Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A47

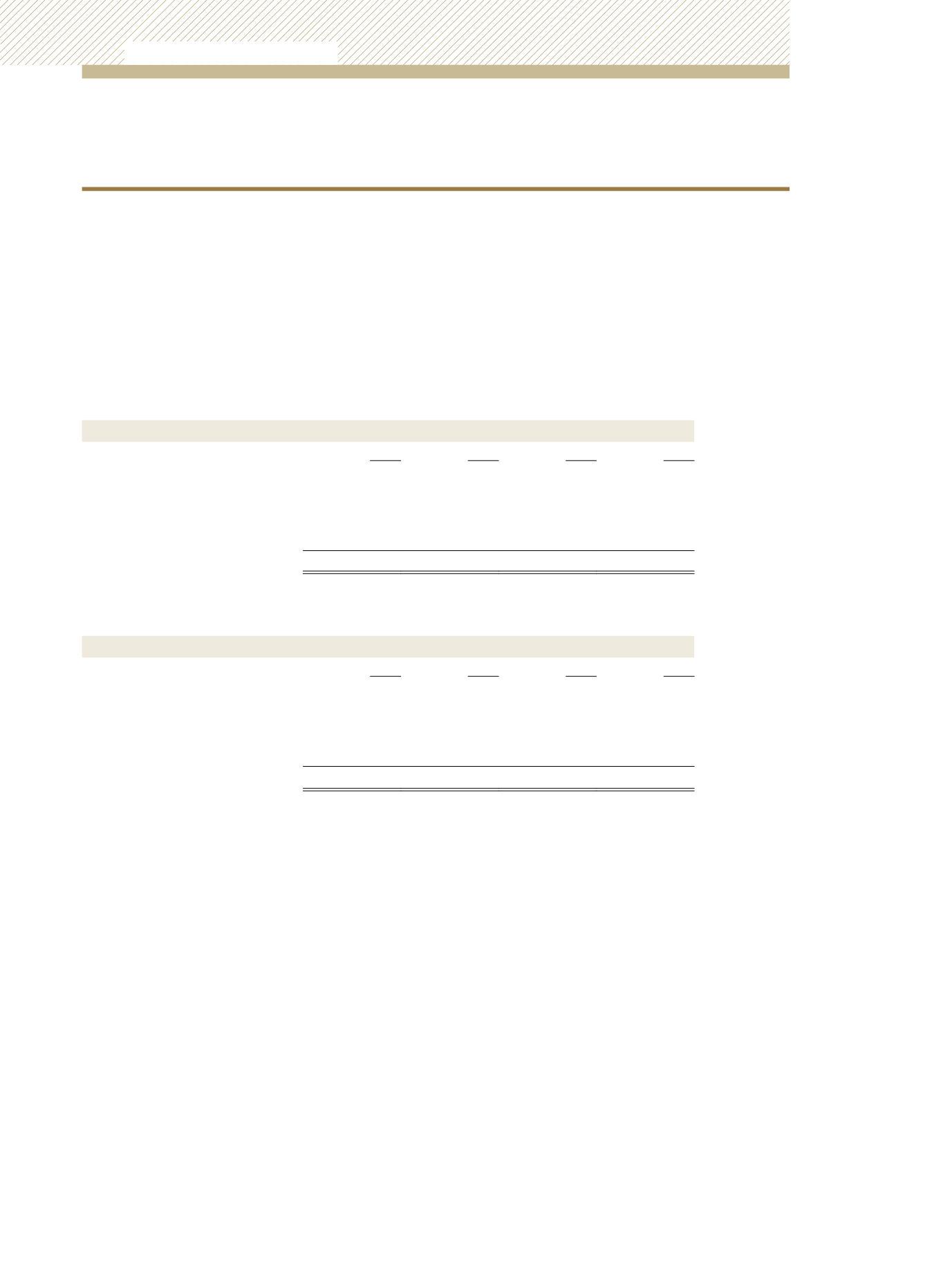

Past due, impaired or other distressed investments held by the Collective Investment Schemes managed by the

Corporation are monitored by management and reported to the Management Risk Committee, the Investment

Committee and the Board. The carrying values of assets past due but not impaired at the 2012 year end for the Collective

Investment Schemes are as follows:

Days past due as at 31 December, 2012

1-30 days

31-90 days

91-180 days Over 180 days

$’000

$’000

$’000

$’000

US$ Income Fund

-

-

-

54,122

TT$ Income Fund

-

-

-

-

Growth & Income Fund

-

-

-

-

Universal Retirement Fund

-

-

-

-

Total

-

-

-

54,122

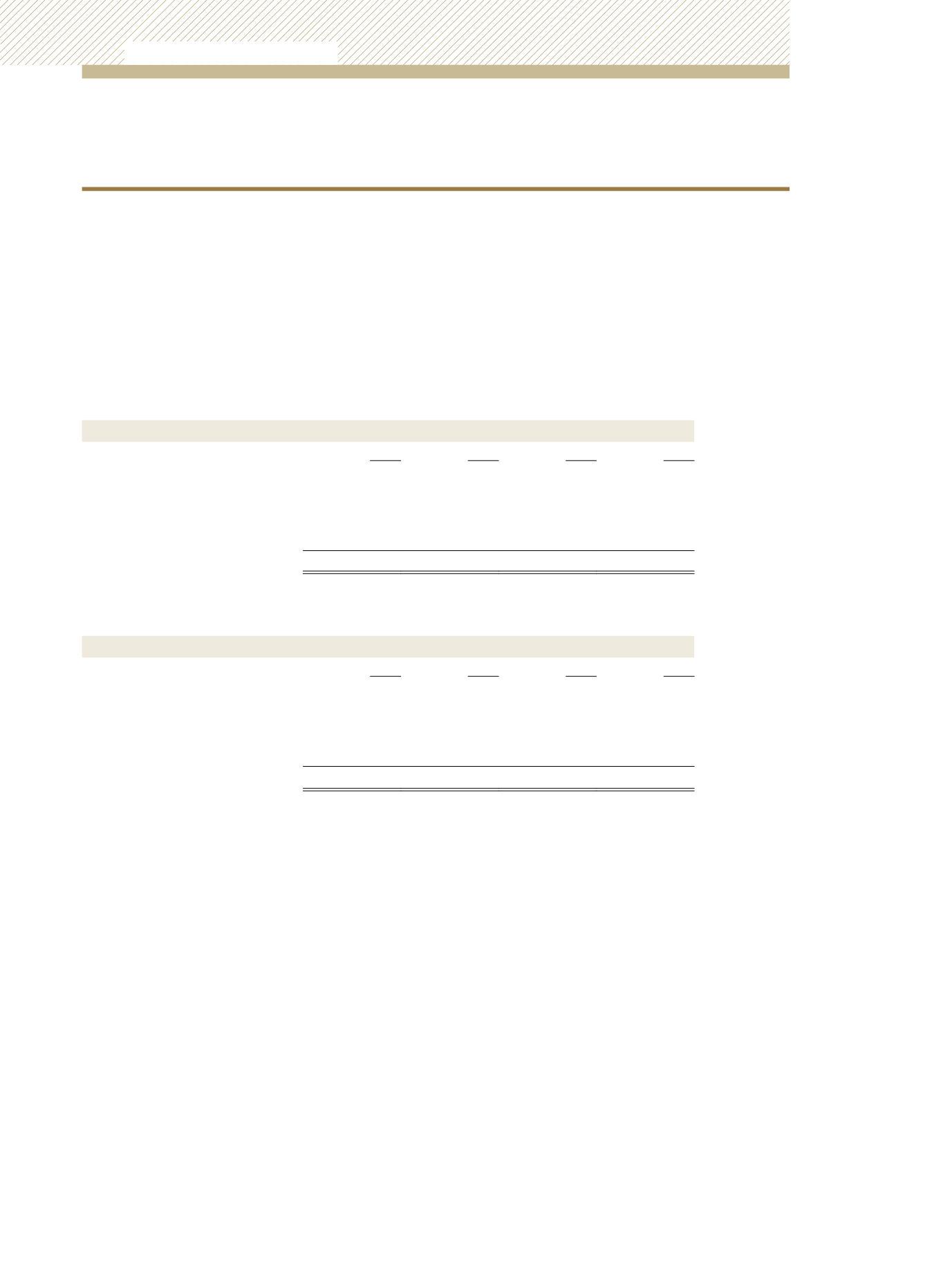

Days past due as at 31 December, 2011

1-30 days

31-90 days

91-180 days Over 180 days

$’000

$’000

$’000

$’000

US$ Income Fund

-

44,398

-

105,483

TT$ Income Fund

-

-

-

54,459

Growth & Income Fund

-

-

-

14,608

Universal Retirement Fund

-

-

-

1,415

Total

-

44,398

-

175,965

Proprietary Investments

During the course of its proprietary investment activities, the Corporation may incur credit exposures through its fixed

income securities and cash holdings. Except for a single instrument with a book value of approximately $9.9 million,

which has been deemed to be of low credit quality, substantially all of the Corporation’s fixed income exposures, totalling

roughly $1.8 billion as at 31 December 2012, were with issuers/counterparties of a high credit quality - i.e. rated at least

BBB- equivalent by international credit rating agencies or having an internally determined credit score consistent with

such a credit rating.

29) FINANCIAL RISK MANAGEMENT

(continued)

Credit risk

(continued)

Unit Trust Corporation

Annual Report 2012