REVIEW OF THE ECONOMY 2013

37

SUSTAINING GROWTH, SECURING PROSPERITY

generated $2,034.9 million in incremental

receipts in 2013. This revenue increase is

associated with a return of $560.0 million on

collateral posted on a SWAP transaction, the

receipt of $800.0 million as Share of Profits

from oil companies, and dividends from the

National Gas Company (NGC) and the Colonial

Life Insurance Company Limited (CLICO)

Investment Fund. The increases more than

compensated for the revenuedeclines in Interest

Income, Royalties and Non Industrial Sales from

2012 to 2013. Interest Income is estimated to

decline from $21.0 million to $20.5 million and,

receipts from Royalties on Oil is expected to fall

by 14.3 percent to $2,098.4 million, as a result of

falling oil production. Lower revenue collections

are also expected from Non Industrial Sales

decreasing from $23.3 million in fiscal 2012 to

$21.2 million in fiscal 2013.

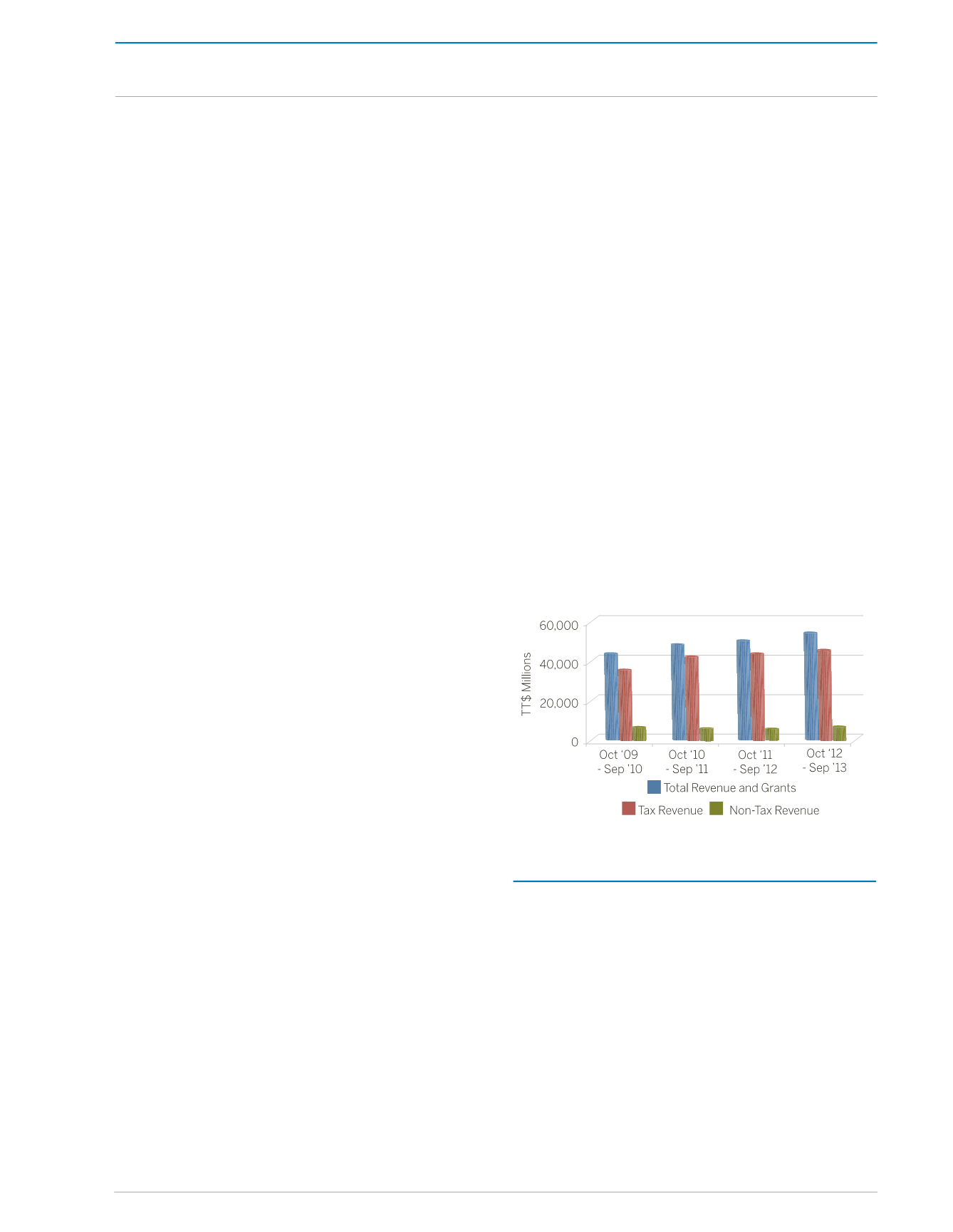

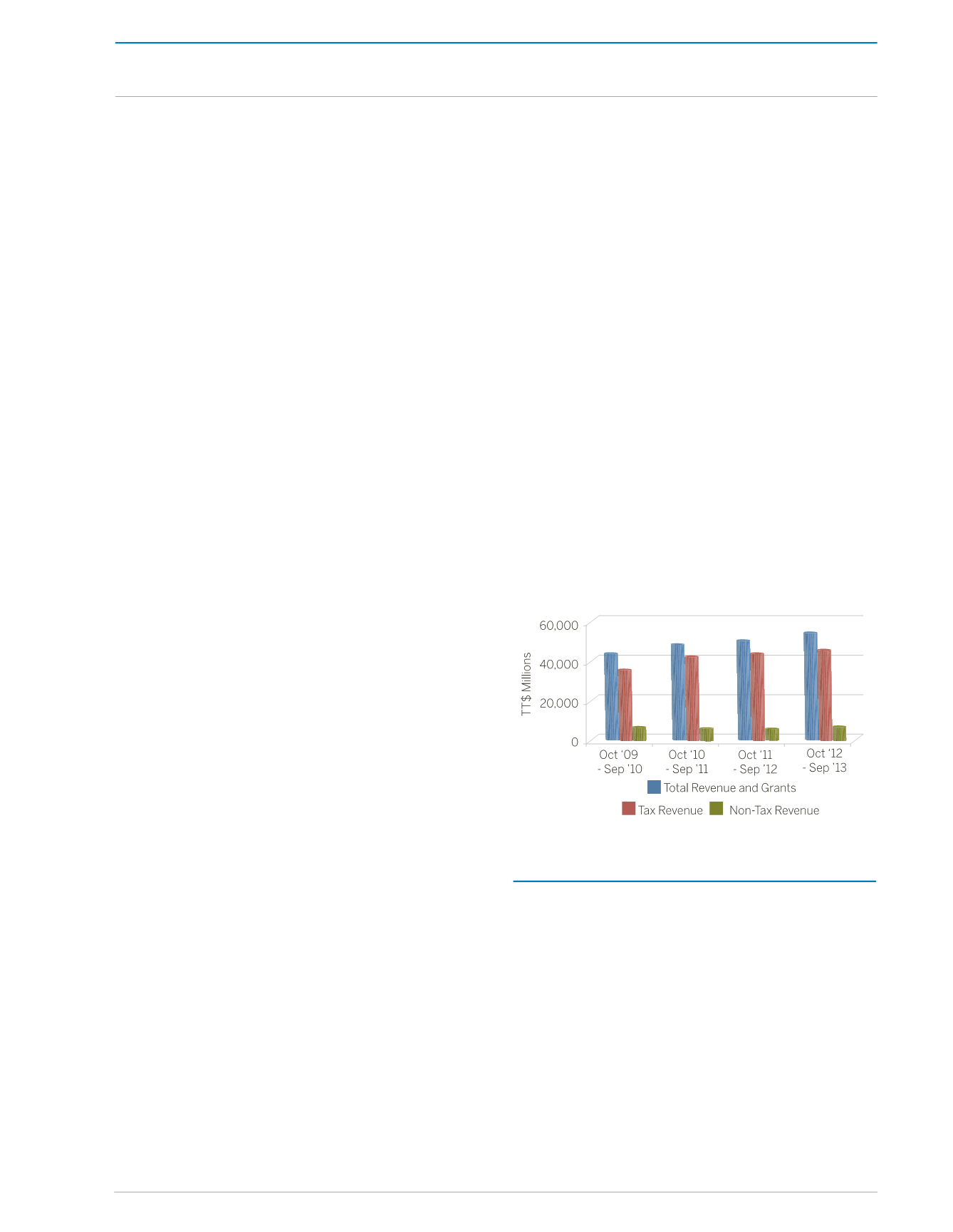

Figure 10:

Central Government Revenue

Source: Ministry of Finance and the Economy

EXPENDITURE

Actual Total Expenditure and Net Lending for the

fiscal 2013amountedto$59,470.2millionor36.6

percent of GDP representing an increase of 12.6

percent over fiscal 2012. Recurrent Expenditure

amounted to $50,467.1 million or 84.8 percent

of Total Expenditure and Net Lending, of which

Subsidies and Transfers amounted to $29,815.3

million or 50.1 percent of Total Expenditure and

Net Lending and Capital expenditure amounted

Taxes on International Trade

Receipts from Taxes on International Trade

for 2013 are estimated at $2,496.9 million,

consistingentirelyof ImportDuties, representing

an increase of 7.7 percent over fiscal 2012. Other

Taxes, consisting exclusively of stamp duties, is

expected to yield revenue amounting to $244.1

million in 2013, which is $29.9 million higher

than the previous fiscal year’s total.

Taxes on Property

Taxes on Property continue to contribute

minimally to revenue since fiscal 2010 as no

legislation has since been put in place to resume

Land and Building Taxes’ collections. The

expected outturn for fiscal 2013 of $39.6 million

is $8.3 million higher than for 2012.

Capital Receipts

Capital Receipts, comprising receipts from

Grants, the Sale of Assets or from Other Capital

revenue items was originally expected to

generate $47.1 million for fiscal 2013. However,

overall Capital Receipts performance for 2013

is expected to be significantly boosted by

disbursements relating to the termination of

the contract for the Offshore Petrol Vessels.

This is expected to contribute $406.8 million

to the estimate of Capital Receipts, while a

disbursement from the European Union (EU),

with respect to theSugar Protocol, is responsible

for the increase in Grants of $80.7 million,

yielding $487.5 million in 2013.

Non-Tax Revenue

Non-Tax Revenue receipts are estimated at

$7,346.7 million in 2013, representing a 29.7

percent improvement over last fiscal year’s

receipts of $5,665.7 million. This performance

reflects superior collections fromOther Non-Tax

Revenue,Profits fromNon-Financial Enterprises,

Administrative Fees and Charges, and Profits

from Financial Enterprises which collectively

CENTRAL GOVERNMENT OPERATIONS