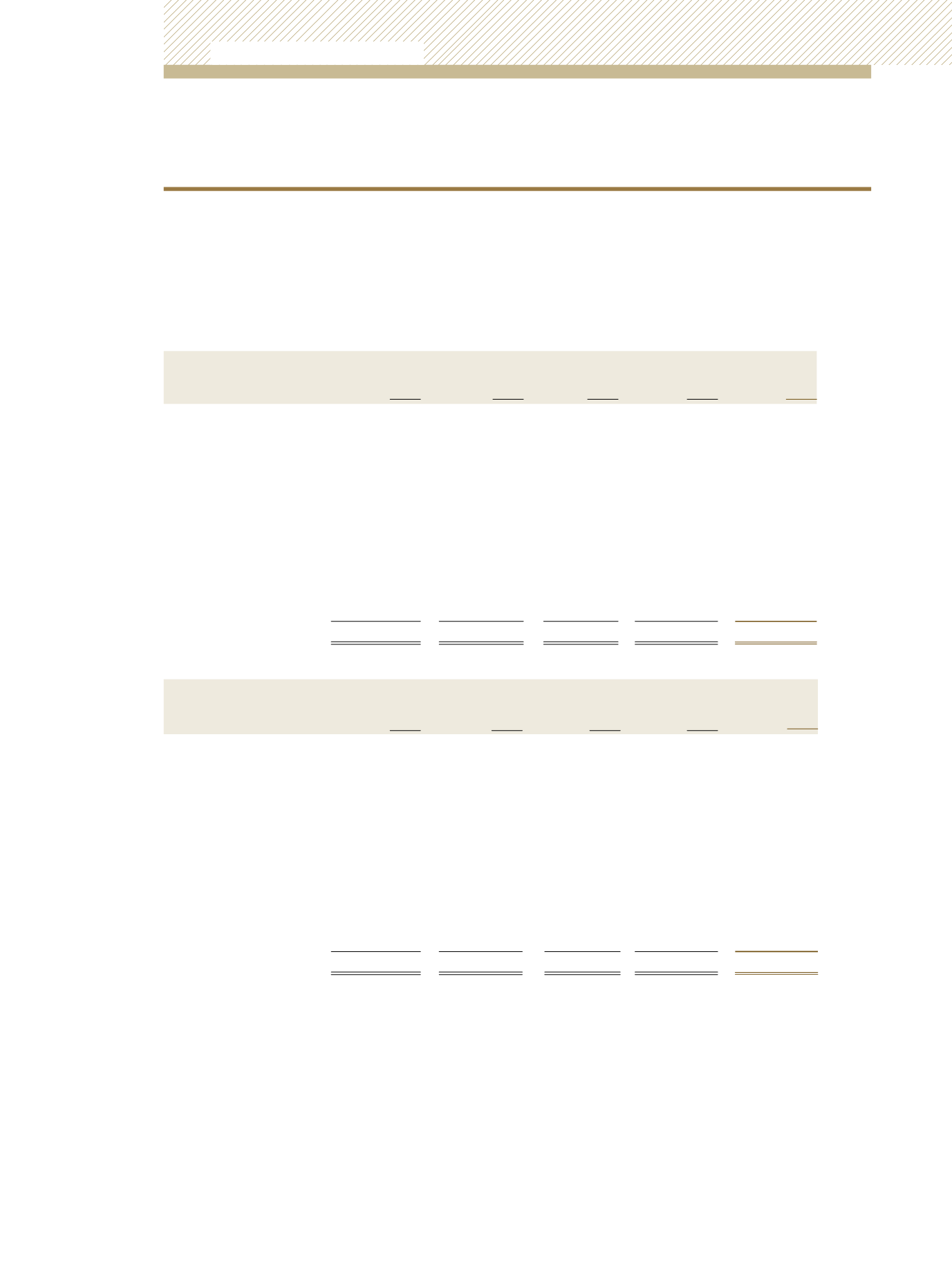

The interest rate re-pricing exposures of Corporation assets and liabilities are provided

below as at 31 December, 2012 and 31 December, 2011:

Less than 1

year

Between 1

and 5 years

Over 5 years

Non-Interest

Bearing

Total

$’000

$’000

$’000

$’000

$’000

At 31 December, 2012

Assets

Cash & Cash Equivalents

615,584

-

-

-

615,584

Money Market Instruments

88,737

-

-

-

88,737

Fixed Income Securities

1,646,668

-

18,066

-

1,664,734

Equities & Mutual Funds

-

-

-

391,782

391,782

Liabilities

Financial Instruments

(1,577,918)

-

(2,459)

-

(1,580,377)

Other Liabilities

(5,701)

(7,886)

-

-

(13,587)

Rate Re-pricing Position

767,370

(7,886)

15,607

391,782

1,166,873

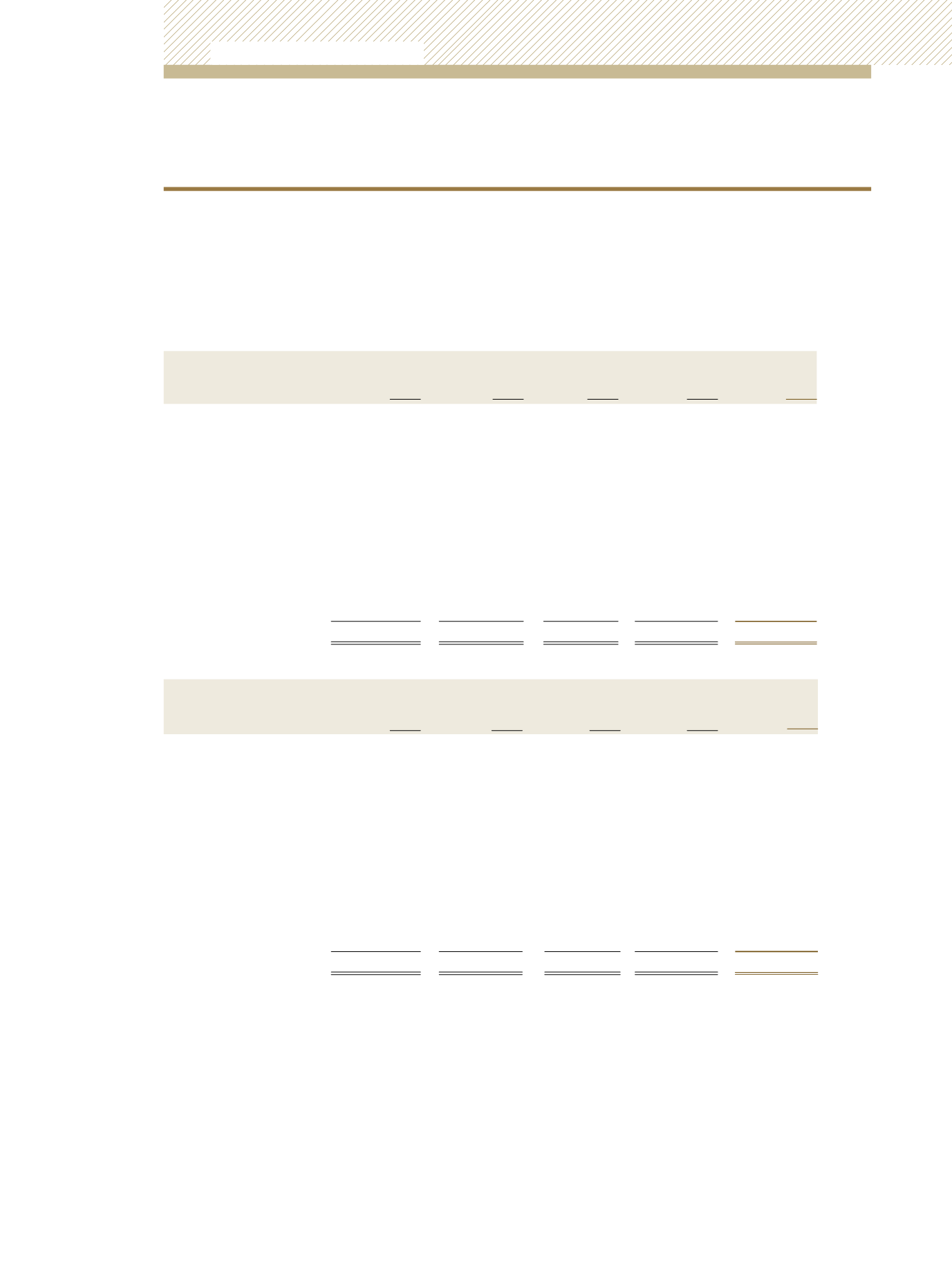

Less than 1

year

Between 1

and 5 years

Over 5 years

Non-Interest

Bearing

Total

$’000

$’000

$’000

$’000

$’000

At 31 December, 2011

Assets

Cash & Cash Equivalents

308,035

-

-

-

308,035

Money Market Instruments

52,510

-

-

-

52,510

Fixed Income Securities

2,276,887

22,696

-

-

2,299,583

Equities & Mutual Funds

-

-

-

304,425

304,425

Liabilities

Financial Instruments

(2,458,816)

-

(3,810)

-

(2,462,626)

Other Liabilities

-

(7,805)

-

-

(7,805)

Rate Re-pricing Position

178,616

14,891

(3,810)

304,425

494,122

Given the above rate re-pricing profile, a change in short term market rates of interest of

1% effective from 31 December, 2012 would have modified net interest income over the

coming twelve months by an estimated TT$1.8 million (2011: TT$4.2 million) with all other

variables held constant.

29) FINANCIAL RISK MANAGEMENT

(continued)

Interest rate risk

(continued)

Unit Trust Corporation

Annual Report 2012