Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A50

Liquidity risk

Proprietary Investments

Liquidity risk is the risk that the Group is unable to meet payment

obligations associated with its financial liabilities when they fall due.

The Corporation’s treasury management activities include: (i) daily

monitoring of future cash flow requirements; (ii) maintenance of a

portfolio of investments that can be easily liquidated as protection

against any unforeseen interruptions to cash flow; and (iii)

management of the concentration and profile of debt maturities.

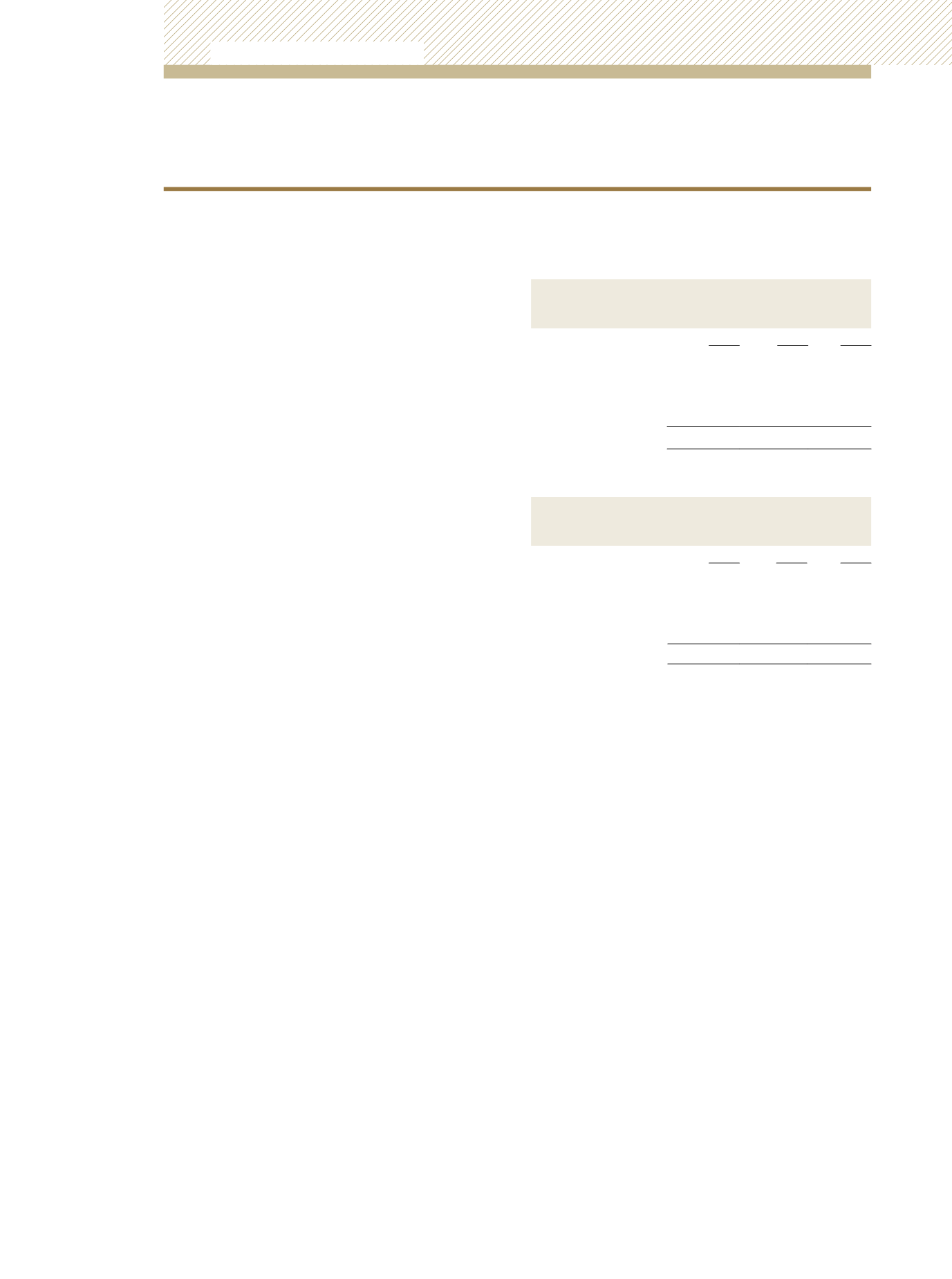

The following Table presents cash flows payable by the Group

for financial liabilities. The amounts disclosed in the Table are the

contractual undiscounted cash flows.

29) FINANCIAL RISK MANAGEMENT

(continued)

Less than

1 year

Between

1 and 5

years

Over

5 years

$’000

$’000 $’000

At 31 December, 2012

Sinking Fund Liabilities

5,701

7,866

-

Financial Instruments

1,577,918 - 2,459

Total

1,583,619 7,866 2,459

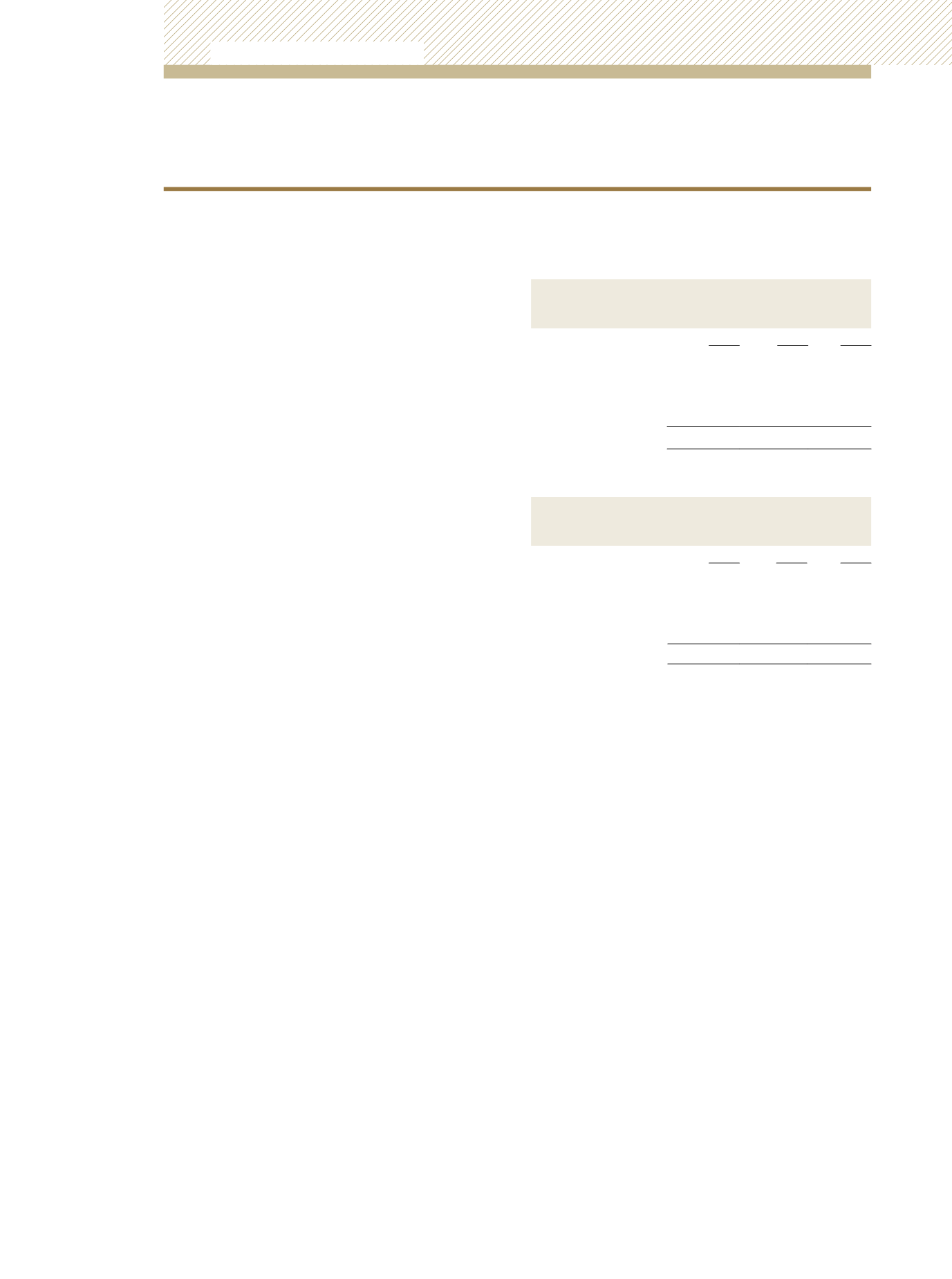

Less than

1 year

Between

1 and 5

years

Over

5 years

$’000

$’000 $’000

At 31 December, 2011

Sinking Fund Liabilities

-

7,805

-

Financial Instruments

2,458,816 -

3,810

Total

2,458,816 7,805 3,810

Collective Investment Schemes - Registered as local unit trust

schemes and as overseas subsidiaries

Units in the Growth & Income Fund, the TT$ Income Fund and the

US$ Income Fund are redeemable upon demand by investors. This

is also true of the fund products issued by the overseas subsidiaries.

Consequently, these Funds are exposed to daily unit redemptions.

The Funds mitigate this risk by maintaining adequate portfolio

liquidity through appropriate cash, near cash and other short-term

investments. Given the tradable nature of a substantial proportion

of the Fund portfolios, this risk is not deemed significant.

Unit Trust Corporation

Annual Report 2012