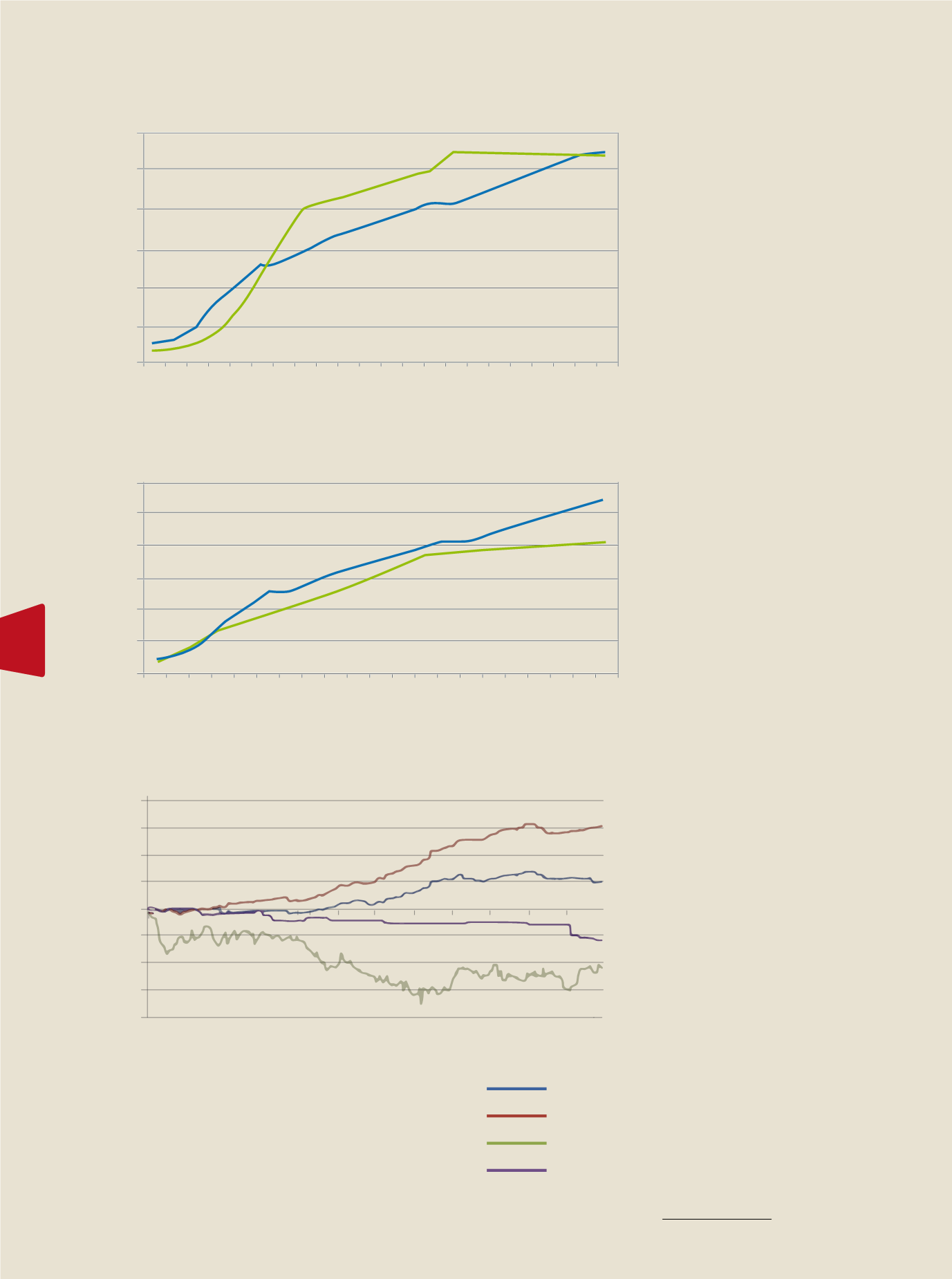

Figure 7:

T&T Government Yield Curve (June Vs Dec 2012)

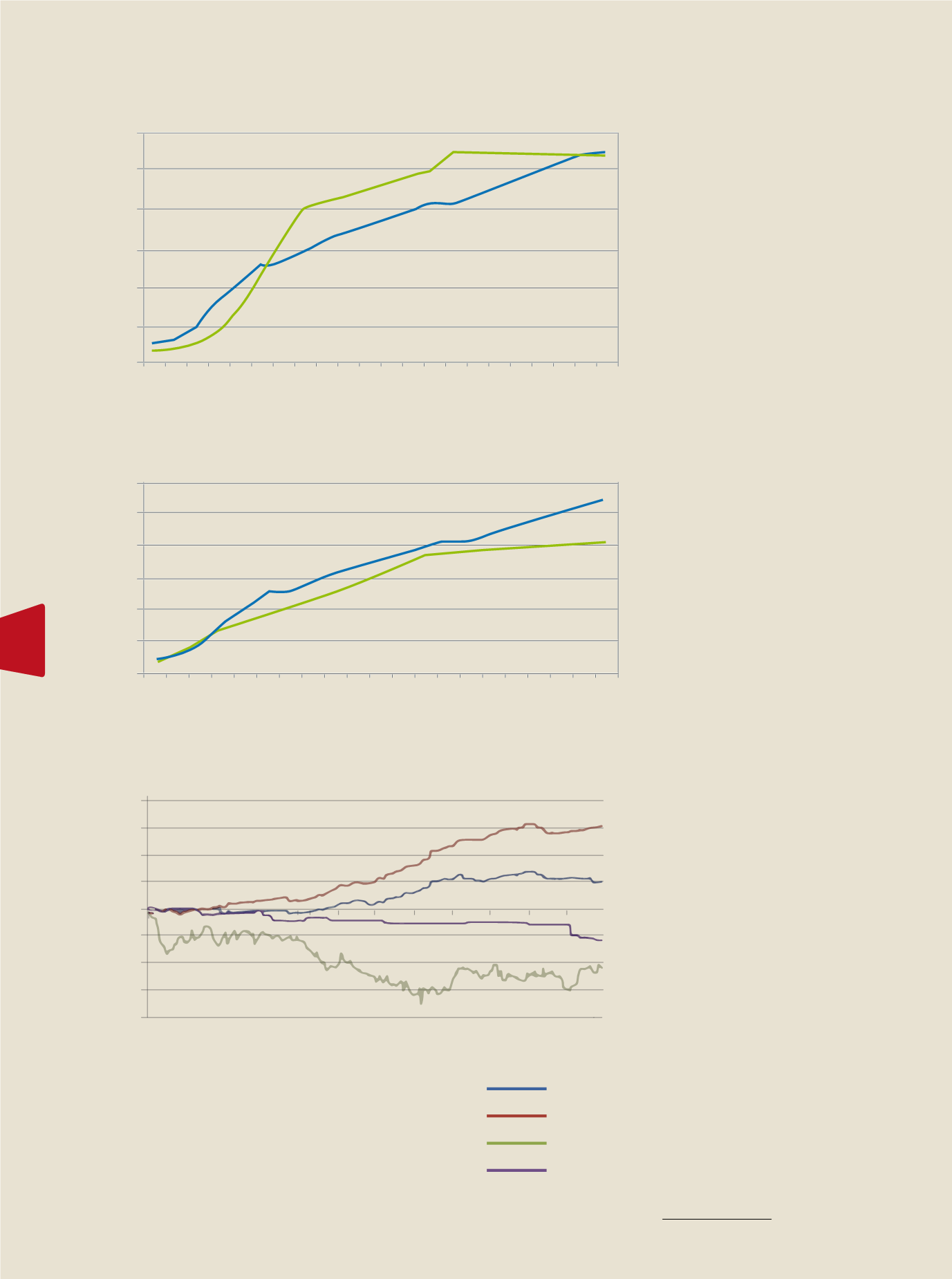

Figure 8:

Local & Regional Stock Market Performances - FY 2012

3 Months

6 Months

1Year

2Years

3Years

4Years

5Years

6Years

7Years

8Years

9Years

10Years

11Years

12Years

13Years

14Years

15Years

16Years

17Years

18Years

19Years

Trinidad and Tobago Government

Yield Curve - December 2012

Trinidad and Tobago Government

Yield Curve - June 2012

0

1

2

3

4

5

6

Per cent

0.00%

5.00%

-5.00%

10.00%

-10.00%

15.00%

-15.00%

20.00%

-20.00%

3-Jan-12

3-Feb-12

3-Mar-12

3-Apr-12

3-May-12

3-Jun-12

3-Jul-12

3-Aug-12

3-Sep-12

3-Oct-12

3-Nov-12

3-Dec-12

Source: Central Bank of Trinidad and Tobago

Source: Central Bank of Trinidad and Tobago

Figure 6:

T&T Government Yield Curve (Dec 2011 Vs June 2012)

3 Months

6 Months

1Year

2Years

3Years

4Years

5Years

6Years

7Years

8Years

9Years

10Years

11Years

12Years

13Years

14Years

15Years

16Years

17Years

18Years

19Years

20Years

Trinidad and Tobago Government

Yield Curve - December 2011

Trinidad and Tobago Government

Yield Curve - June 2012

0

1

2

3

4

5

6

Per cent

T&T Composite Index

All T&T Index

BSE Local Index

All Jamaica Composite Index

EXECUTIVE DIRECTOR’S LETTER

Unit Trust Corporation

Annual Report 2012

34

ends of the TT Government Yield Curve,

whereas yields improved at the shorter-end

of the curve during 2012. Refer to Figures 6-7.

The domestic and international interest rate

outlook over the next few years is bleak and is

premised on an extended period of low inter-

est rates, offering little relief for such investors.

(Figures 6, 7)

Local & Regional Equity

Market Performance

The Trinidad and Tobago equity market en-

joyed its third consecutive year of positive

returns and outperformed its regional coun-

terparts.

Figure 8

refers. The T&T Composite

and All T&T Indices posted returns of 5.14

percent and 15.5 percent

1

respectively, while

the Cross Listed Index generated a negative

return of 13.68 percent for calendar 2012.

Total market capitalization as at December

31, 2012 stood at TT$97.35 billion, compared

to TT$94.47 billion a year ago. The market

was less active in 2012 relative to the preced-

ing year with a total of 8,778 trades and a

volume of 50.68 million shares crossing the

floor, valued at TT$746.6 million. This com-

pares to 9,188 trades and a volume of 564.06

million shares valued at TT$1.029 billion in

2011. The top performing sectors included:

Manufacturing I which gained 30.07 percent,

Trading with a gain of 24.80 percent, and

Conglomerates which added 12.26 percent.

Market laggards included the Property and

Manufacturing II sectors which returned

negative 21.94 percent and negative 19.35

percent respectively.

The other major regional stock indices un-

derperformed in 2012. The JSE Market Index

lost 3,195.98 points or 3.35 percent while the

JSE All Jamaican Composite Index declined

by 11,017.19 points or 10.78 percent over the

year. Market volumes were also lower in 2012

with a total of 19,492 trades and 1.43 billion

shares exchanging hands valued at J$18.30

billion compared to 23,293 trades and a vol-

ume of 1.55 billion shares valued at J$18.10

billion in the preceding year.

1 The YTD returns provided here refer only to capital

appreciation and thus exclude dividend yield.