1.000

10.000

10.500

11.000

11.500

12.000

13.000

12.500

1.050

1.100

1.150

1.200

1.250

1.300

1.350

1.400

1.450

1.500

9-Dec-11

9-Jan-12

9-Feb-12

9-Mar-12

9-Apr-12

9-May-12

9-Jun-12

9-Jul-12

9-Aug-12

9-Sep-12

9-Oct-12

9-Nov-12

9-Dec-12

0

5.000

10.000

15.000

20.000

25.000

100

105

110

115

120

125

130

135

12-Feb-12

12-Mar-12

12-Apr-12

12-May-12

12-Jun-12

12-Jul-12

12-Aug-12

12-Sep-12

12-Oct-12

12-Nov-12

12-Dec-12

12-Dec-11

5.000

6.000

7.000

8.000

9.000

10.000

11.000

30.000

32.000

34.000

36.000

38.000

40.000

42.000

44.000

46.000

9-Dec-11

9-Jan-12

9-Feb-12

9-Mar-12

9-Apr-12

9-May-12

9-Jun-12

9-Jul-12

9-Aug-12

9-Sep-12

9-Oct-12

9-Nov-12

9-Dec-12

4.000

6.000

8.000

10.000

12.000

14.000

16.000

18.000

800

850

900

950

1.000

1.050

1.100

1.150

1.200

9-Dec-11

9-Jan-12

9-Feb-12

9-Mar-12

9-Apr-12

9-May-12

9-Jun-12

9-Jul-12

9-Aug-12

9-Sep-12

9-Oct-12

9-Nov-12

9-Dec-12

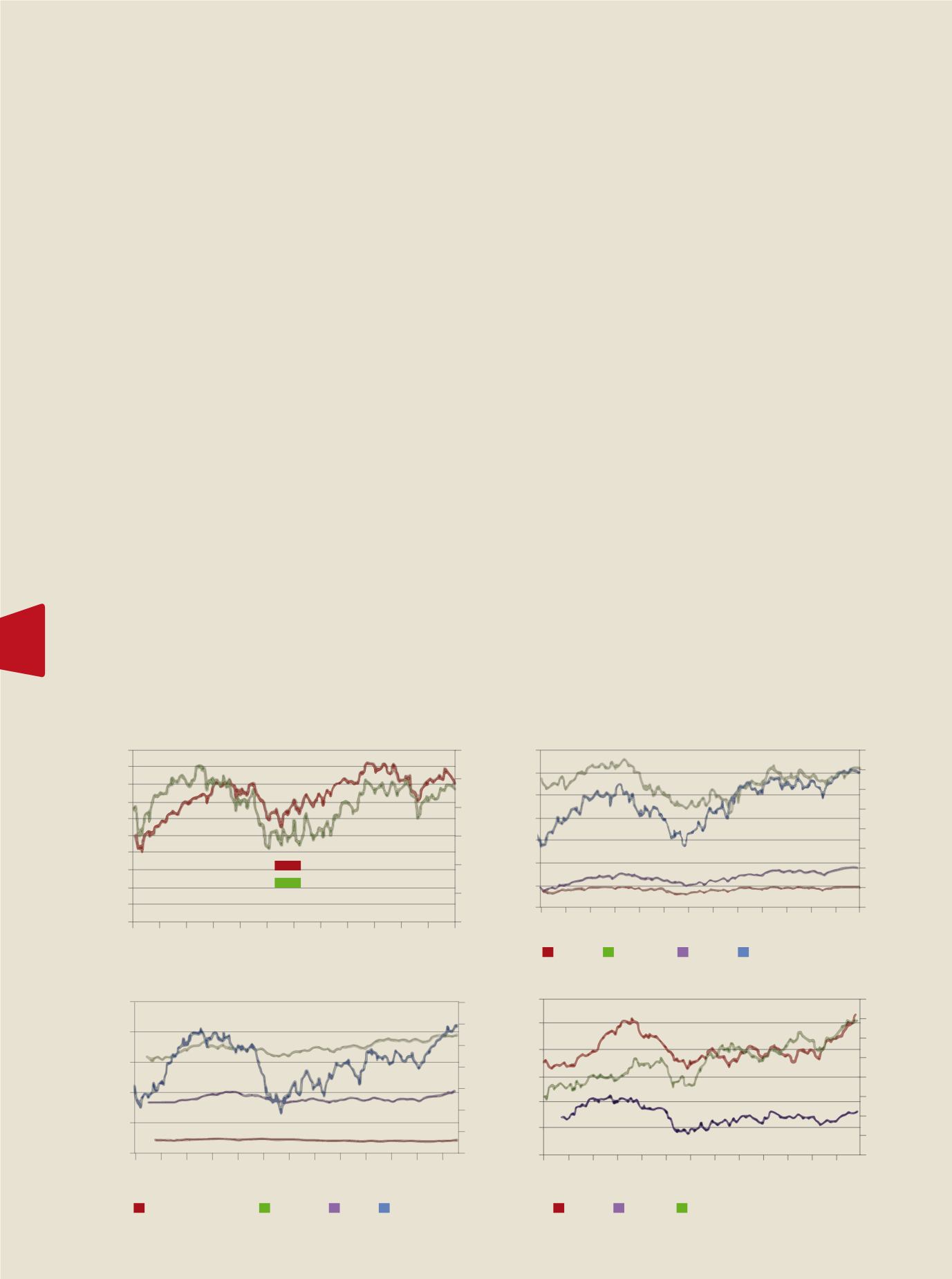

Figure 1:

North American Equity Indices

S&P 500

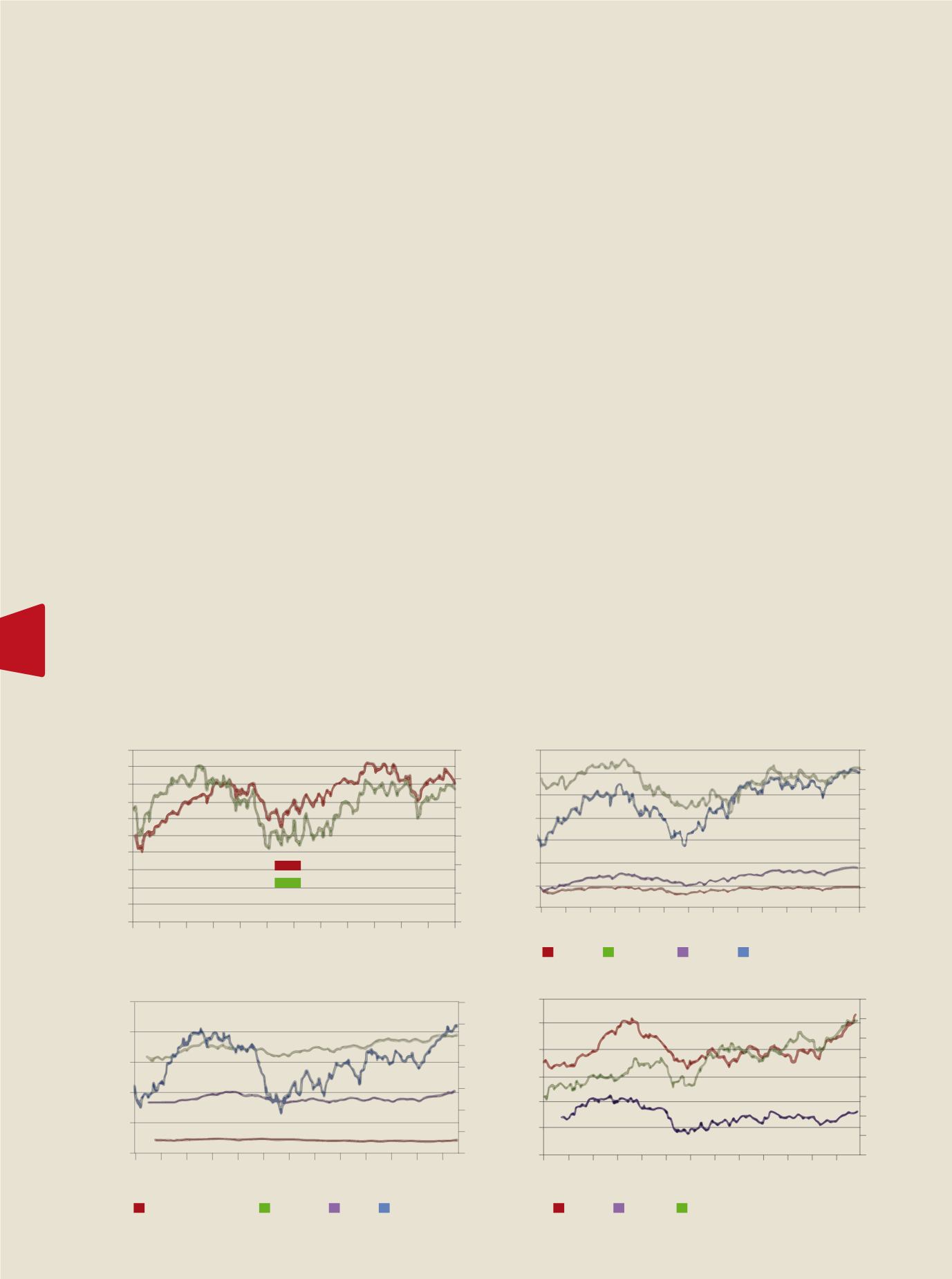

FTSE

Shanghai SE Composite

Bovespa

DAX

Nikkel

S&P LAC

S&P TSX Composite Index

FTSE MIB

BSE Sensex

Mexico Bolsa IPC

S&P 350 Europe

MSCI Asia pacific

S&P 500 Index

S&P TSX Composite Index

MSCI Asia Pacific Index

Mexico Bolsa IPC Index

S&P 350 Europe Index

Figure 2:

European Equity Indices

Figure 3:

Asian Equity Indices

Figure 4:

Latin American Equity Indices

EXECUTIVE DIRECTOR’S LETTER

Unit Trust Corporation

Annual Report 2012

32

Emerging market economic conditions were

tempered by the Euro-area recession as these

regions depend heavily on that area’s external

demand. The Asian region still managed to

grow at a rate of 6.28 percent in 2012 com-

pared to 7.54 percent in 2011, while Latin

America grew at 2.57 percent compared to

4.17 percent in 2011. These regions’ largest

economies, China and Brazil, grew at 7.80 per-

cent and 0.87 percent respectively in 2012.

Turning our attention to the Caribbean, many

of the region’s tourism intensive economies

continued to face challenges of elevated

public debt levels, weak external demand,

and adverse terms of trade. The Jamaican

economy encountered continued difficulties

in 2012, however, in February 2013, Jamaican

authorities and the International Monetary

Fund (IMF) reached a staff-level agreement

for an Extended Fund Facility which should

provide some support in the medium term.

Barbados’ economic growth stagnated in

2012 as the economy remains challenged

owing to the protracted global economic

weakness which significantly impacts tour-

ism. In contrast, the region’s key commodity

exporters, Guyana and Suriname, were more

resilient and are expected to post moderate

economic growth of 3.9 percent and 4.0 per-

cent respectively for 2012.

TheCentral Bank ofTrinidad&Tobago forecasts

GDP growth of 1.2 percent and 2.5 percent

for 2012 and 2013 respectively. Third quarter

GDP for 2012 grew by 1.5 percent year-over-

year following a 3.3 percent contraction in the

preceding quarter. Crude, natural gas and pet-

rochemical production all deteriorated during

the year and various downstream energy pro-

jects were postponed. Notably, however, there

was increased exploratory and drilling activity

in the upstream energy sector during 2012

along with new oil and gas finds.

In January 2013, the IMF revised its 2013

projection for world growth to 3.5 percent,

marginally lower than its October 2012 fore-

cast of 3.6 percent. World trade is expected to

decelerate further, expanding at a pace of 3.8

percent in 2013 following 2.8 percent growth

in 2012. Commodity prices are also expected

to ease, while inflation should remain stable

in the developed economies though rising

slightly in the emerging market and develop-

ing economies. Any substantial deterioration

in economic conditions for either of these

economies would suggest negative implica-

tions for global economic growth.

Financial Markets-

International Equity Performance

Equity markets posted solid returns in 2012,

outperforming fixed-income markets as in-

vestors sought to purchase risk assets despite

the uncertainties of the economic issues

dominating the headlines. In North America,

the US benchmark S&P 500 Index rose 13.41

percent for the year, compared to return of 0.0

percent in 2011. The Financial sector was the

year’s best performer returning 26.26 percent

followed by the Consumer Discretionary and

Healthcare sectors which saw gains of 21.87

percent and 15.19 percent respectively. The

sole US sector showing a negative return was

the Utilities sector, the worst performer for

the year. The Energy sector was the second

worst performer returning 2.33 percent.

Industries within the Energy sector exhibited

mixed performance with the best performer,

the S&P Oil and Gas Refining and Marketing

Index, rising a magnificent 80.07 percent