REVIEW OF THE ECONOMY 2013

22

SUSTAINING GROWTH, SECURING PROSPERITY

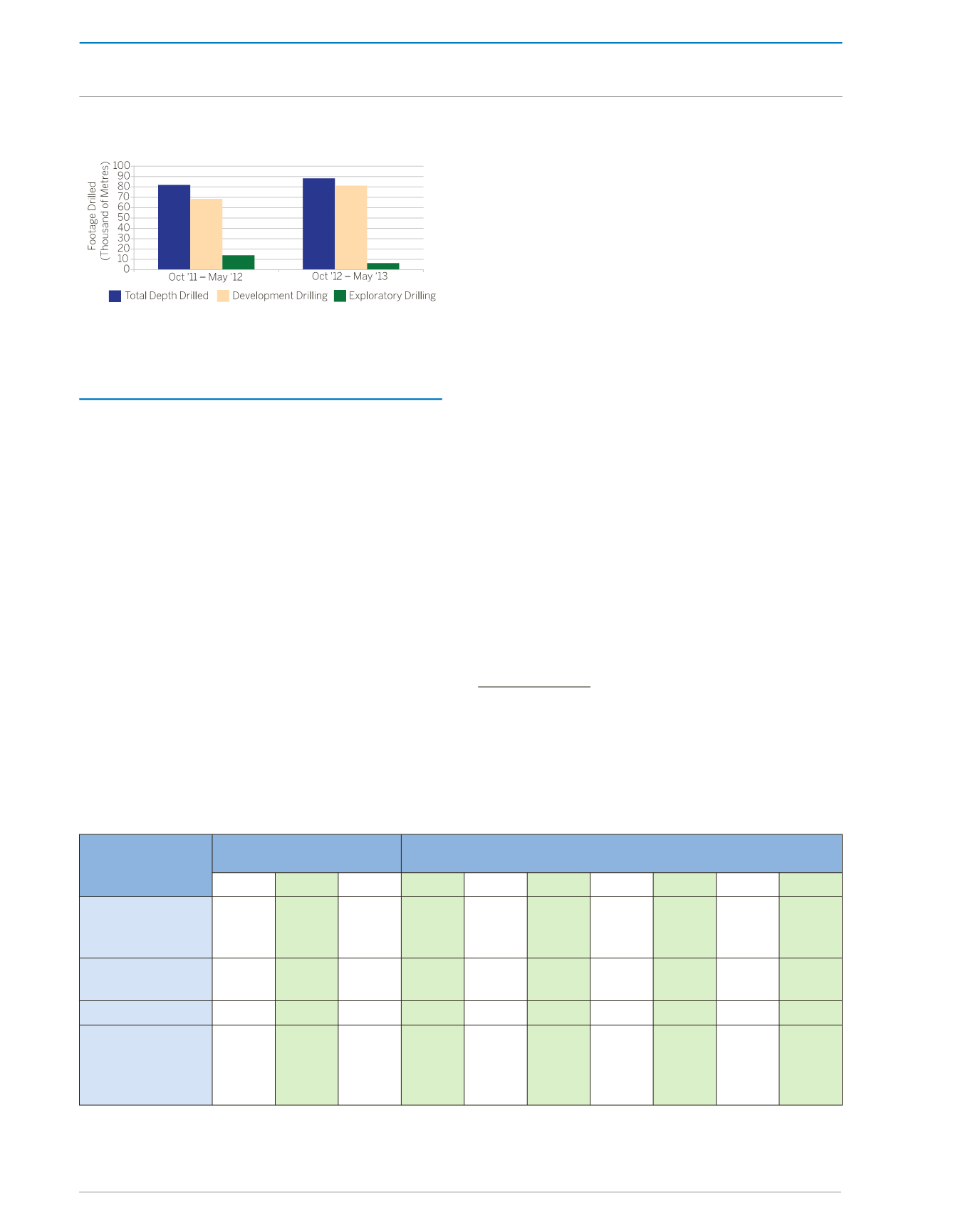

Figure 1:

Development and Exploratory Drilling

Source: Ministry of Energy and Energy Affairs

CRUDE OIL AND CONDENSATE

Production of crude and condensate totalled

19.7 million barrels during the period October

2012 to May 2013, representing a 4.3 percent

decline from the 20.6million barrels produced in

the corresponding period one year earlier. This

outcome was precipitated by a 25.6 percent

decline in condensate production (from 3.9

million barrels to 2.9 million barrels), which

outstripped a 0.6 percent expansion in crude

production (from 16.7 million barrels to 16.8

million barrels)

(Appendix 7)

. The extraction of

drier natural gas from new and existing natural

gas reservoirs, accounted in most part for the

lower condensate yield during the period.

Offshore crude and condensate production

declined by 11.3 percent to 14.0 million barrels

during the eight-month review period, whilst

onshore production increased by 18.9 percent

to 5.7 million barrels. As a consequence, the

share of total crude and condensate which is

produced onshore rose to 28.7 percent from

23.1 percent, and the share produced offshore

fell to 71.3 percent from 76.9 percent.

During the period October 2012 to July 2013,

Trinidad and Tobago’s oil and gas export

products generally benefitted from strong

export prices on account of the continued, albeit

subdued recovery in global economic growth,

and the on-going geopolitical tensions in the

Middle East. However, though higher than one

year ago, the Henry Hub price for natural gas

remained relatively soft, when compared to gas

prices in other export markets, owing to the on-

going impact of shale gas

4

.

The average monthly price per barrel of West

Texas Intermediate (WTI) crude oil fluctuated

between US$89.49 in October 2012 and

US$87.86 in December 2012, before ascending

4

Shale gas refers to natural gas that is trapped within shale

formations (fine-grained sedimentary rocks that can be rich

sources of petroleum and natural gas). The use of hori-

zontal drilling and hydraulic fracturing in recent years has

facilitated access to large volumes of shale gas that were

previously uneconomical to produce.

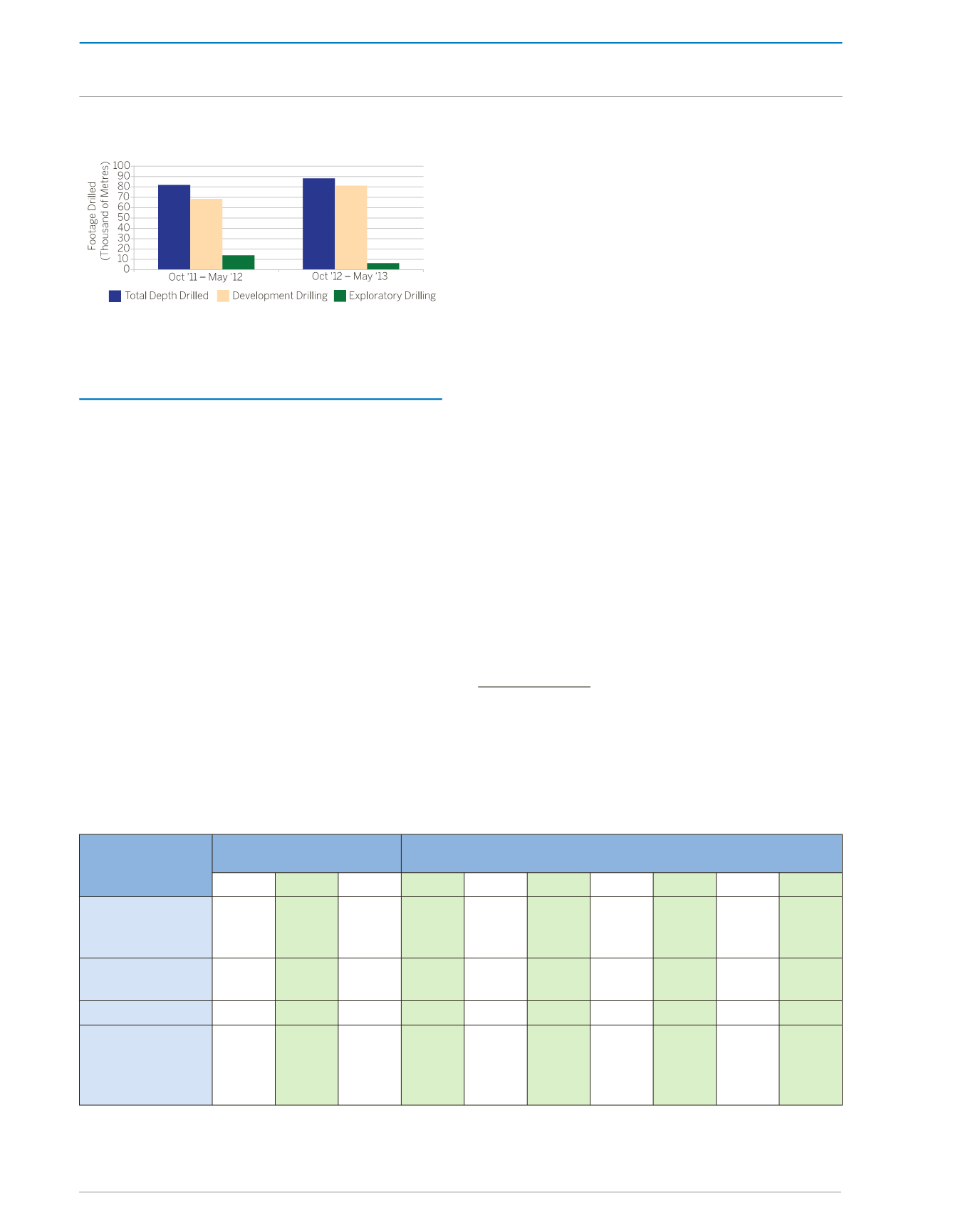

2012

2013

Oct

Nov Dec Jan Feb Mar

Apr

May Jun Jul

Crude Oil

(Spot Price US$/

Barrel)

West Texas

Intermediate

89.49 86.53 87.86 94.76 95.31 92.94 92.02 94.51 95.77 104.67

European Brent

111.71 109.06 109.49 112.96 116.05 108.47 102.25 102.56 102.92 107.93

Natural Gas

(US$/Thousand

Cubic Feet)

Henry Hub

3.32 3.54 3.34 3.33 3.33 3.81

4.17 4.04 3.83 3.62

Source: Energy Information Administration (US)

Table 3:

Oil and Gas Prices

THE REAL ECONOMY