REVIEW OF THE ECONOMY 2013

28

SUSTAINING GROWTH, SECURING PROSPERITY

In chemicals and non-metallic minerals, the

second largest manufacturing sub-sector,

growth is expected to rise sharply to 15.3 percent

in 2013, following a contraction of 0.2 percent in

2012. This strong growth expectation is based

primarily on a recovery in the production of

cement and concrete products, such as blocks

and bricks. Growth is also projected for thewood

and related products sub-sector, though at a

much reduced level of 3.1 percent, compared to

the 29.0 percent rate one year earlier.

With the exception of a flat performance in

miscellaneous manufacturing (0.04 percent),

declines are expected in the remaining

manufacturing sub-sectors. The sharpest

contraction (4.2 percent) is anticipated in

assembly type and related industries, the third

largest manufacturing sub-sector, on account

of an anticipated fall in the production of iron

and steel products. This is nonetheless an

improvement on the sub-sector’s estimated 8.1

percent contraction in 2012.

Food, beverages and tobacco, the largest

manufacturing sub-sector, is expected to

record a marginal decline of 0.4 percent in 2013,

following an estimated expansion of 1.5 percent

one year earlier. A slightly larger contraction

of 1.4 percent is also projected for the printing,

publishing etc. sub-sector.

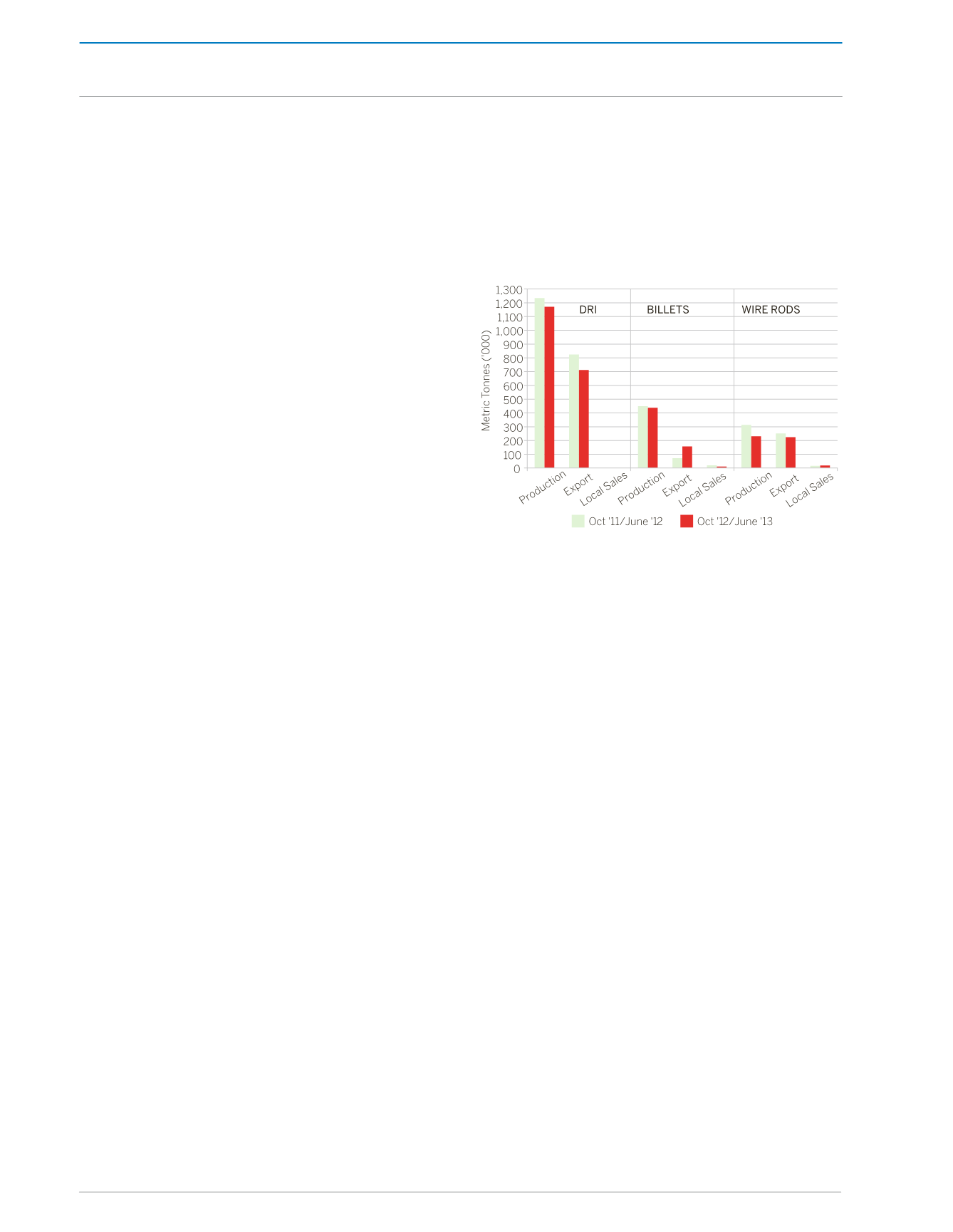

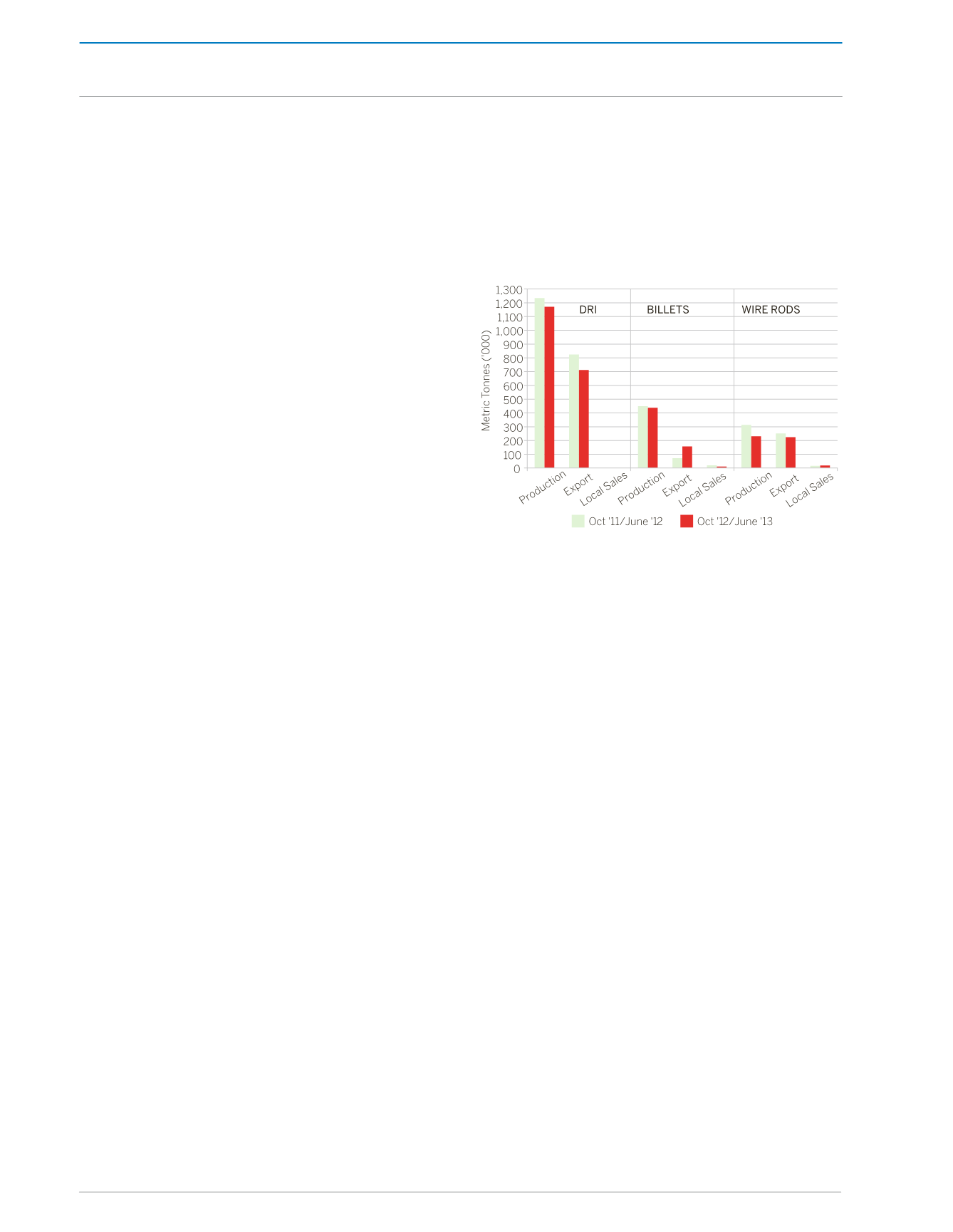

IRON AND STEEL

Over the period October 2012 to June 2013, iron

and steel production declined by 7.6 percent,

which was a further weakening from the 0.8

percent decline recorded one year earlier.

The most significant decline was related to

the production of wire rods which fell by 20.6

percent, from 300.2 thousand metric tonnes to

238.4 thousand metric tonnes. More moderate

declines were experienced in respect of the

production of direct reduced iron (DRI) which

fell by 6.5 percent, from 1,252.7 thousandmetric

tonnes to 1,170.8 thousand metric tonnes, and

the production of billets, which fell by 2.1 percent

from 458.1 thousand metric tonnes to 448.7

thousand metric tonnes

(Appendix 10 and

Figure 5)

.

Figure 5:

Production, Exports and Local Sales

of Iron and Steel

Source: ArcelorMittal Point Lisas Ltd.

Overall, iron and steel exports declined by 5.2

percent during the October to June period,

from 1,171.0 thousand metric tonnes to 1,110.5

thousand metric tonnes, notwithstanding an

88.6 percent increase in exports of billets from

85.9 thosand metric tonnes to 161.9 thousand

metric tonnes. The robust export performance

of billets was outweighed by declines in export

sales for both DRI and wire rods of 12.8 percent

and 11.8 percent respectively. The decline in

export volumes was exacerbated by falling

prices for both DRI and wire rods.

The three-month contract price per tonne for

DRI exports which averaged US$345.00 for the

first six months of fiscal 2013 was 2.4 percent

below the average price of US$353.47 obtained

during the corresponding period of fiscal 2012.

The price of wire rods declined fromUS$620.00

per tonne in October 2012 to US$600.00 per

tonne in December, trended upwards over the

next four months and thereafter, it peaked at

US$615.00 per tonne in March 2013, before

easing to US$586.25 per tonne in June. In

the case of billets, the export price rose from

THE REAL ECONOMY