REVIEW OF THE ECONOMY 2013

56

SUSTAINING GROWTH, SECURING PROSPERITY

commercial bank deposits and treasury bills

given the high liquidity and low interest rate

environment in the domestic economy. Over

the 9-month period October 2012 to June 2013,

aggregate funds under management increased

by 0.5 percent from $40.2 billion in October

2012 to $40.3 billion by June 2013. On a year-

on-year basis, funds under management grew

by 7.5 percent from $37.5 billion to $40.3 billion.

This increase in funds under management was

driven by aggregate net sales, which increased

threefold by over 217 percent on a year-on-year

basis from$1.3 billion inJune 2012 to $3.9 billion

by June 2013.

The impetus for the growth in funds under

subdued, issuing only two (2) out of the eleven

(11) bonds that came tomarket during the review

period. RBC Royal Bank (Trinidad and Tobago)

Limited issued a $300 million, 15 year, 4.75

percent callable bond in November 2012, while

Prestige Holdings Limited issued a $140 million

10 year, 6.25 percent per annum floating rate

bond. Prestige Holdings Limited bond’s coupon

rate of 6.25 percent per annum represented the

highest interest rate offered among the other

ten (10) bonds issued during the review period.

Mutual Funds

Mutual funds featured as a relatively attractive

investment alternative to instruments such as

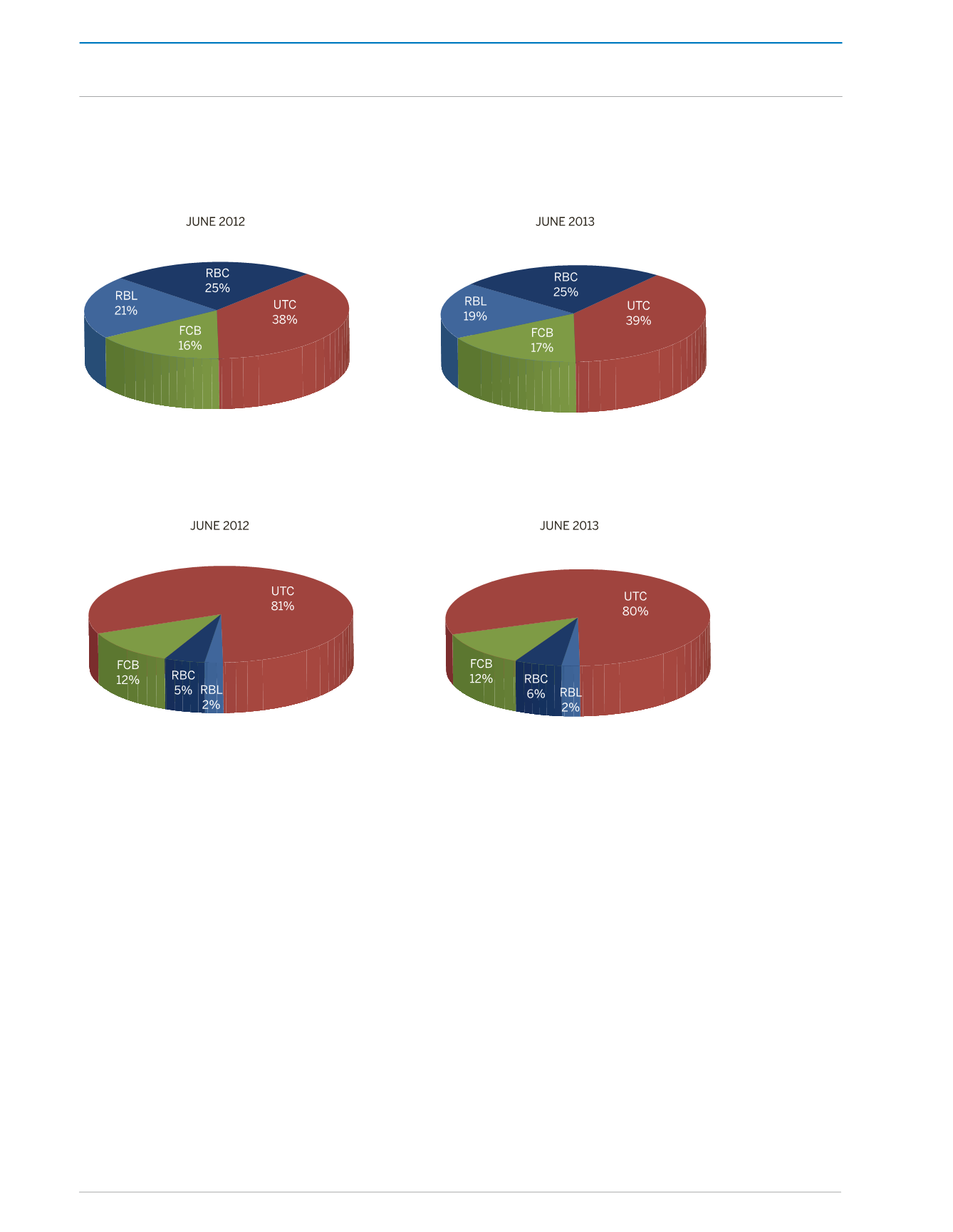

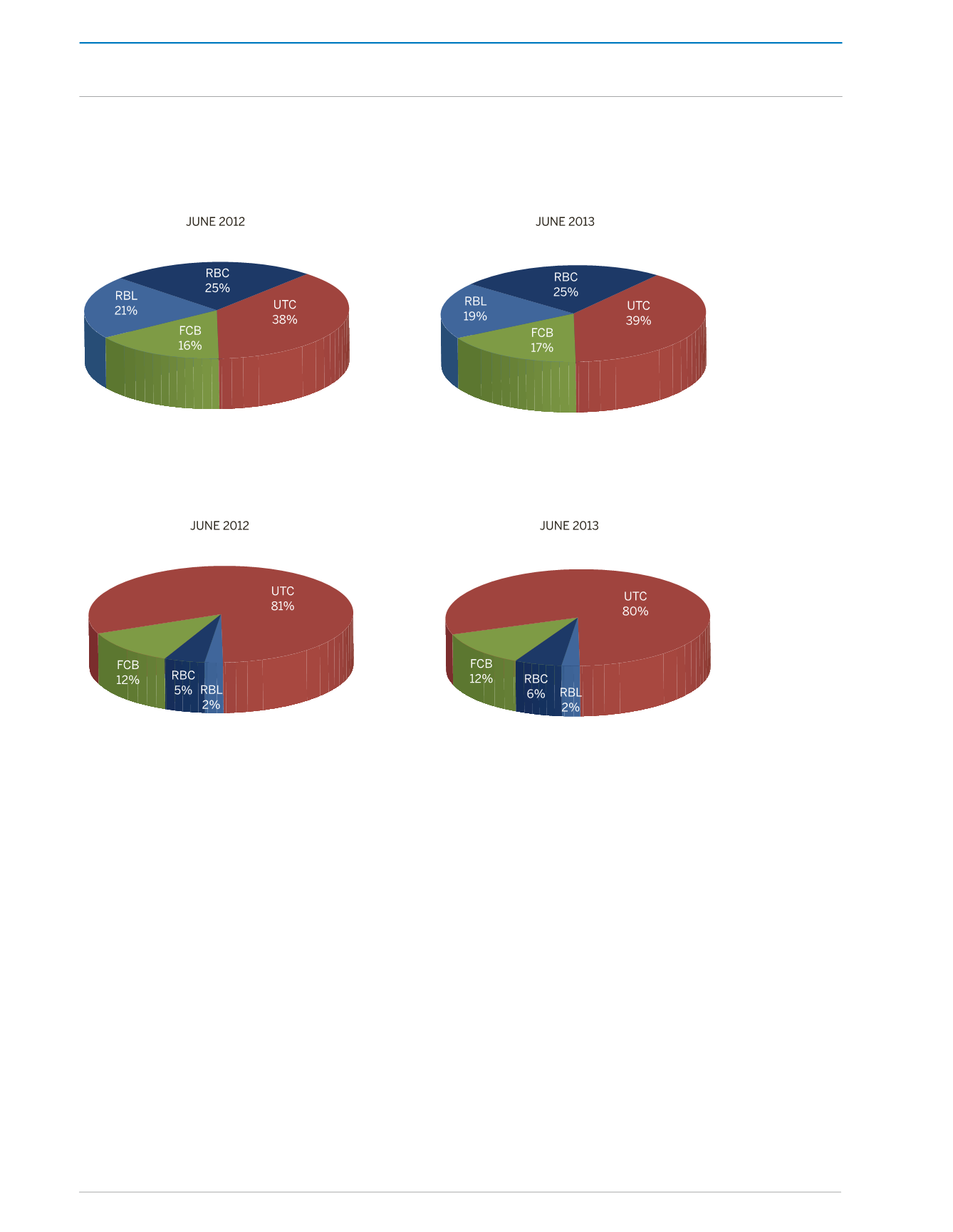

Figure 18:

Comparative Analysis – Market Share

a) Money Market Funds

b) Growth and Income Funds

Sources: UTC, RBL, RBC and FCB

THE MONETARY SECTOR