REVIEW OF THE ECONOMY 2013

36

SUSTAINING GROWTH, SECURING PROSPERITY

surpassed the original budgeted sum of

$5,806.7 million and exceeded 2012 collections

by $667.3 million. This performance was mainly

associated with rising employment and the

settlement of collective agreements across

the Energy, Government, Finance, Distribution

and Transport sectors. Receipts from Business

Levy, Unemployment Levy Withholding Tax and

Green Fund all fell marginally short of budgetary

expectations.

Taxes on Goods and Services

Receipts from Taxes on Goods and Services are

expected to amount to $8,261.1 million in 2013

exceeding the originally budgeted estimate by

$49.5million.This canbeattributed toa stronger

than anticipated collection performances by

Motor Vehicle Taxes and Duties associated with

higher than anticipated sales of new and used

foreign-used vehicles and increased payments

for inspection fees and driving permits. Taxes

on Goods and Services for 2013 is expected

to yield $335.5 million more than realised for

2012 based on stronger collections of Value

Added Tax associated with stronger economic

activity. Additionally, Betting and Entertainment

and Other Taxes on Goods and Services are

both estimated to perform better than last

fiscal year’s outturn by $12.8 million and $36.6

million respectively. The increases in these

revenue categories are mitigated by declines

in collections in excise duties which at $701.9

million is $23.4 million lower than the fiscal

2012 outturn of $725.3 million. This decline is

associated with lower production mainly in rum,

spirit, oil and cigarettes. Motor Vehicle Taxes

and Duties are also anticipated to decline by

$21.7 million from its 2012 outturn to $502.6

million by the end of this fiscal year on account

of the introduction of the five (5) year driving

permit. Receipts from Liquor and Miscellaneous

Licenses and Alcohol and Tobacco Taxes in 2013

are both expected to be marginally less than

realised in the last fiscal year.

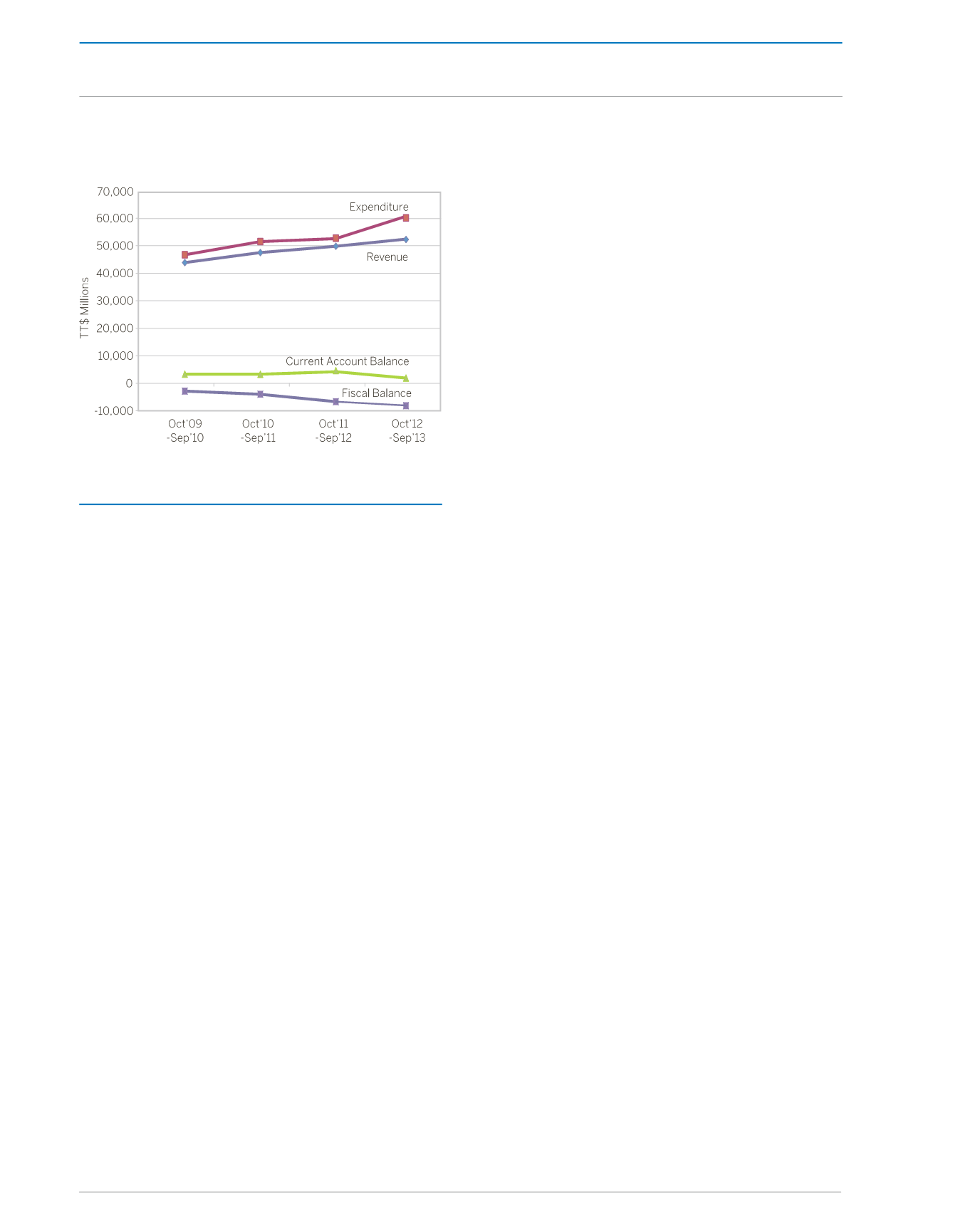

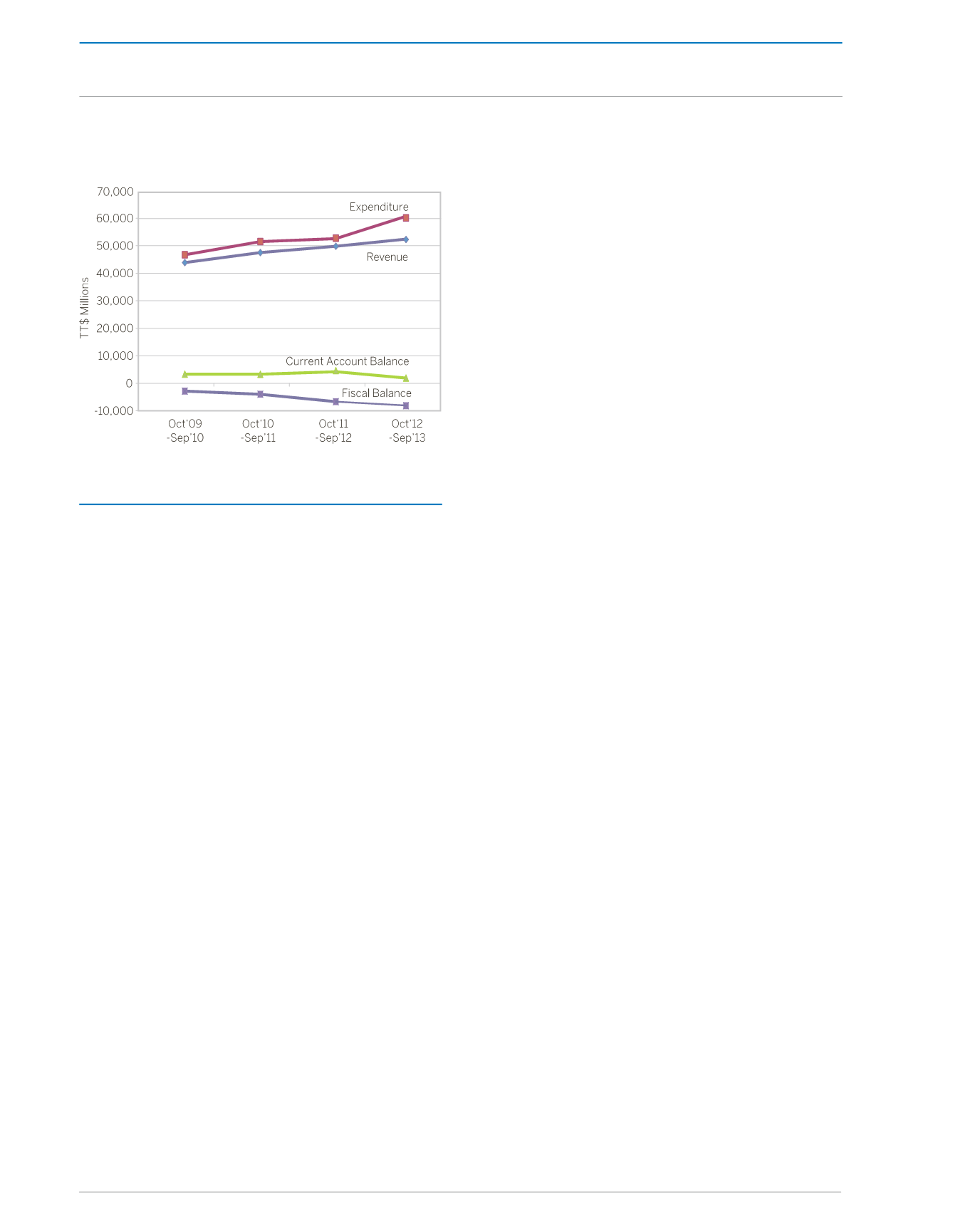

Figure 9:

Central Government Fiscal

Operations

Source: Ministry of Finance and the Economy

REVENUE

At the end of fiscal 2013, Total Revenue and

Grants in the amount of $52,984.8 million

exceeded budgetary estimates by $3,706.9

million and was $3,706.9 million in excess of

revenue receipts for fiscal 2012. Favourable

variances in Taxes on Income and Profits of

$1,030.6 million and in Taxes on Goods and

Services of $335.5 million were the main

contributors to the stronger than anticipated

revenue performance for 2013.

Taxes on Income and Profits

In 2013, collections from Taxes on Income and

Profits which amounted to $34,108.9 million

surpassedreceiptsfrom2012by$1,030.6million

primarily as a result of higher than budgeted

receipts from Companies and Individuals.

Actual receipts from Companies exceeded the

original budgeted sum of $24,429.2 million by

$858.7 million and outperformed collections

from 2012 by $814.6 million. This superior

performance in 2013 was due mainly to an

increase in the number of companies paying

corporation tax as well as from the inclusion of

receipts that had been previously classified as

Business Levy. Actual receipts from Individuals

CENTRAL GOVERNMENT OPERATIONS