REVIEW OF THE ECONOMY 2013

44

SUSTAINING GROWTH, SECURING PROSPERITY

in 2013 and noted that boosting exploration and

production as well as enlarging downstream

activities, could bolster GDP growth, improve

government finances and reduce sovereigndebt.

Furthermore, their‘AA’transfer and convertibility

(T&C) assessment remains unchanged.

After several years of contraction and near

zero growth, Standard & Poor’s Rating Services

expects GDP growth to exceed 2.0 percent in

2013. Increases in investment in exploration

and production directly influence long-term

growth projections, furthered by government

recently offering more fiscal incentives to

boost oil and gas production. Additionally,

enlarging

downstream

activities

could

reinforce GDP growth, progressively improve

government finances and decrease the debt

burden. Persistent stunted economic growth

and extended fiscal deficits could result upon

failure of government to implement their own

investment strategies or protracted slowdown

in the energy sector thereby weakening the

country’s fiscal and external profiles. In this

case, Standard & Poor’s present ratings can be

affected.

results in a government to debt revenue ratio of

150 percent, on par with Bahrain and Lithuania

and significantly lower than the Bahamas and

Mauritius. Further, Moody’s noted that in the

Caribbean,Trinidad andTobago’s closest peer is

the Bahamas (Baa1 / negative outlook). The

Bahamas has a less favourable external position

than Trinidad and Tobago. This was attributed to

a much faster rate of debt-accumulation since

2009; limited fiscal room to manoeuvre and a

much narrower revenue base.

STANDARD & POOR’S RATINGS

SERVICES

In January 2013, Standard & Poor’s affirmed

its long and short-term sovereign credit ratings

for Trinidad and Tobago at A/A-1 with a Stable

Outlook. This rating is based on the economy’s

stable political system, its generally prudent

framework for macroeconomic policies, low net

general government debt, net external asset

position, and favourable debt profile limiting its

external vulnerability.

The stable outlook reflected the viewof Standard

& Poor’s that the country would resume growth

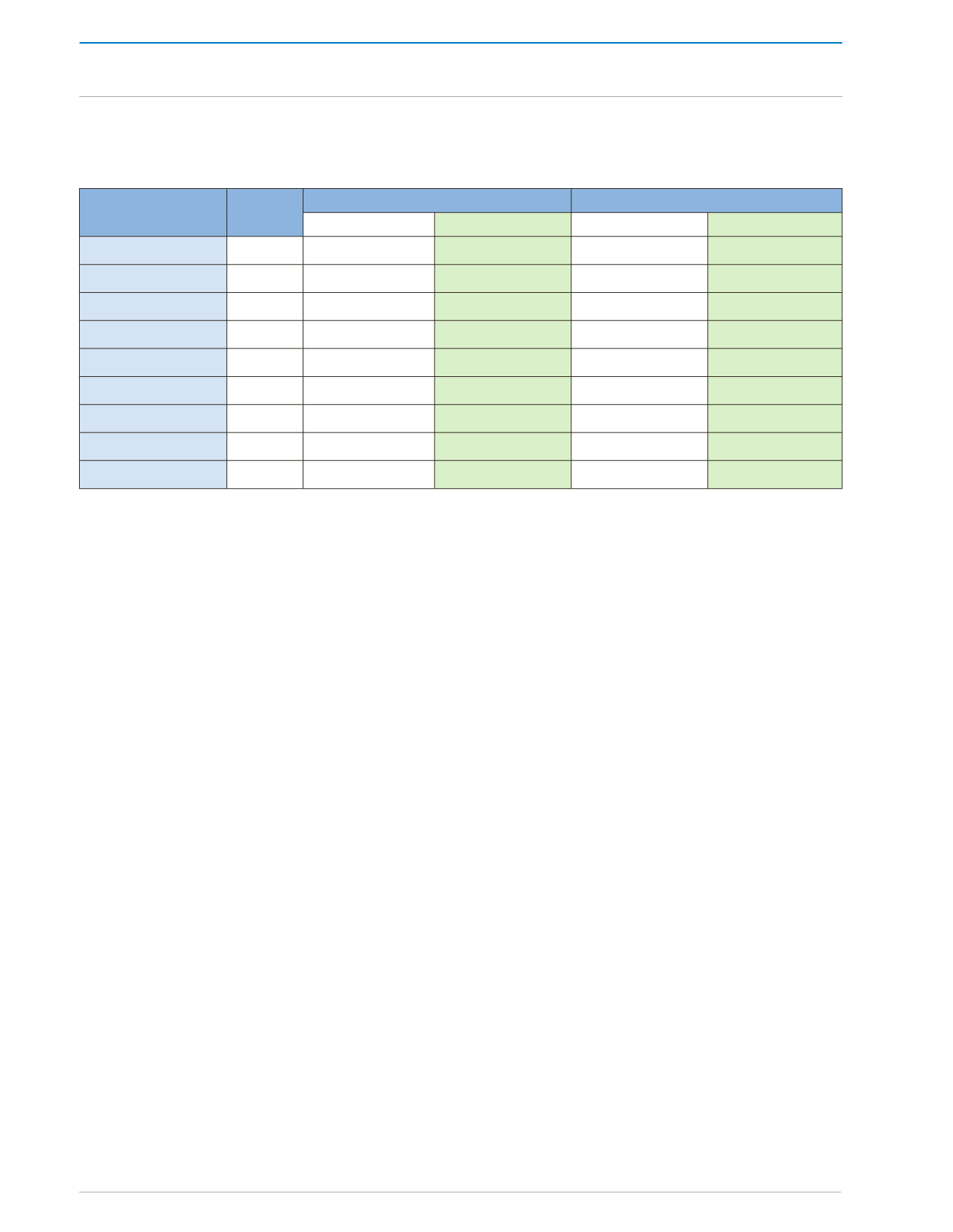

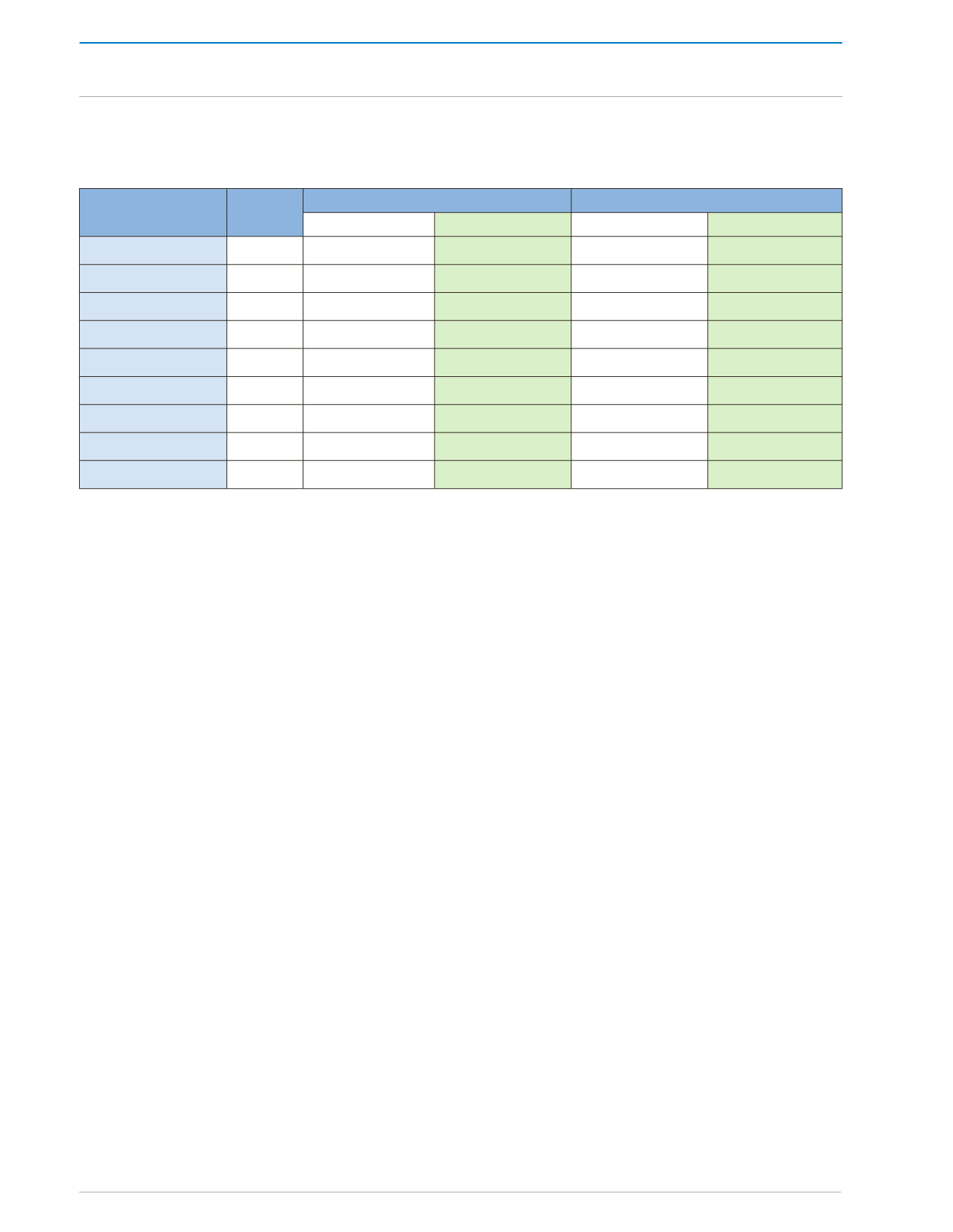

Table 5:

Trinidad and Tobago Credit Rating History: 2005 -2013 By Standard & Poor’s Ratings

Services

Year

Outlook

Foreign currency

Local currency

Long term Short term Long term Short term

Jan 2013

Stable

A

A-1

A

A-1

Jan 2012

Stable

A

A-1

A

A-1

Aug 2011

Stable

A

A-1

A

A-1

Jan 2011

Stable

A

A-1

A+

A-1

Dec 2009

Stable

A

A-1

A+

A-1

Apr 2009

Negative

A

A-1

A+

A-1

Aug 2008

Stable

A

A-2

A+

A-1

Sep 2007

Positive

A-

A-2

A+

A-1

Aug 2006

Stable

A-

A-2

A+

A-1

Source: Standard & Poor’s Ratings Services (2013)

CENTRAL GOVERNMENT OPERATIONS