Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A48

Impaired assets

Impairment charges are computed in accordance with IFRS and

the Group’s accounting policies. In summary, an asset is considered

impaired where there is no longer reasonable assurance of

collection (within the contractually established timeframe) of the

full amount of principal and interest due to deterioration in the

credit quality of the counterparty or any other factor which may

affect contractual performance. In other words, an asset is impaired

if its estimated recoverable amount is less than its carrying amount.

The Corporation’s accounting policies require review for impairment

of all financial assets at each reporting period or more regularly when

individual circumstances require. The assessment includes a review

of the collateral held (including re-confirmation of its enforceability)

and the anticipated receipts for that financial asset.

Collective Investment Schemes -

Registered as local unit trust schemes

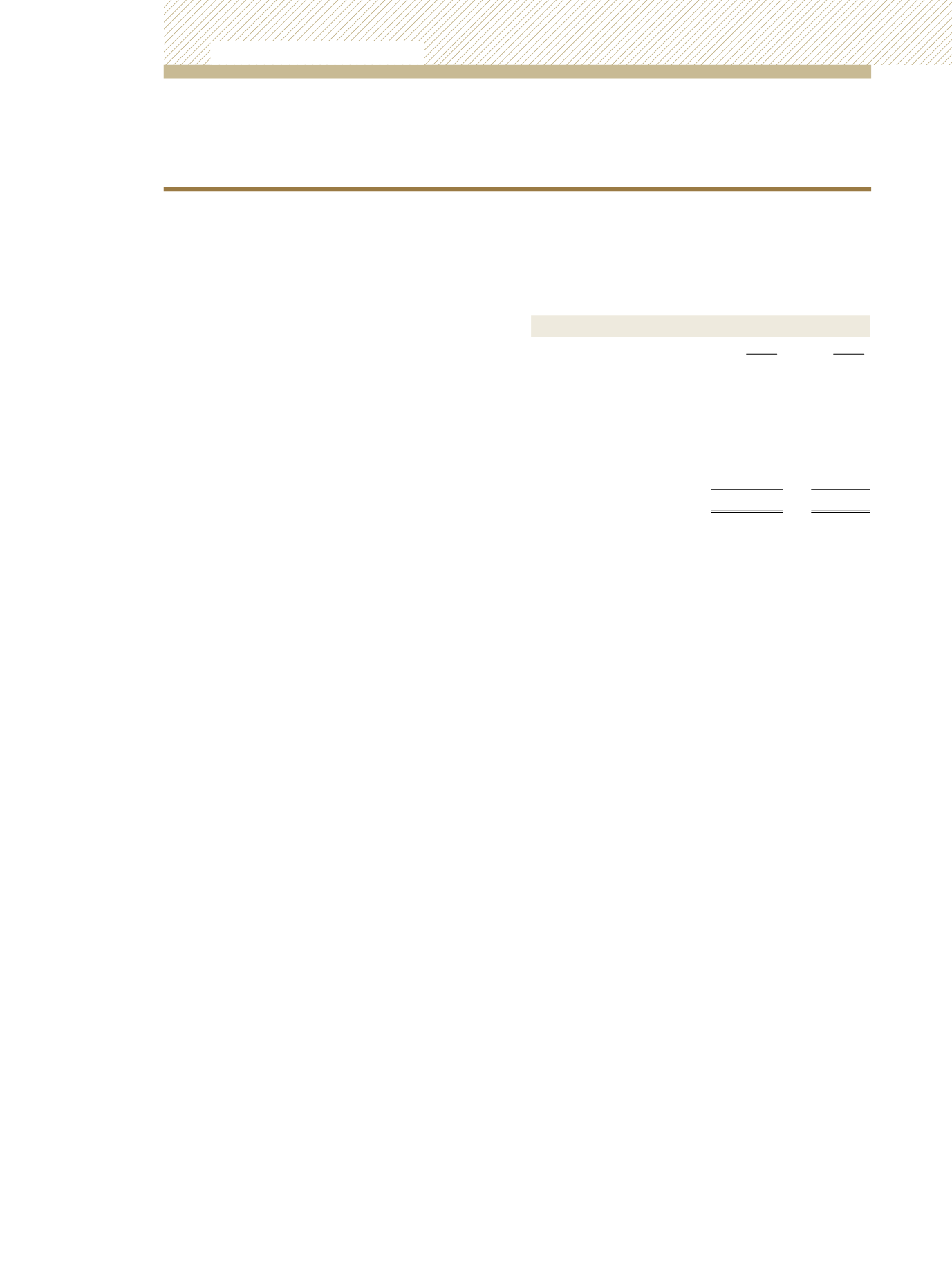

During the course of 2012, seven assets were impaired across the

Funds. The impairment charges recognised are summarized in the

following Table. No impairment charge was required in respect of

the local Collective Investment Schemes at 31 December, 2011.

2012

2011

$’000

$’000

Growth and Income Fund

21,811

-

TT$ Income Fund

79,434

-

Universal Retirement Fund

1,900

-

US$ Income Fund

211,017

-

Total

314,162

-

Collective Investment Schemes -

Registered as overseas subsidiary companies

With regard to the overseas Funds, no impairment losses were

recorded for the years ended 31 December, 2012 and 31 December,

2011.

Proprietary Investments

An impairment charge of $160,000 was recognised for the

proprietary investments of the Corporation in 2012. No impairment

charge was required in respect of these investments as at 31

December, 2011.

29) FINANCIAL RISK MANAGEMENT

(continued)

Credit risk

(continued)

Unit Trust Corporation

Annual Report 2012