Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A33

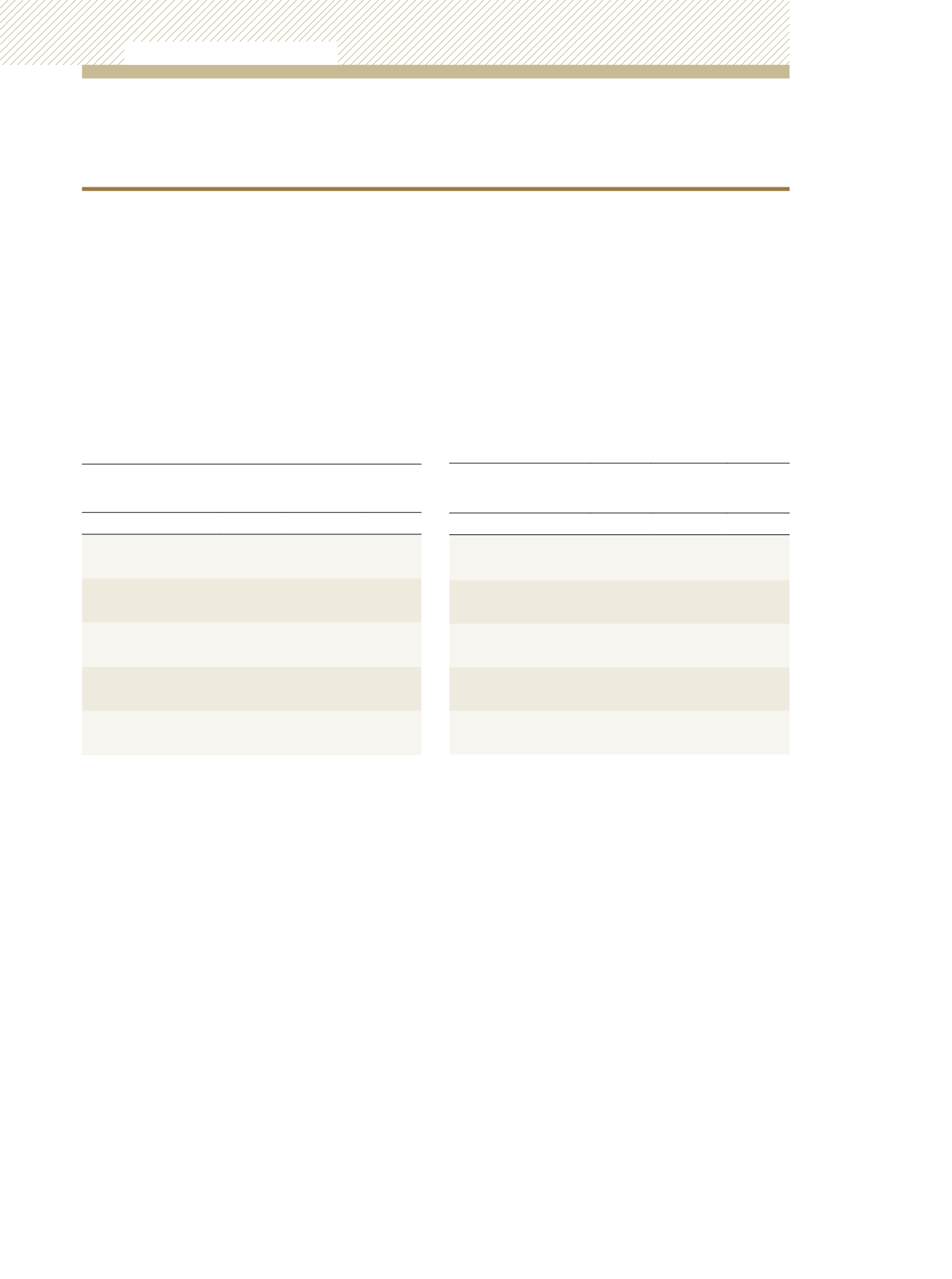

Collective Investment Schemes – Registered overseas as

subsidiary open ended investment companies

The equity price risk exposure of the fund portfolios in the

overseas subsidiary companies is also monitored and measured via

categorization of the stocks by their historical price sensitivity to the

overall market. The categorization of the portfolios’equity holdings

is provided below both in dollar terms and as a percentage of total

equity holdings in the relevant Fund:

At 31 December, 2012

Lower

than

market

Comparable

to

market

Higher

than

market

$’000

$’000

$’000

UTC Energy Fund

1,661

18,077

10,008

5.6% 60.8% 33.6%

UTC European Fund

1,502

3,896

115

27.2% 70.7% 2.1%

UTC Asia Pacific Fund

2,735

8,138

98

24.9% 74.2% 0.9%

UTC Latin American Fund 863

4,587

1,320

12.7% 67.8% 19.5%

UTC North American Fund 67,582

50,533

15,241

50.7% 37.9% 11.4%

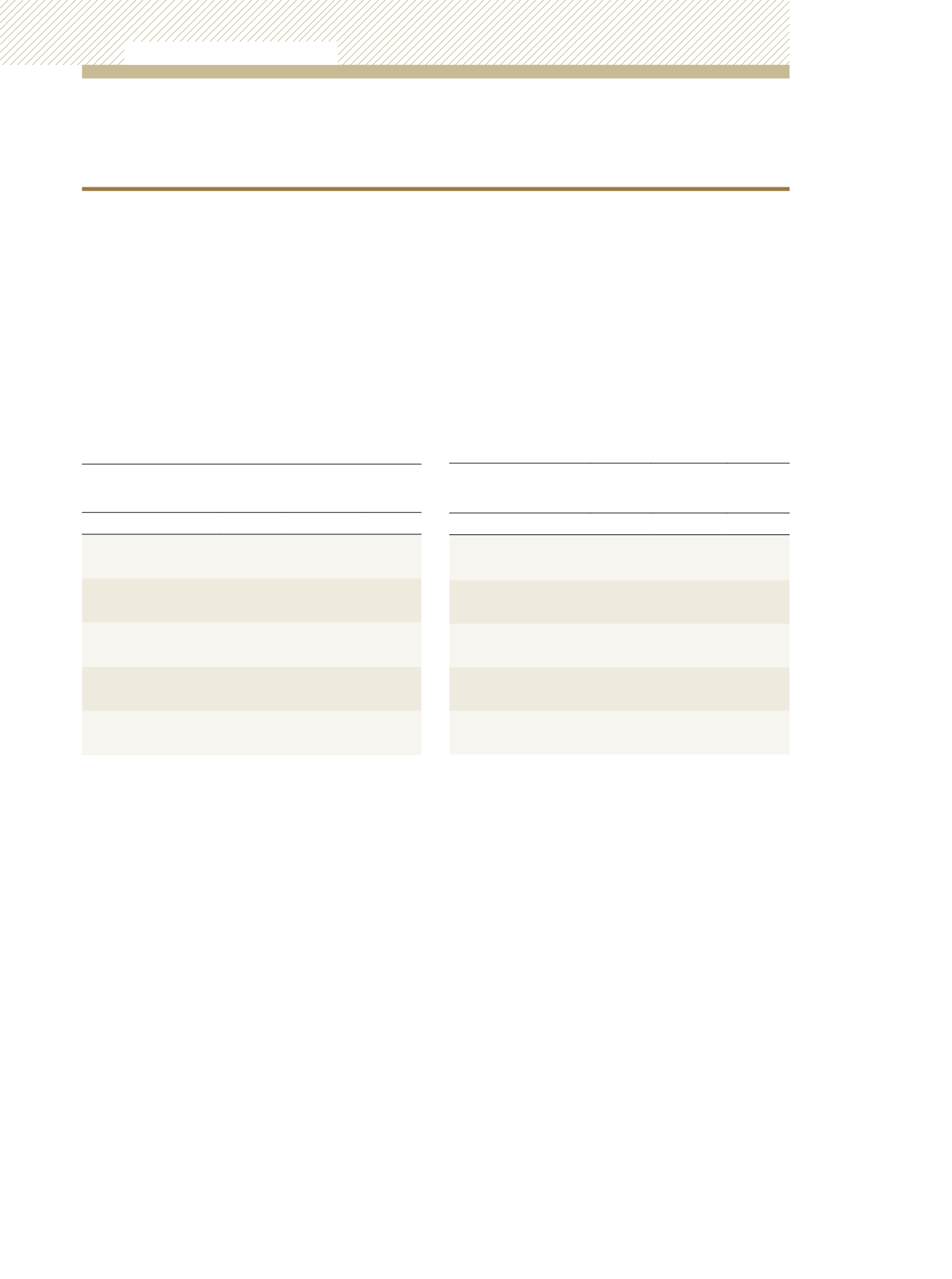

29) FINANCIAL RISK MANAGEMENT

(continued)

Equity price risk

(continued)

At 31 December, 2011

Lower

than

market

Comparable

to

market

Higher

than

market

$’000

$’000

$’000

UTC Energy Fund

663

6,178

18,291

2.6% 24.6% 72.8%

UTC European Fund

1,383

692

3,207

26.2% 13.1% 60.7%

UTC Asia Pacific Fund

8,091

1,432

1,336

74.5% 13.2% 12.3%

UTC Latin American Fund 839

2,992

2,812

12.6% 45.1% 42.3%

UTC North American Fund 97,711

30,207

16,919

67.2% 21.0% 11.8%

Unit Trust Corporation

Annual Report 2012