Trinidad and Tobago Unit Trust Corporation

Notes

to the Consolidated

Financial Statements

FOR THE YEAR ENDED

31 DECEMBER, 2012

Expressed in

Trinidad and Tobago dollars

A35

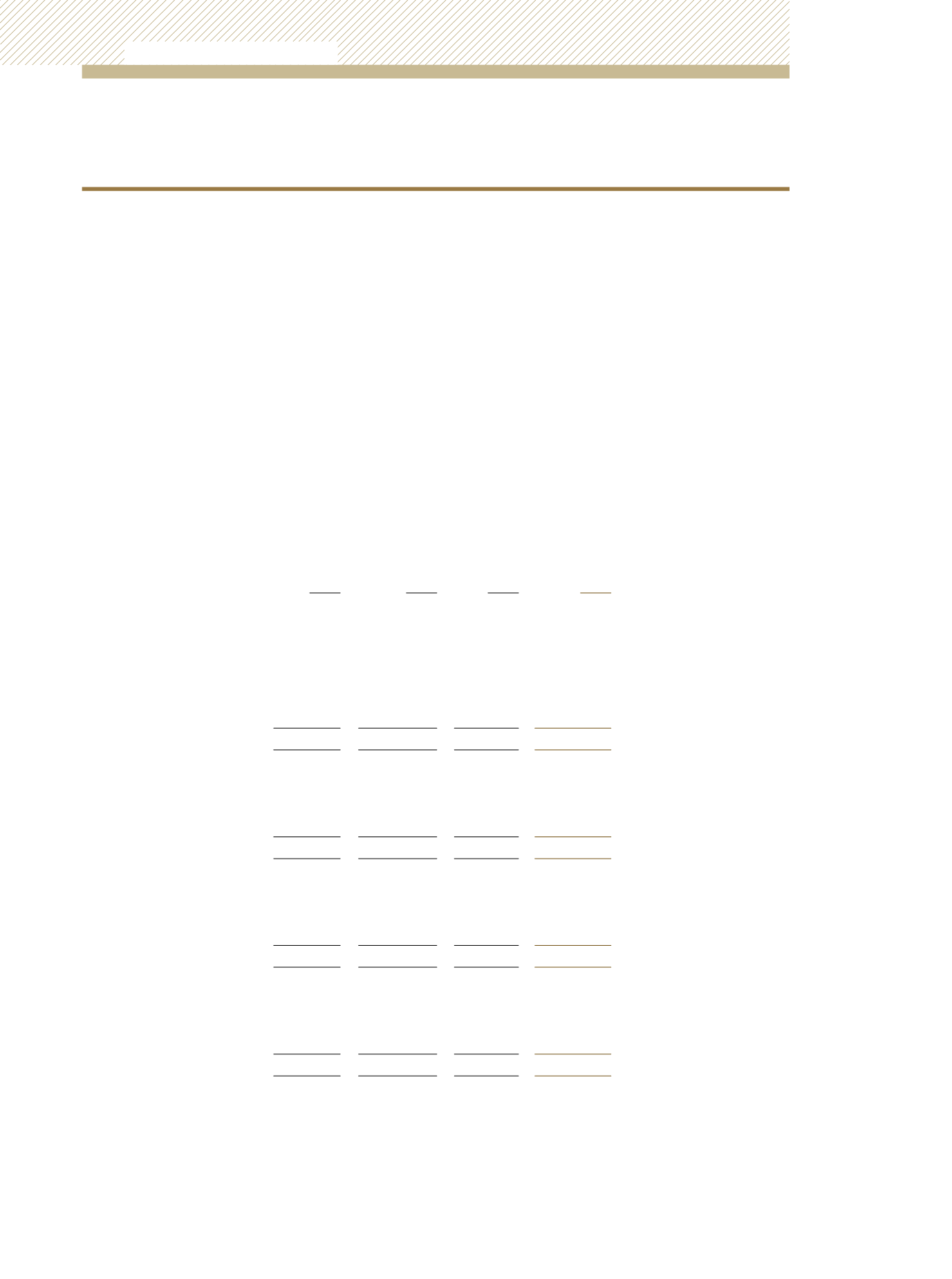

Given the general offsetting effect of exposures to fair value interest rate risk and cash flow interest rate

risk, the overall interest rate risk is managed by making judicious adjustments of the overall weighted

average term to maturity (i.e. duration) based on the relevant economic and financial market outlook.

Management monitors the duration of the portfolios by segregating the fixed income securities by the

earlier of contractual maturity or interest rate reset dates that are less than or equal to one year, greater

than one year but less than five years, and greater than or equal to five years. The degree of interest rate

sensitivity in the overall portfolio is then reflected by the relative proportions in the given maturity terms/

interest rate reset frequencies.

An interest rate re-pricing analysis (as defined by the earlier of the contractual maturity or interest

fixing date for each instrument) is provided below for the Collective Investment Schemes’ fixed income

portfolio as at 31 December, 2012 and 31 December, 2011:

Less than

1 year

Between 1

and 5 years

Over 5

years

Total

$’000

$’000

$’000

$’000

At 31 December, 2012

Growth and Income Fund

Debt instruments – traded

-

-

27,519

27,519

Debt instruments – non-traded

52,468

67,961

691,034

811,463

Cash & other net assets

387,342

-

-

387,342

439,810

67,961

718,553

1,226,324

TT$ Income Fund

Debt instruments – traded

139,595

91,085

-

230,680

Debt instruments – non-traded

1,464,618

1,360,389

1,924,423

4,749,430

Cash & other net assets

6,174,611

-

-

6,174,611

7,778,824

1,451,474

1,924,423

11,154,721

Universal Retirement Fund

Debt instruments – traded

-

-

-

-

Debt instruments – non-traded

8,018

7,141

31,846

47,005

Cash & other net assets

22,522

-

-

22,522

30,540

7,141

31,846

69,527

US$ Income Fund

Debt instruments – traded

662,792

310,026

581,771

1,554,589

Debt instruments – non-traded

253,994

119,788

142,938

516,720

Cash & other net assets

2,447,450

-

-

2,447,450

3,364,236

429,814

724,709

4,518,759

29) FINANCIAL RISK MANAGEMENT

(continued)

Interest rate risk

(continued)

Unit Trust Corporation

Annual Report 2012