20.00%

5.14%

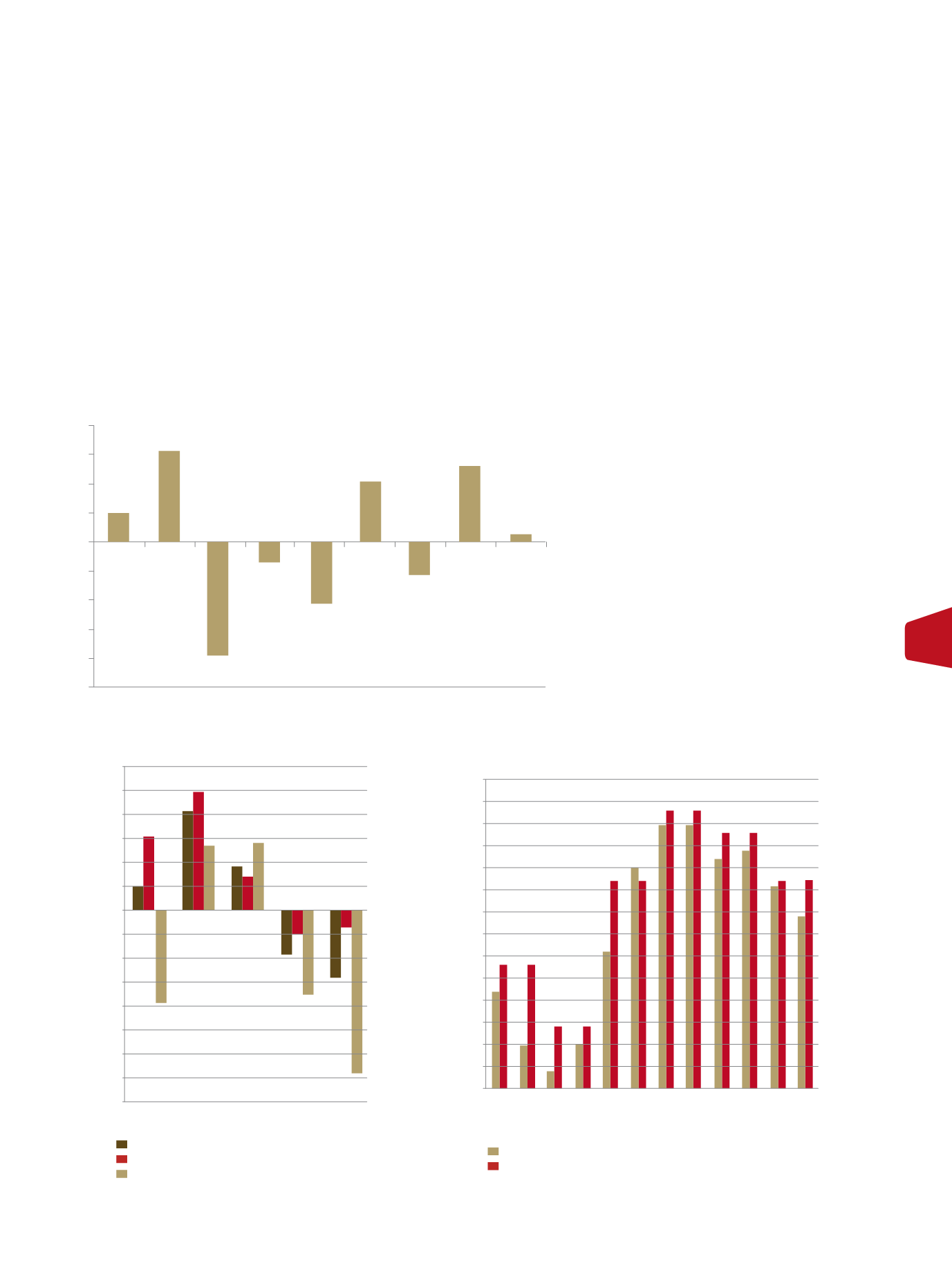

TT Composite

AII T$T

TT Cross Listed

JSE AII Jamaican Composite

JSE AII Market Index

JSE AII Cross Listed

BSE Local

BSE Cross Listed

BSE Junior

15.5%

-19.54% -3.4% -10.8%

10.0%

12.9%

1.1%

-5.7%

-20.00%

-25.00%

15.00%

-15.00%

10.00%

-10.00%

5.00%

-5.00%

0.00%

Figure 2: 2012 Regional Stock Indices Returns

0.00%

0.05%

0.10%

0.15%

0.20%

0.25%

0.30%

0.35%

0.40%

0.45%

0.50%

0.55%

0.60%

0.65%

0.70%

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Jun-12

Jul-12

Aug-12

Sep-12

Oct-12

Nov-12

Dec-12

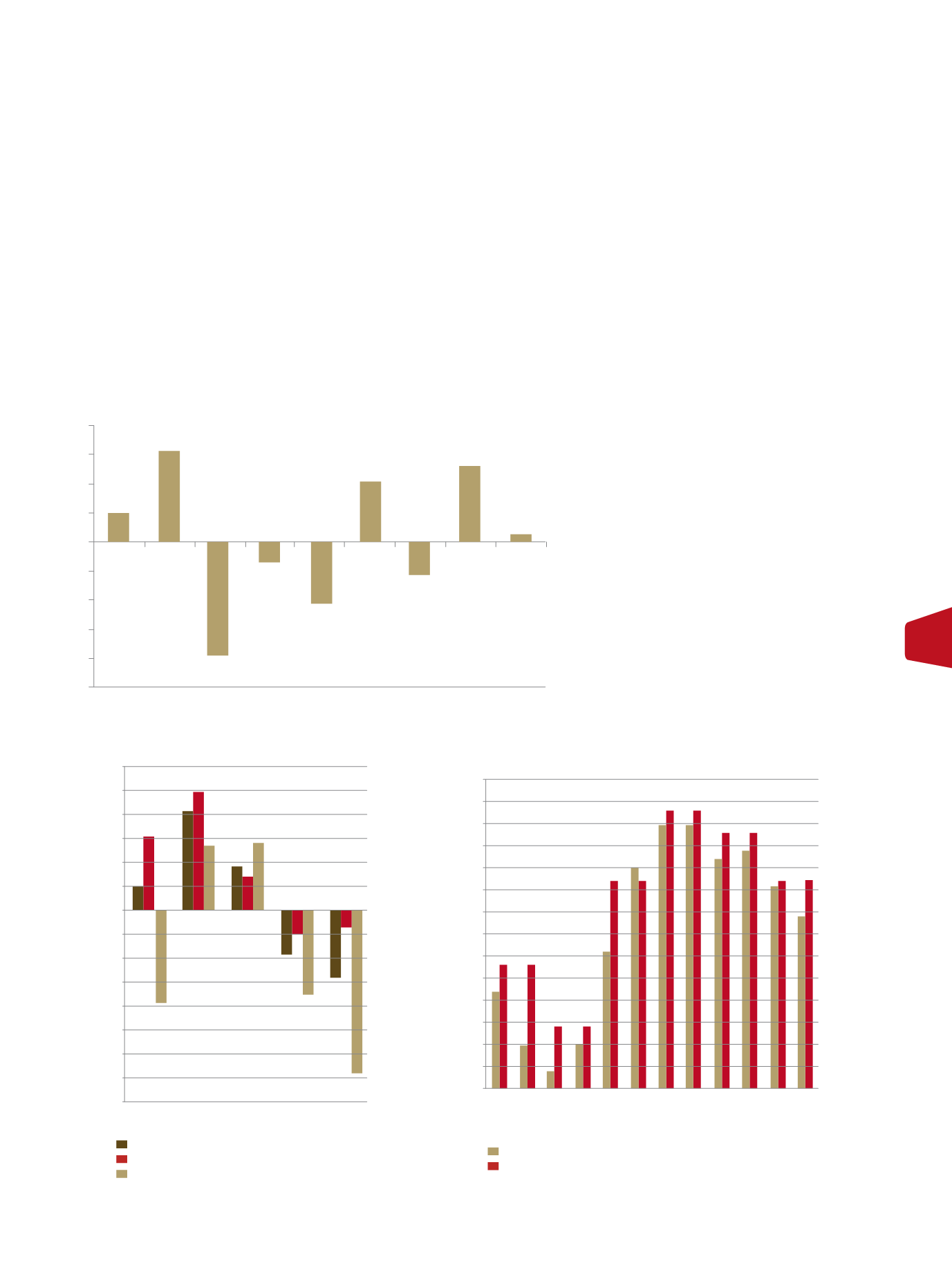

20.00%

30.00%

25.00%

-20.00%

-25.00%

-30.00%

-35.00%

-40.00%

15.00%

-15.00%

10.00%

-10.00%

5.00%

-5.00%

0.00%

2012

2011 2010 2009 2008

2012

2011 2010 2009 2008

Figure 3: T&T Stock Market Returns 2008-2012

Figure 4: T&T Treasury Bill Rates 2012

TT Comp Index

AII TT Index

3 Month T Bill

Cross Listed Index

6 Month T Bill

Chairman’s Review

Unit Trust Corporation

Annual Report 2012

27

growth is expected to be negative, with fiscal

challenges leading to Grenada debt going

into selective default in March 2013. Overall,

the Caribbean region grew by 1.1% in 2012 in

comparison to 3.3% in 2011.

In Trinidad and Tobago, economic activi-

ty picked up in the third quarter, with GDP

growth of 1.5% following a contraction of 3.3

percent in the previous quarter. Growth was

driven by the non-energy sector, particularly

Trading & Distribution, Financial Services and

continue to depress short-term interest rates.

Excess liquidity was roughly TT$3.97 billion at

the end of 2012.

The maintenance of a low interest rate en-

vironment positively impacted borrowing

costs. As a result, the bond market saw a

marked increase in activity during the sec-

ond half of 2012. Primary bond issues totaled

twelve for the year valued at TT$4.3 billion,

with only one in the first half. This compares

to twenty issues in 2011, valued at TT$7.2

billion. On the secondary market, there were

67 transactions valued at TT$1.38 billion, the

bulk of which occurred in December. This

represents a significant improvement over

that seen in 2011 when a total of 46 trades

were effected valued at TT$177 million.

Activity on the local stock market picked

up from where it left off in 2011, as the

Composite Index and All T&T Index rallied

5.14% and 15.5% respectively. Regional

stocks however did not fare so well as the

Cross Listed Index fell 19.5%.

Construction. Energy sector GDP was less re-

silient, increasing by a mere 0.50% year-over-

year and reflected the reduction in crude oil,

natural gas and petrochemical production.

Several scheduled downstream energy pro-

jects were also put on hold.

The financial landscape continues to be char-

acterized by low interest rates and liquidity

build ups. High levels of excess liquidity, sus-

tained by weak private sector credit demand

and high net domestic fiscal injections,