REVIEW OF THE ECONOMY 2013

53

SUSTAINING GROWTH, SECURING PROSPERITY

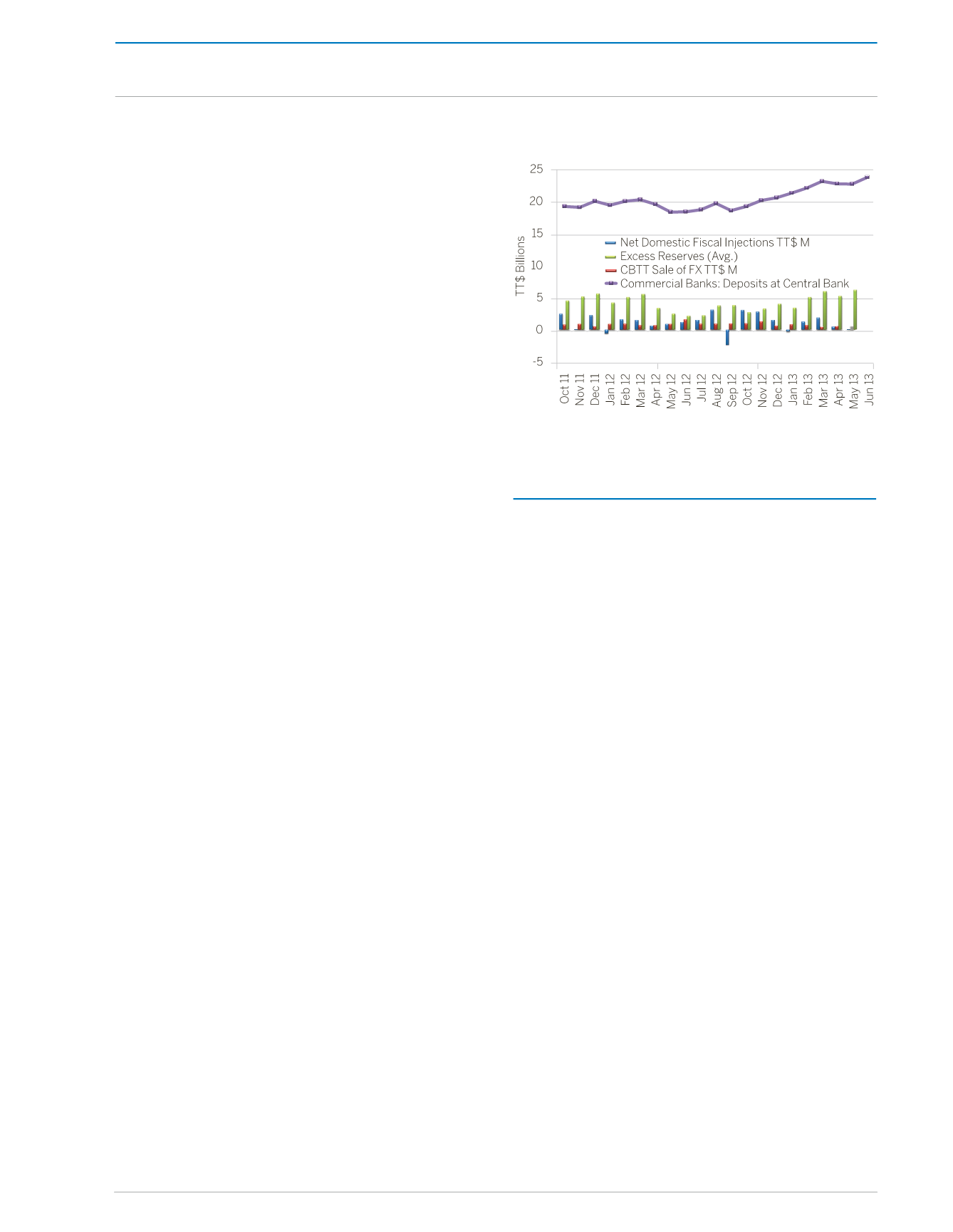

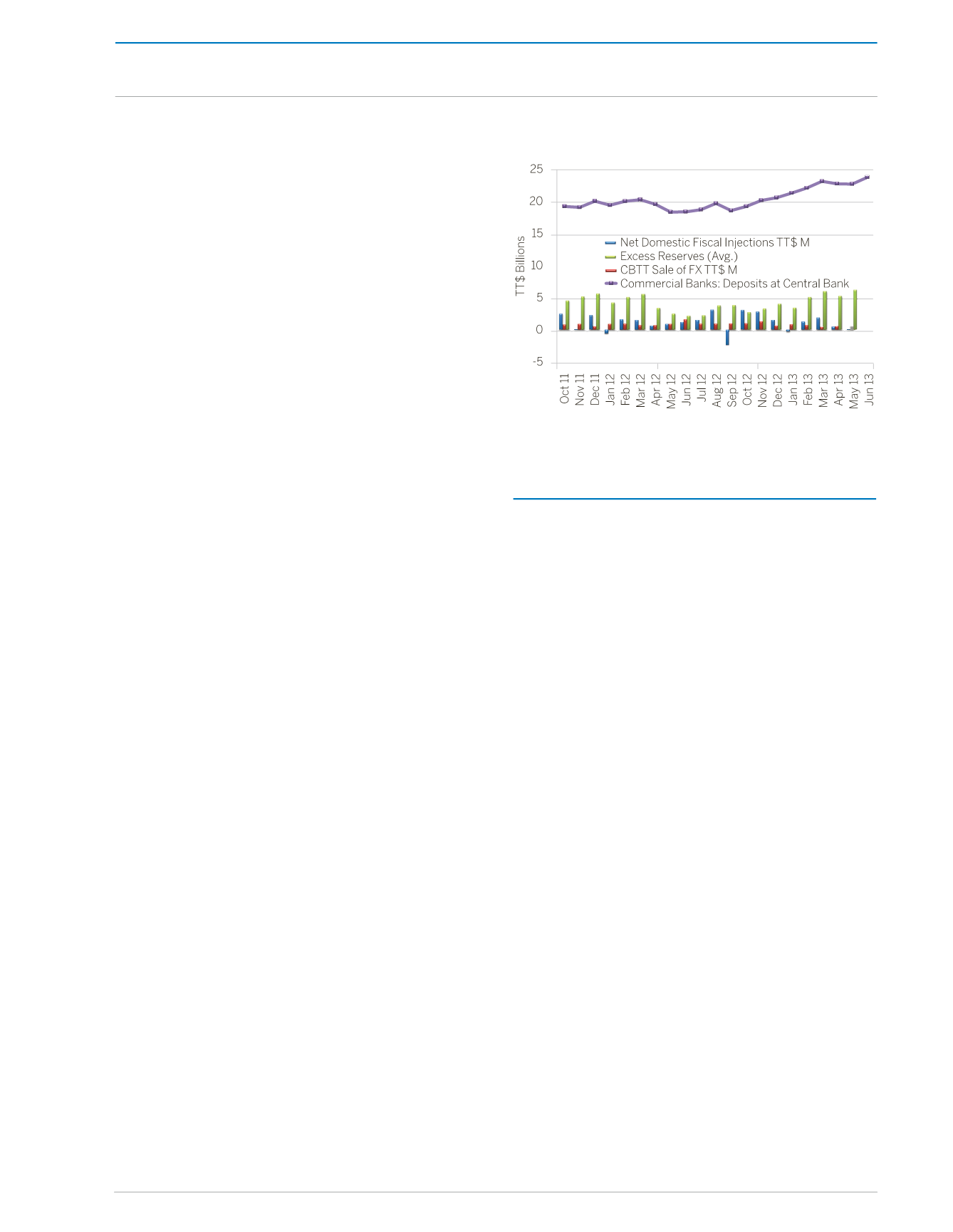

Figure 17:

Liquidity Indicators

Source: Central Bank of Trinidad and Tobago

FINANCIAL SECTOR

PERFORMANCE

CAPITAL MARKET ACTIVITY

Trinidad and Tobago Securities and Exchange

Commission (TTSEC)

During the review period October 2012 to June

2013 the Trinidad and Tobago Securities and

Exchange Commission’s (TTSEC) regulatory

capacity was enhanced with the passage of

the Securities Act in December 2012. The

improvements contained in this new Act will

assist the Commission in attaining its ultimate

goal of creating an efficient and fair domestic

financial market.

The size of the domestic capital market

stood at TT$273.9 billion as at May 2013. In

relation to the size of the national economy

this represents approximately 178.0 percent of

GDP. The domestic capital market had a total

of 210 registrants as at May 31, 2013 up from

208 registrants at May 31, 2012. The Securities

Act 2012 has introduced several changes in

the classification of some registrants. Traders/

Brokers are now classified as Registered

Representatives and Securities Companies are

now classified as Broker-Dealers.

LIQUIDITY

Liquidity in the financial system as measured

by commercial banks’ reserves held with the

Central Bank increased significantly by 24.0

percent from $19,404.9 million in October 2012

to $23,987.5 million by the end of June 2013,

after having declined by 4.4 percent in the

previous comparative period. On a year-on-year

basis, the average monthly level of reserves of

commercial banks held with the Central Bank

registered strong growth of 29.0 percent from

$18,552.7 million in June 2012 to $23,987.5

million in June 2013.

This build-up of liquidity in the domestic banking

system was fuelled by two factors, mainly the

net domestic fiscal injections which rose by 21.2

percent to $10,865.4 million at the end of May

2013, and the anaemic credit and investment

environment. In attempting to alleviate the

liquidity pressures, the Central Bank withdrew

$200.0million fromthe financial systemthrough

the issuance of Treasury Bills and Notes.

Other liquidity absorptions measures taken

by the Central Bank included the issuance of

a $1.0 billion Treasury bond in May 2013, the

sale of foreign exchange to authorised dealers

in the sum of TTD$6,022.1 million over the

review period, commercial bank’s special fixed

deposits of $1.5 billion and $1 billion matured

and were rolled over in the months of March and

May 2013, respectively. Notwithstanding these

liquidity absorption measures, high liquidity

levels still prevailed in the domestic financial

system. There was no activity recorded in the

repo market during the review period.

THE MONETARY SECTOR