REVIEW OF THE ECONOMY 2013

40

SUSTAINING GROWTH, SECURING PROSPERITY

Proceeds of the bond issues were utilised for

the capitalisation of the CLICO Investment Fund

(CIF). During the year, a total of $3,646.8 million

of the 11-20 year portion of the Zero Coupon

bond series issued in December 2011 under the

Purchase of Certain Rights and Validation Act

#17 was exchanged for units in the CIF, resulting

in a reduced balance of $5,725.5million on these

Zero Coupon Issues. Also contributing to the

increase in Central Government Domestic Debt

was a US$4.6 million, 3.75 percent loan facility,

due 2017 for the local financing component of

the procurement of a digital communication

system for the Trinidad and Tobago Police

Service (TTPS).

The Central Government External Debt,

accounting for 24.2 percent of Net Public Sector

Debt, is projected to rise by 0.1 percent or

$11,181.4 million. The relatively minimal increase

is consequent upon disbursements on new and

existing loans being offset by repayments on

existing loans.

During the year, four (4) new external loans were

contracted, namely: GORTT US$26.3 million,

2.42 percent, due 2022, representing the foreign

financing component for the procurement

of the digital communication system for the

TTPS. Other external loans contracted by the

Central Government during the year included: a

year. However, the external component of Net

Public Sector Debt is projected to contract by

$126.7 million or 1.0 percent.

By the end of the current fiscal year, Central

Government Debt; comprising both foreign and

domestic components; is expected to rise by 5.2

percent to $43,718.3 million or 26.5 percent of

GDP, while Contingent Liabilities or Government

Guaranteed Debt is projected to increase by 9.5

percent to $30,198.5 million or 18.3 percent of

GDP. By the end of September 2013, Central

Government Debt is anticipated to comprise

59.1 percent of Net Public Sector Debt with 40.9

percent attributed to Contingent Liabilities.

Central Government Debt

The 5.2 percent increase in Central Government

Debt during fiscal 2013, is largely attributable

to the domestic component which accounts

for 75.0 percent of Net Public Sector Debt.

Accordingly, Central Government Domestic

Debt is anticipated to rise by $2,222.1 million

or 7.3 percent by the end of fiscal 2013. This

increase is primarily due to the issuance, in

October 2012, by the Government of a $5,100

million, fixed rate bond due 2032/2037, and

issued in two tranches: Tranche I $4,397.1

million,4.20 percent, due 2032; and Tranche

II $702.9 million, 4.25 percent, due 2037.

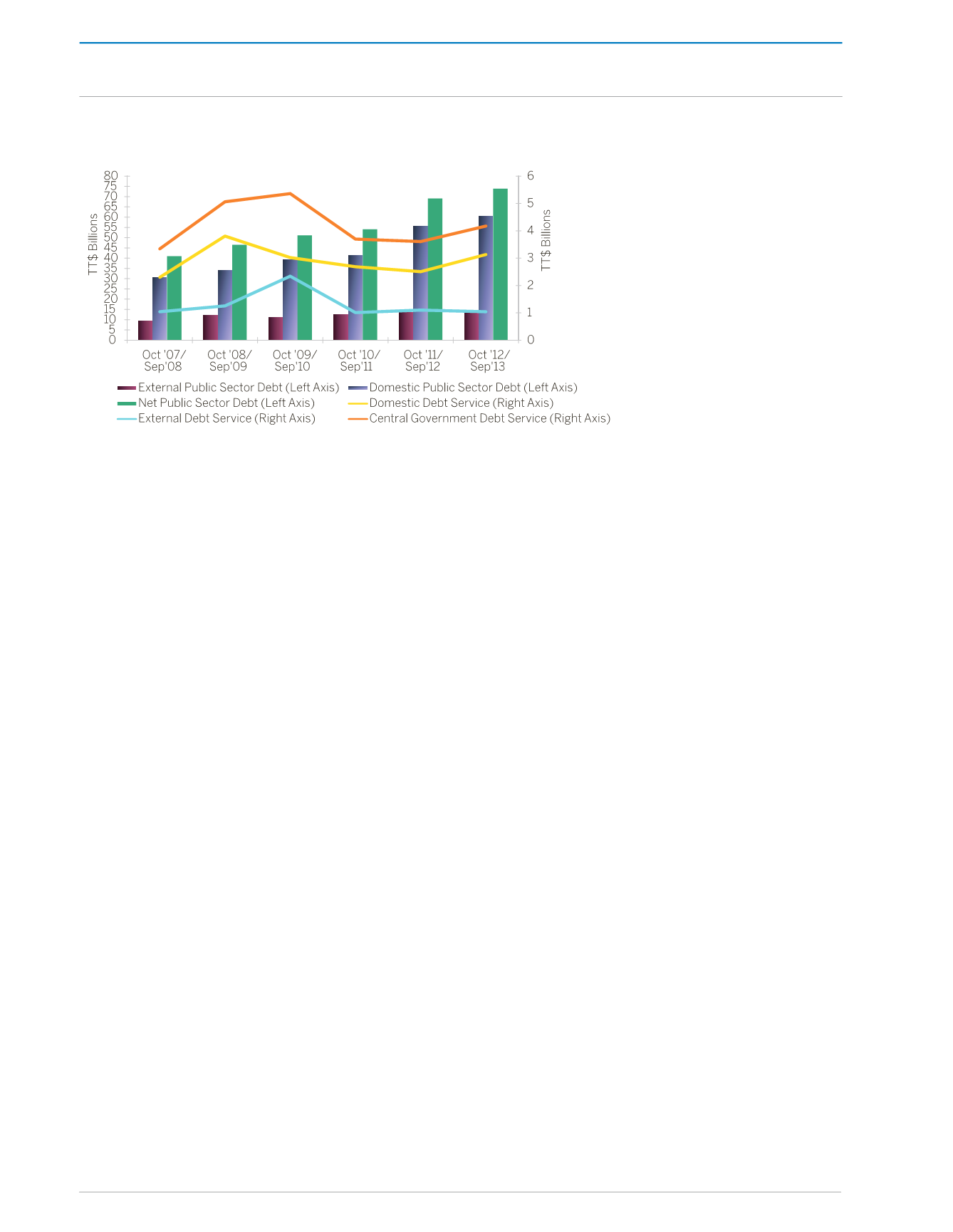

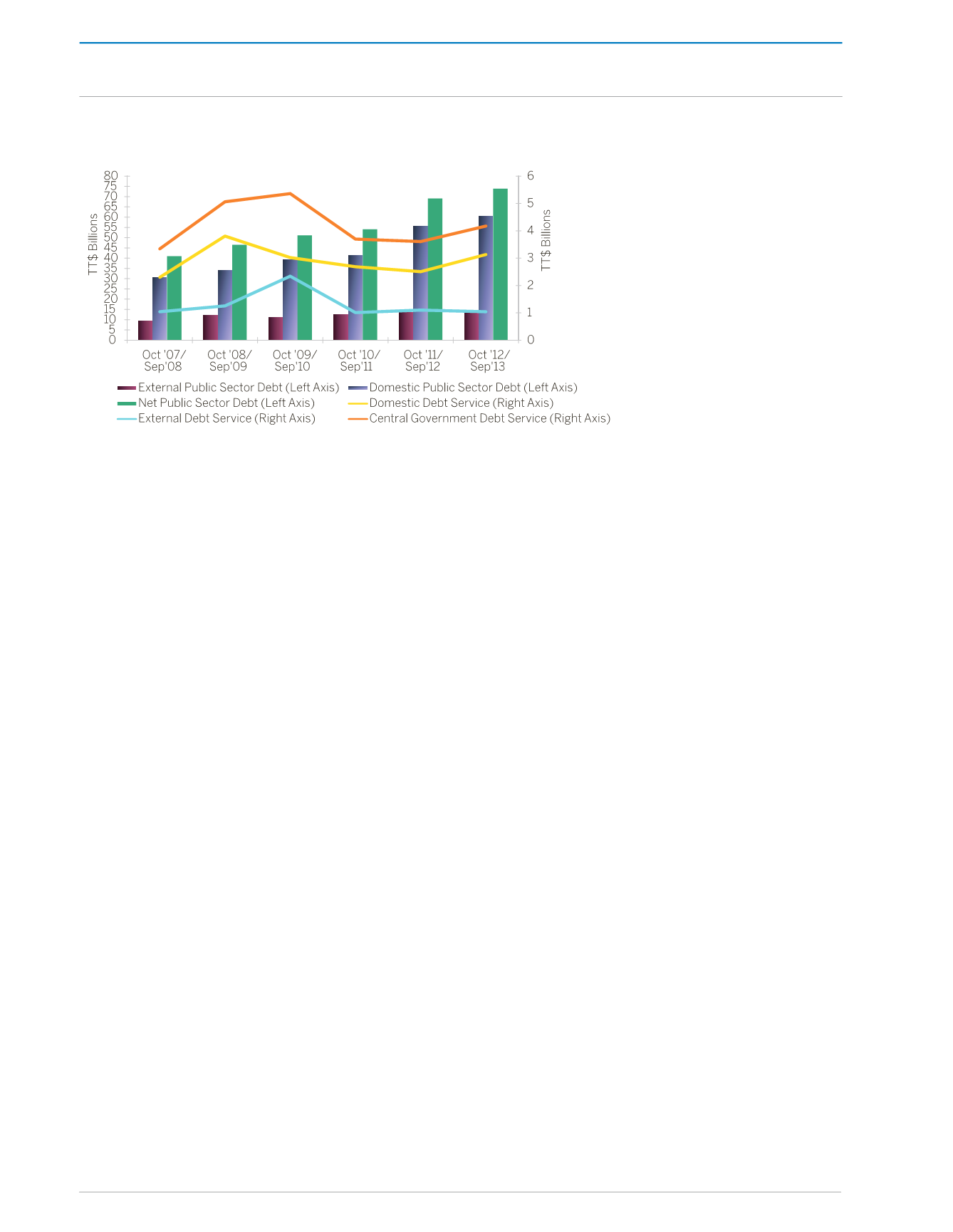

Figure 13:

Public Sector Debt and Debt Servicing

Source: Ministry of Finance and the Economy

CENTRAL GOVERNMENT OPERATIONS