REVIEW OF THE ECONOMY 2013

54

SUSTAINING GROWTH, SECURING PROSPERITY

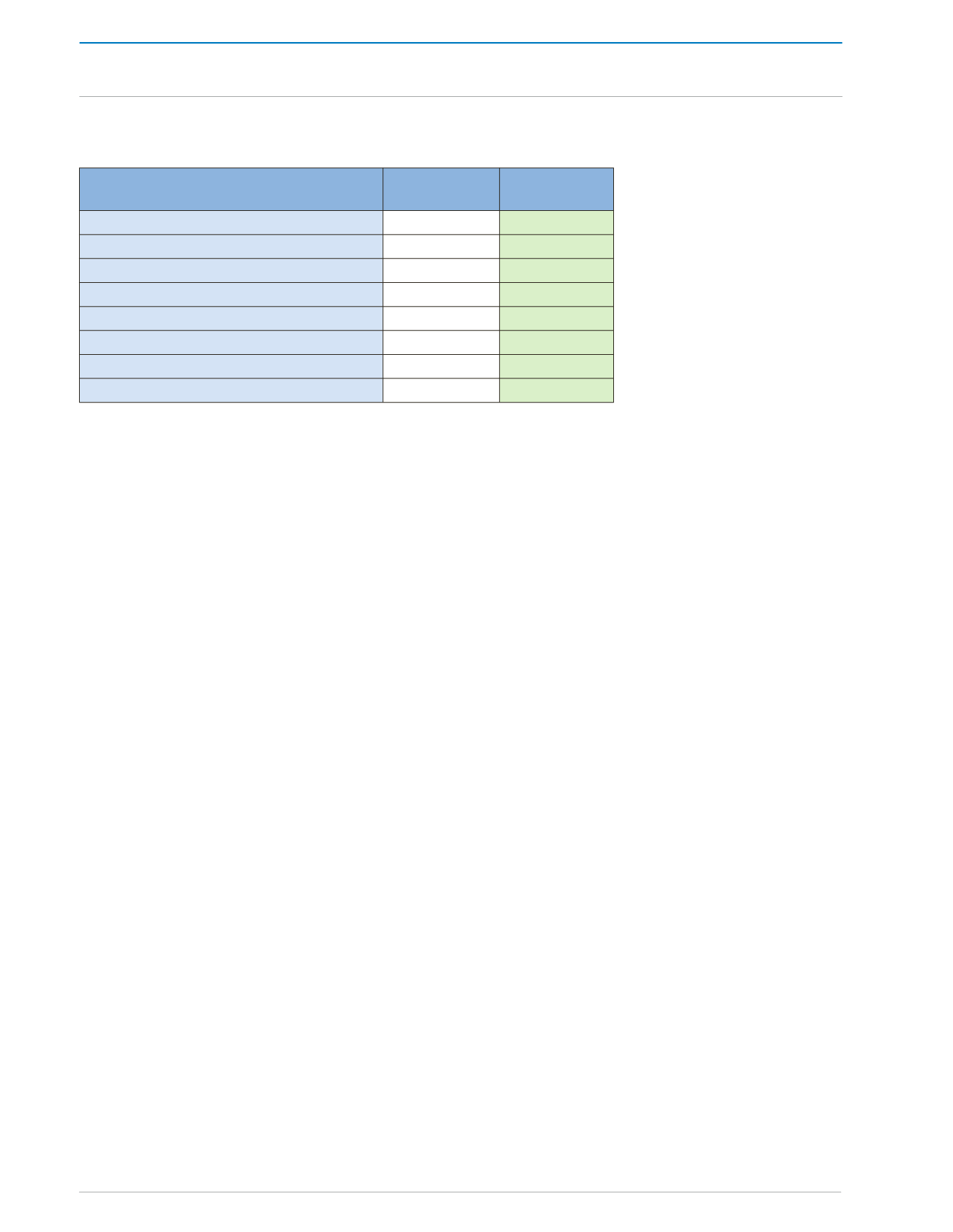

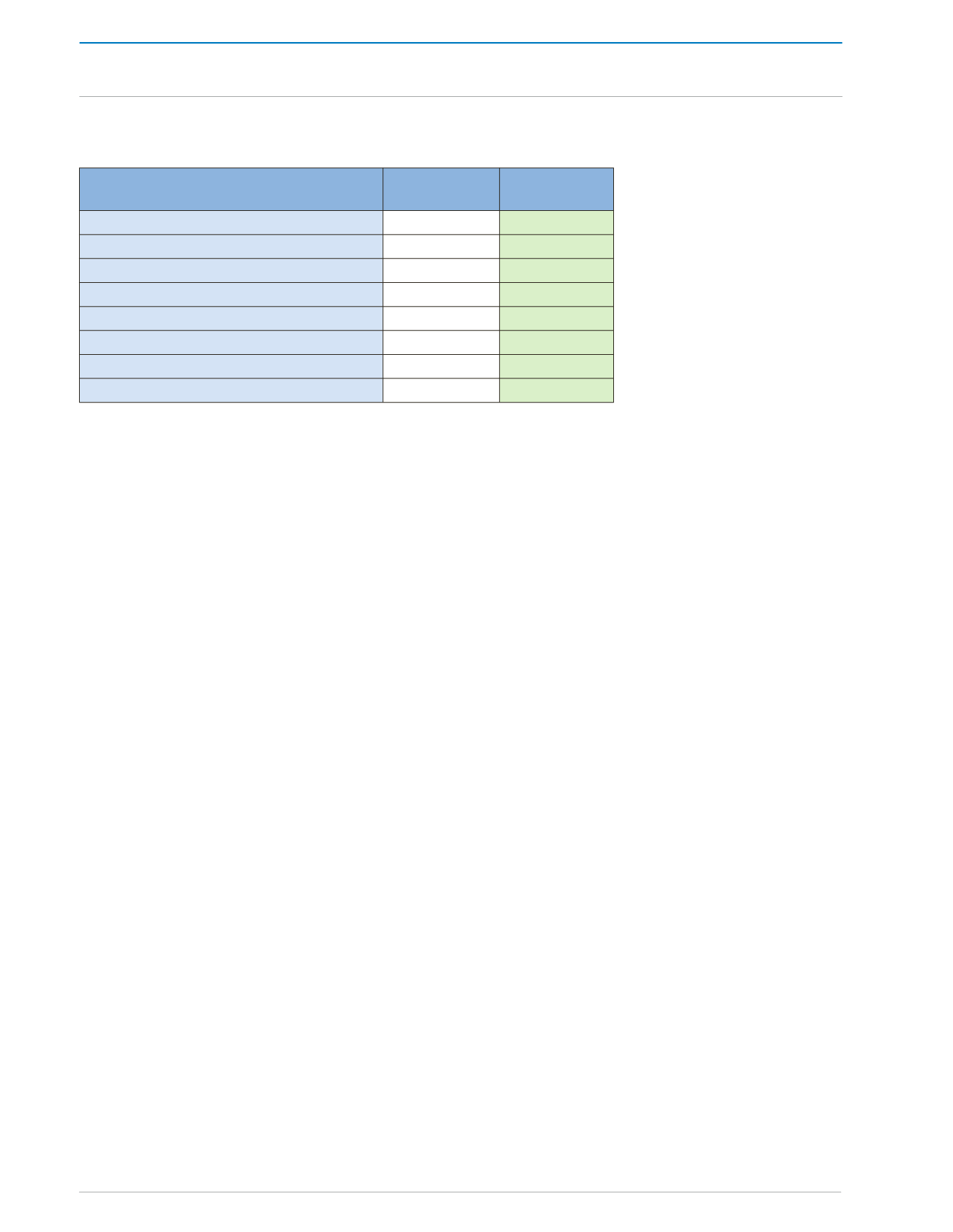

Over the review period, the number of market

registrants with the SEC increased marginally

from 208 to 210. Declines in the number

of Registered Representatives (Brokers),

Investment Advisors and Underwriters were

more than compensated for by increases in the

number of Reporting Issuers, Broker-Dealers,

and Registered Representatives (Traders). Self-

Regulatory Organisations remained unchanged

at two (2) - the Unit Trust Corporation and the

Trinidad and Tobago Stock Exchange.

A total of twenty-seven (27) securities were

registered during the nine-month period

ending June 2013, representing an increase

of thirteen (13) from the previous nine-month

period October 2011 to June 2012. The new

securities registered comprised twenty (20)

bond issues, six (6) certificates of participation

and one (1) Commercial Paper. The aggregate

value of securities registered increased from

TT$6.22 billion at the end of June, 2012 to

TT$17.36 billion at the end of June 2013. Bond

issues with an aggregate face value of TT$13.7

billion represented 79.0 percent of the value

of all securities registered. Certificates of

participation accounted for the remaining 20.0

percent or TT$3.5 billion of securities registered

with the Commission over the review period.

Table 9:

Total Registrants

As at May 31,

2012

As at May 31,

2013

Registered representatives (Brokers)

33

27

Investment Adviser

18

16

Reporting Issuers

94

95

Broker-Dealers (Securities Companies)

36

42

Self-Regulatory Organisations (SRO)

2

2

Registered representatives (Traders)

23

27

Underwriter

2

1

Total

208

210

Source: Securities and Exchange Commission

Equities

For the nine month period October 2012 to June

2013 the domestic stock market performed

favourably. The Composite Price Index (CPI),

grew by 9.96 percent over the review period,

from 1,022.4 to 1,123.9 in June 2013 (year-on-

year). The volume of shares traded on the first

tier market increased by 19.7 percent from

41,399,250 to 49,567,167. The value of shares

traded over the review period increased by 26.9

percent to $623.8 million. Market capitalisation

on the first tier market stood at $102.5 billion at

the end of the nine month period ending June

2013 up by 9.1 percent from $93.9 billion.

There were several major developments which

took place at the Trinidad and Tobago Stock

Exchangeover theperiodunder review.Firstly,on

November 12th 2012, Savinvest India Asia Fund

(SIAF) was de-listed pursuant to a resolution

passed by SIAF’s unit holders approving the

de-listing. This action was taken as part of the

process to convert SIAF to an open-ended fund.

Secondly, on December 24th 2012, Capital &

Credit Financial Group Limited (CCFG) was de-

listed pursuant to the acquisition of CCFG by

Jamaica Money Market Brokers Limited. Thirdly,

on January 4th 2013, CLICO Investment Fund

(CIF) was listed on the Exchange’s Mutual Fund

THE MONETARY SECTOR