REVIEW OF THE ECONOMY 2013

43

SUSTAINING GROWTH, SECURING PROSPERITY

recurring current account surpluses, and a

strong international reserve position.

Upward pressure on the rating is influenced

by increased foreign investment in oil/natural

gas exploration and commercialisation activity.

Moody’s also highlighted that approval of

fiscal reforms that incorporate limits to public-

sector wage growth, the divestment of state-

owned enterprises, and reforming subsidies

could positively impact the rating. In addition,

improved execution of public sector capital

expenditure commitments and reform of the

Heritage and Stabilisation Fund to make it a

more effective instrument for countercyclical

fiscal policy could also contribute to improved

ratings. Downward pressure on the rating could

arise from a sustained decline in oil or gas prices

and the failure to credibly commit to a medium-

term fiscal consolidation program to halt the

deterioration of the fiscal balance and stabilise

debt levels. Further, the consequential effect of

contingent liabilities from debt held by public

sector corporations could negatively affect the

rating as well as any resumption of large scale

industrial action.

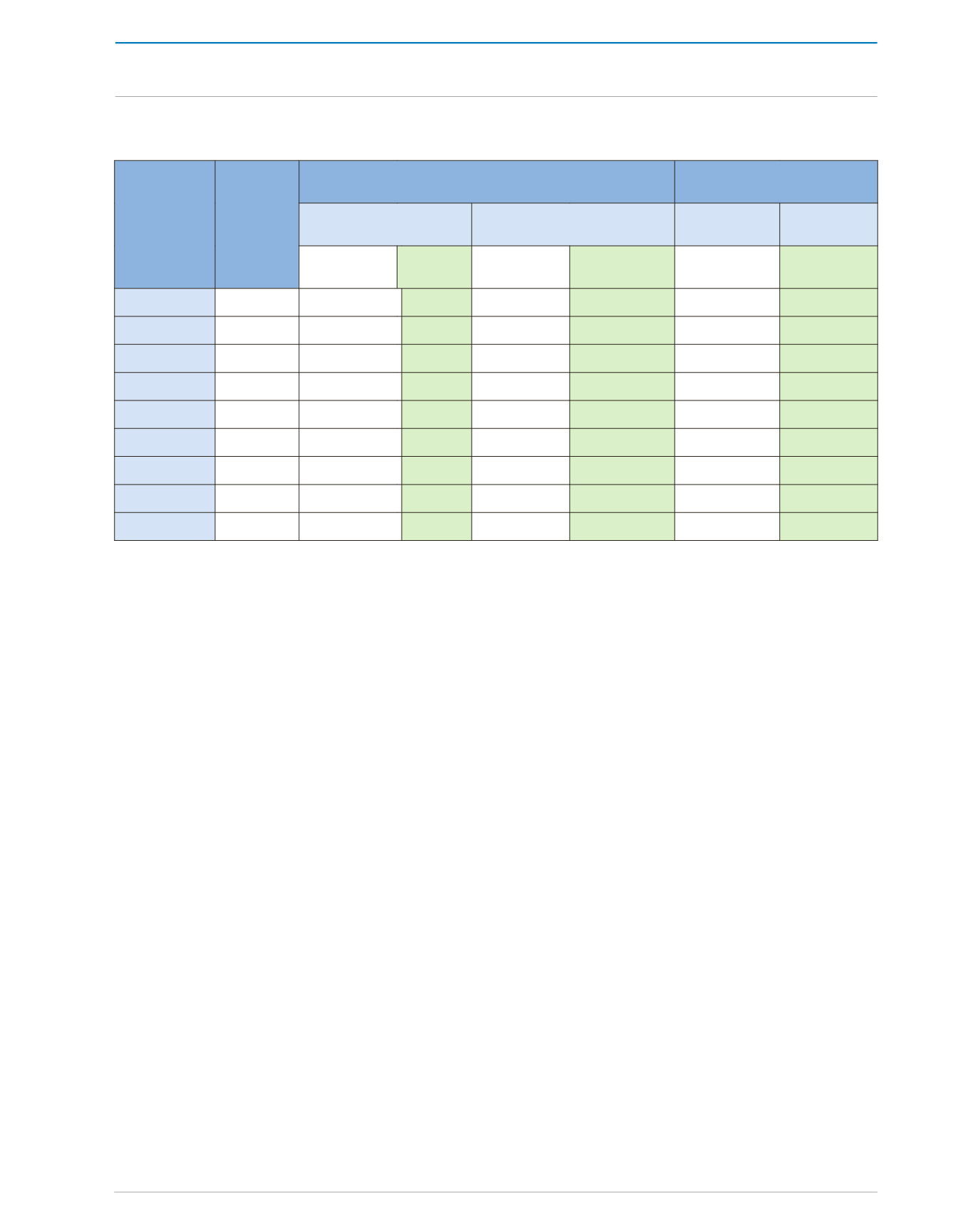

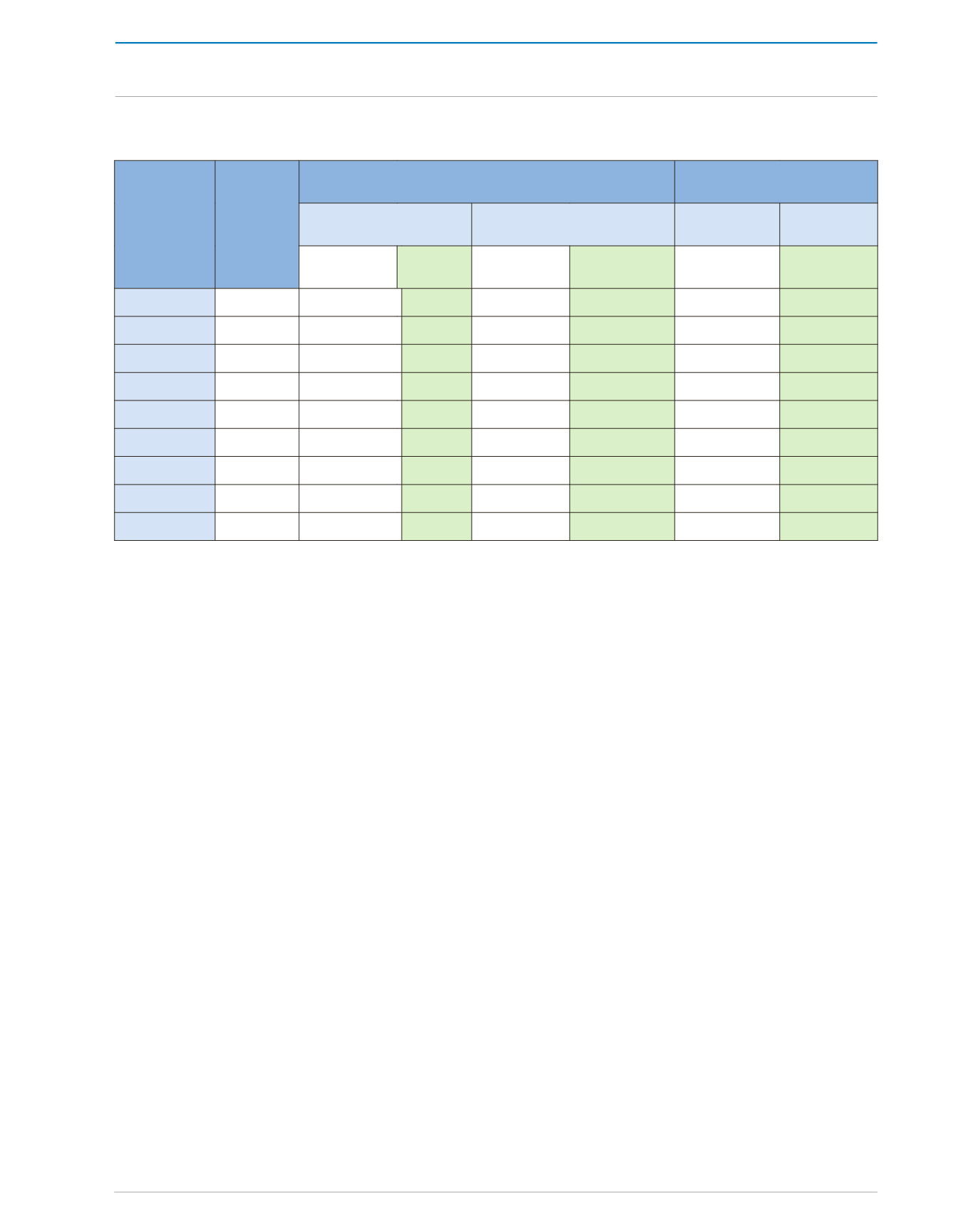

Year

Outlook

Foreign Currency Ceiling

Government Bond

Ratings

Bonds and Notes

Bank Deposits

Foreign

Currency

Local

Currency

Long

term

Short

term

Long

term

Short

term

Long

term

Short

term

Jan 2013

Stable

A1

…

Baa1

…

Baa1

Baa1

Aug 2012

Stable

A1

…

Baa1

…

Baa1

Baa1

Jul 2011

Stable

A1

…

Baa1

…

Baa1

Baa1

Jun 2009

Stable

A1

…

Baa1

…

Baa1

Baa1

Dec 2008

Stable

A1

…

Baa1

…

Baa1

Baa1

Oct 2007

Stable

A1

…

Baa1

P-2

Baa1

Baa1

Jul 2006

Stable

A1

…

Baa1

P-2

Baa1

…

May 2006

…

A2

P-1

…

…

…

…

Aug 2005

Stable

Baa2

P-3

Baa2

P-3

Baa2

…

Source: Moody’s Investors Service (2013)

Table 4:

Trinidad and Tobago Credit Rating History: 2005-2013 by Moody’s Investors Service

Moody’s report on Trinidad and Tobago

noted that growth performance in 2012 fell

short of expectations mainly as a result of

the underperformance in the energy sector.

Moody’s projected growth rate of 0.8 percent

for 2012 and 2.0 percent in 2013. Growth was

predicted to recover marginally in 2013 as a

result of increased exploration activity, foreign

investment in the energy sector and public

sector investment projects. Medium term

growth prospects depend on supportive global

energy prices, the effectiveness of public sector

capital investments, the completion of oil/

gas infrastructure maintenance operations,

and the government’s ability to prevent

renewed industrial action by unions. Moody’s

highlighted that Trinidad and Tobago’s debt

position is on par with most other Baa1-rated

peers and that Trinidad and Tobago’s external

position – its current account surplus and

international reserves as a share of GDP – are

superior to most Baa1-rated peers, including

commodity exporters such as Russia and

Bahrain. Moody’s report also highlighted that

Trinidad and Tobago’s broad revenue base

CENTRAL GOVERNMENT OPERATIONS