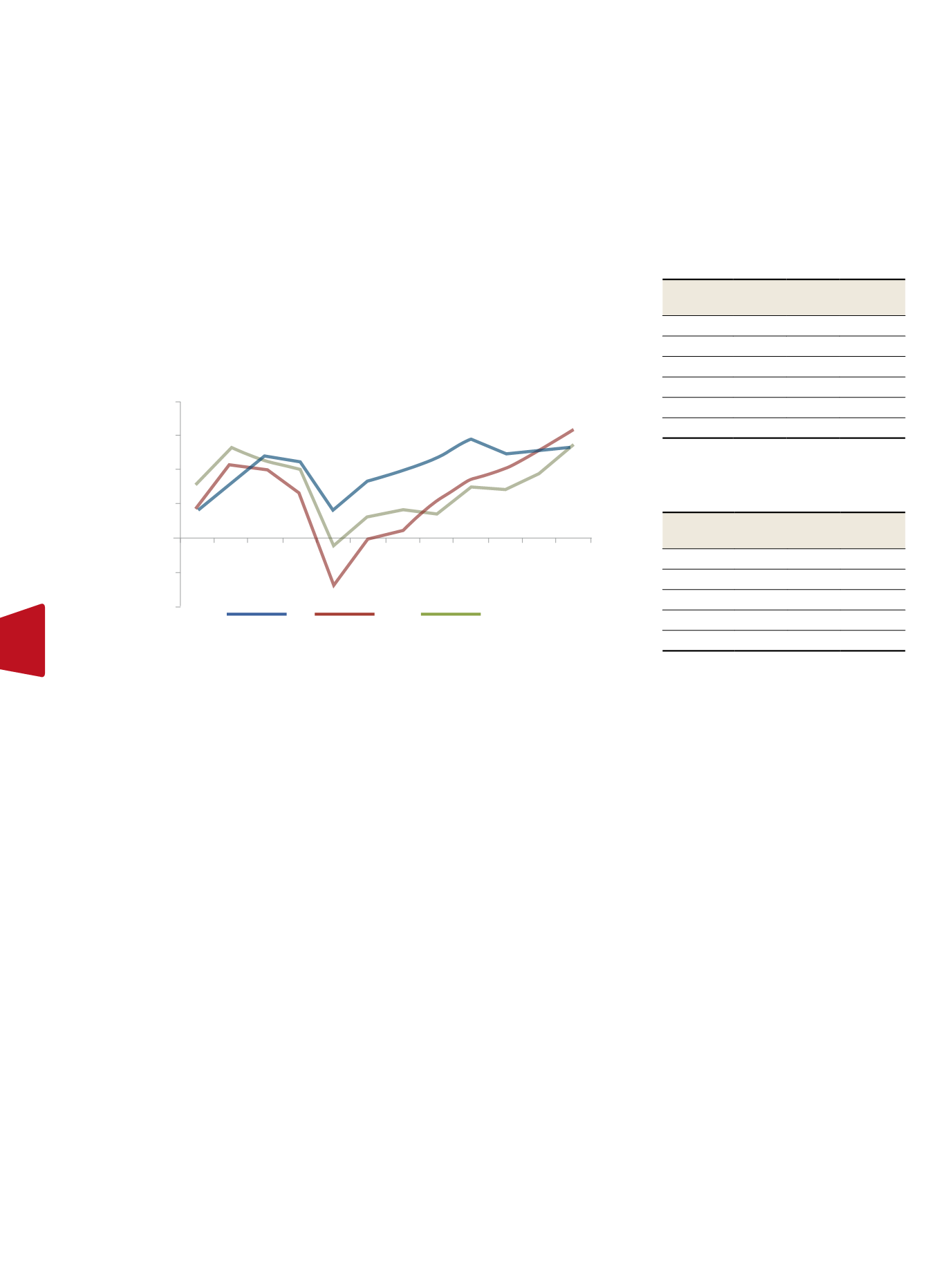

Figure 1: Global Stock Markets

Chairman’s Review

Unit Trust Corporation

Annual Report 2012

26

Global Economy and

Financial Markets

In 2012, economies across the globe faced

numerous headwinds. In the US, against the

backdrop of very slow growth, the Federal

Reserve took decisive action to stimulate

the economy that, in turn, served to create

downward pressure on interest rates. At the

end of the year, the US economy was also

challenged on a political front as lawmakers

were faced with decisions to increase tax

rates and decrease government spending

termed the “fiscal cliff”.

The recessionary woes that plagued Europe

in 2011 continued into 2012 which led to

the credit downgrade of nine (9) Eurozone

countries by Standard & Poors’ Credit rating

agency. In an effort to shore up the econo-

my and to restore confidence in the region,

the ECB announced its “Outright Monetary

Transaction” program which entailed buy-

ing secondary sovereign bonds with the

objective of lowering borrowing costs for

European countries that faced problems in

selling new debt securities.

The UK benefitted greatly from hosting the

Olympics in August of 2012, as GDP rebound-

ed in the third quarter of 2012 expanding 1%

following two consecutive quarterly contrac-

tions. Once the effects of the spending asso-

ciated with the Olympics waned, GDP fell to

0.30% in Q4 2012.

The fallout of Europe’s recessionary pressures

was felt in the Asian and Latin American re-

gions as export demand from Europe con-

tracted which resulted in a slowdown in

several economies. In an attempt to boost

growth, several emerging market central

banks eased their monetary policy. Brazil’s

central bank lowered the Selic rate from

9.75% at the beginning of the year to 8.50%

by the end of June 2012. Similarly, China’s

central bank lowered its Regulated Reserve

ratio from 20.5% in January to 20% in June

while India’s central bank reduced both its

cash reserve ratio and policy rate.

Such credible steps taken by the US and the

European Central Bank aided in bolstering

stock markets around the world as both eco-

nomic activity and investor confidence were

boosted. International stock markets posted

double digit returns while activity on the

local stock market picked up from where it

left off in 2011. Interest rates trended down-

wards over 2012 which positively impacted

fixed income securities.

In line with the more accommodative mon-

etary policies implemented by several cen-

tral banks, the interest rate environment

remained low, with policy interest rates in

Europe and Brazil reaching record lows in

2012. Policy rates in the US, Canada and the

UK remained at 2011 levels of 0.25%, 1% and

0.50% respectively. Yields on 10 year sover-

eign bonds also fell during the year, with the

largest decline occurring in Europe as 10 year

yields declined 51 basis points to 1.32%.

Table 1:

Global Policy Rates

Global Benchmark Rates

Region Dec-12 Dec-11 Y/Y change

(bps)

US

0.25 0.25

0.00

Canada

1.00 1.00

0.00

Eurozone

0.75 1.00

-0.25

UK

0.50 0.50

0.00

Japan

0.10 0.10

0.00

Brazil

7.25 10.75

- 3.50

Table 2:

Global 10 Year Bond rates

Global 10yr. Bond Rates

Region Dec-12 Dec-11 Y/Y change

(bps)

US

1.76 1.88

- 0.12

Canada

1.80 1.94

- 0.14

Eurozone

1.32 1.83

- 0.51

UK

1.83 1.98

- 0.15

Japan

0.79 0.99

- 0.20

European stock markets were the best per-

formers for 2012, with the German DAX post-

ing a gain of 29%. Following suit were the

stock markets in the Asian region, with Hong

Kong’s Hang Seng index increasing by 23%

and the India’s Sensex index climbing 26%.

The US stock market achieved moderate re-

turns of 13.5% in comparison with the oth-

er stock markets owing to the volatility that

arose from the “fiscal cliff”

Regional Economies and

Financial Markets

Economic growth in the Caribbean region de-

celerated further in 2012 against the backdrop

of lingering fragilities in the global economy,

with the region growing by 1.1% in 2012 in

comparison to 3.3% in 2011. Commodity

exporters, Guyana and Suriname are expect-

ed to post GDP growth of 3.9% and 4.0% re-

spectively, and have fared better than their

tourism-intensive counterparts, Barbados and

Jamaica. GDP growth stagnated in Barbados

in 2012 whereas in Jamaica and in Grenada

0.0%

5.0%

-5.0%

10.0%

-10.0%

20.0%

15.0%

Feb-12

Jan-12

Mar-12 Apr-12 May-12Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12

S&P 500 Index

S&P Europe 350 Index

MSCIAC Asia Pacific Index