REVIEW OF THE ECONOMY 2013

23

SUSTAINING GROWTH, SECURING PROSPERITY

to US$95.31 in February 2013. Thereafter, the

price softened to US$92.02 per barrel in April,

before surging to US$104.67 per barrel in July.

Accordingly, the WTI price of a barrel of crude

averaged US$93.39 over the first ten months

of fiscal 2012/2013, a 2.6 percent contraction

from its average of US$95.89 per barrel in the

corresponding 2011/2012 period

(Table 3)

.

The average monthly price of a barrel of

European Brent crude oil also fluctuated

within a narrow band during the first quarter

of fiscal 2012/2013, between US$111.71 in

October 2012 and US$109.49 in December

2012, and thereafter peaked at US$116.05 in

February 2013. The price subsequently fell to

US$102.25 per barrel in April and held steady

for two months before recovering to US$107.93

per barrel in July. During October 2012 to July

2013, the monthly price of a barrel of European

Brent crude oil averaged US$108.34, which was

2.5 percent less that its average of US$111.15,

one year earlier. The monthly average price

differential between WTI and Brent decreased

notably during the review period fromUS$22.22

in October 2012 to US$3.26 in July 2013. The

average price differential for the entire October

to July period was $14.95, which is slightly lower

than the $15.27 differential recorded one year

earlier.

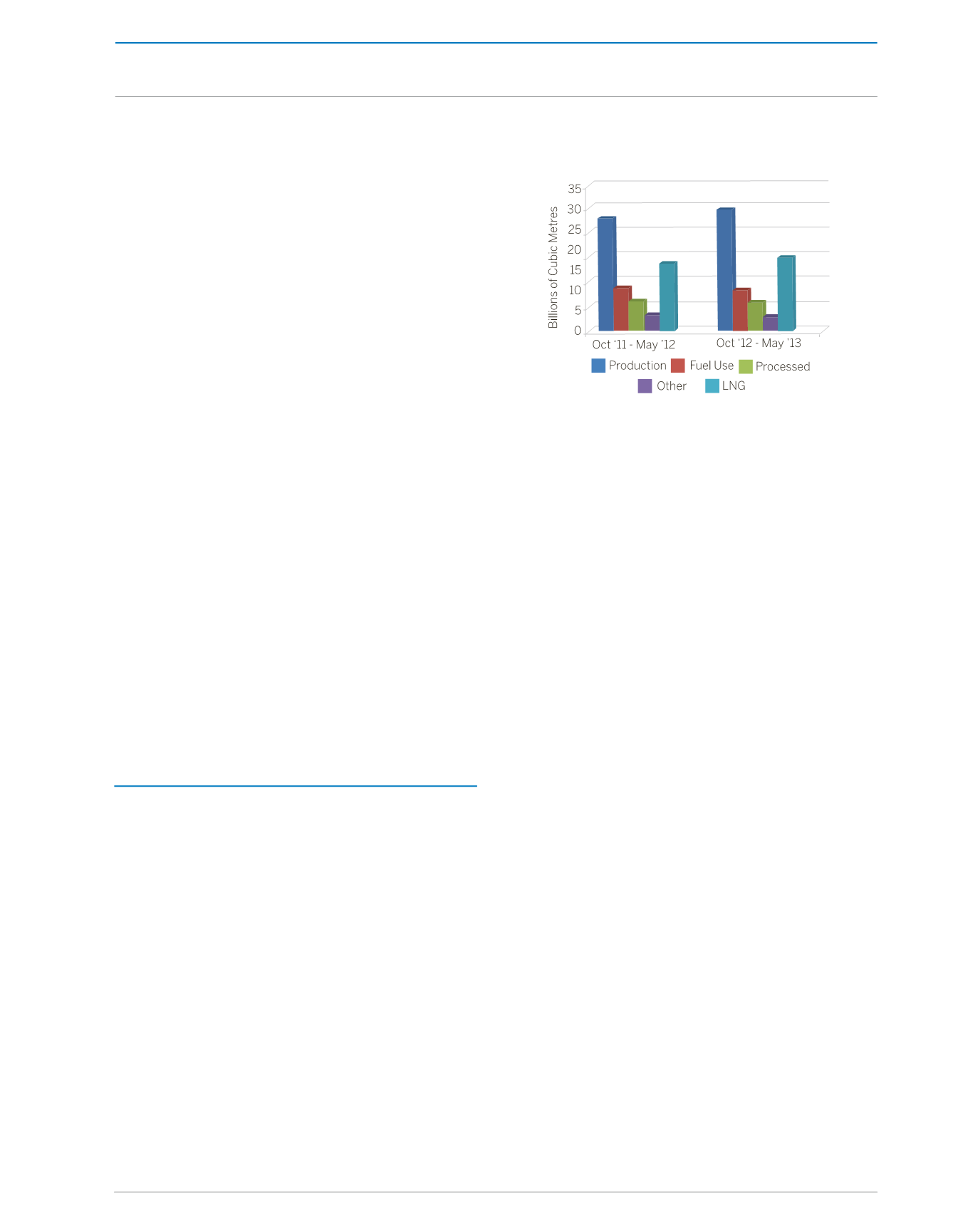

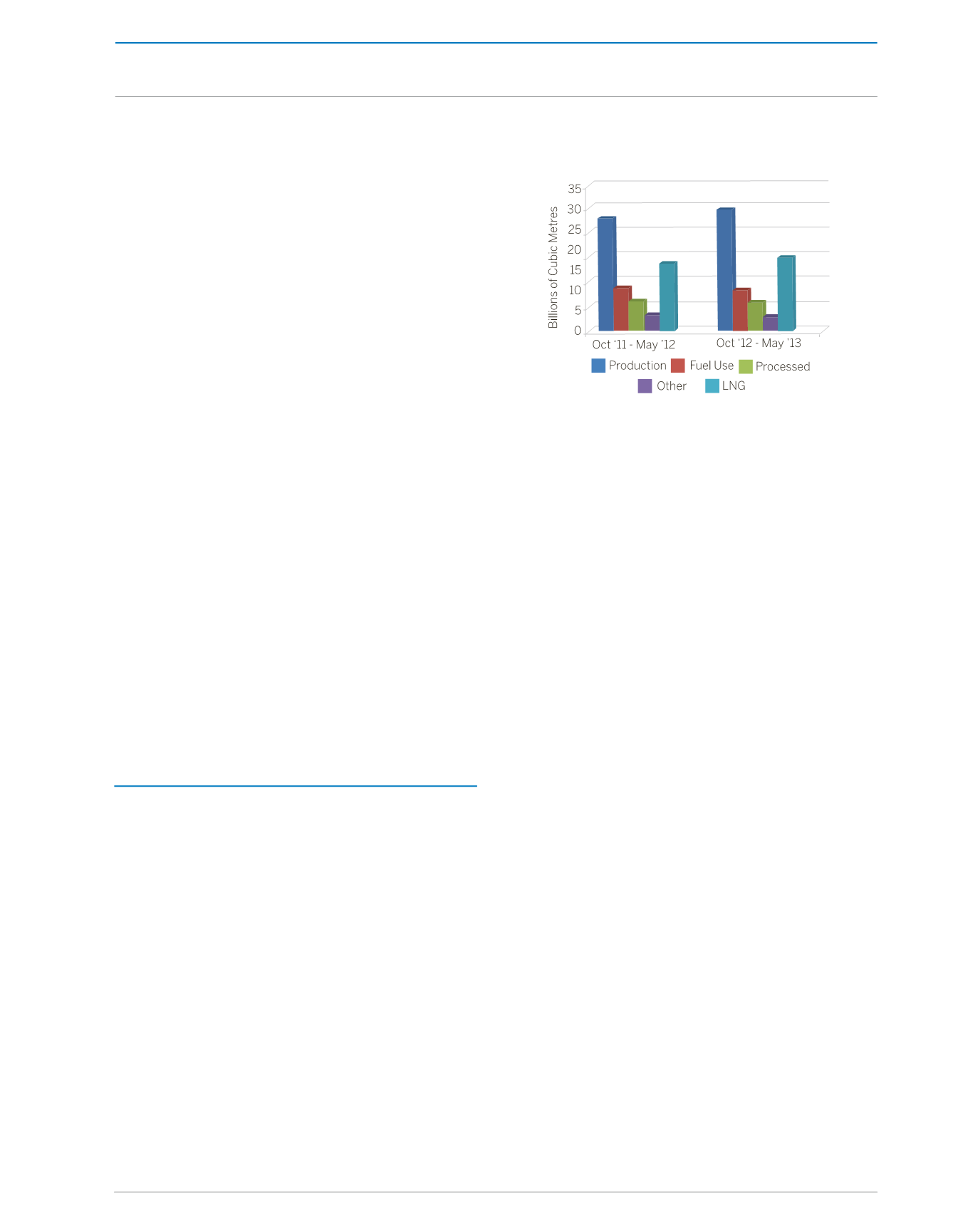

NATURAL GAS

Notwithstanding significant upgrade and

maintenance works by the country’s two largest

natural gas producers, (BPTT and BGTT) in

September and October 2012, natural gas

production rose to 28,733 million cubic metres

during the first eightmonths of fiscal 2012/2013.

This marked a 2.9 percent increase from the

27,923 million cubic metres recorded one year

earlier when the impact of the maintenance

works undertaken by these companies were

more severely felt

(Appendix 8 and Figure 2)

.

Figure 2:

Natural Gas Production and

Utilisation

Source: Ministry of Energy and Energy Affairs

Approximately 48.0 percent or 13,782 million

cubic metres of the total natural gas produced

during the October 2012 to May 2013 period,

was utilised for the production of liquefied

natural gas (LNG). This represented a 7.9

percent increase from the 12,778 million cubic

metres utilised one year earlier. Other major

uses of natural gas during the period were as

a fuel source for industrial plants (7,464 million

cubicmetres) andas processedgas or feedstock

for petrochemical plants (5,103 million cubic

metres). These reflect declines of 2.6 percent

and 3.7 percent respectively, when compared

to the corresponding 2011/2012 period. The

amount of natural gas re-injected into reservoirs

contracted by 0.6 percent to 1,288 million cubic

metres in the current period, whilst natural gas

vented into the atmosphere, and that utilised as

Natural Gas Liquids, increased by 28.4 percent

(to 913 million cubic metres), and 5.9 percent

(to 184 million cubic metres), respectively.

The monthly average Henry Hub price of natural

gas remained relatively stable during the first

five months of fiscal 2012/2013, marginally

increasing from US$3.32 per thousand cubic

feet in October 2012 to US$3.54 per thousand

cubic feet in November, before moderating to

US$3.33 per thousand cubic feet in February

2013. Thereafter, the monthly average price

rose to a high of US$4.17 per thousand cubic

THE REAL ECONOMY