425

430

435

440

445

450

455

460

465

470

475

30-Dec-11

30-Jan-12

29-Feb-12

31-Mar-12

30-Apr-12

31-May-12

30-Jun-12

31-Jul-12

31-Aug-12

30-Sep-12

31-Oct-12

30-Nov-12

31-Dec-12

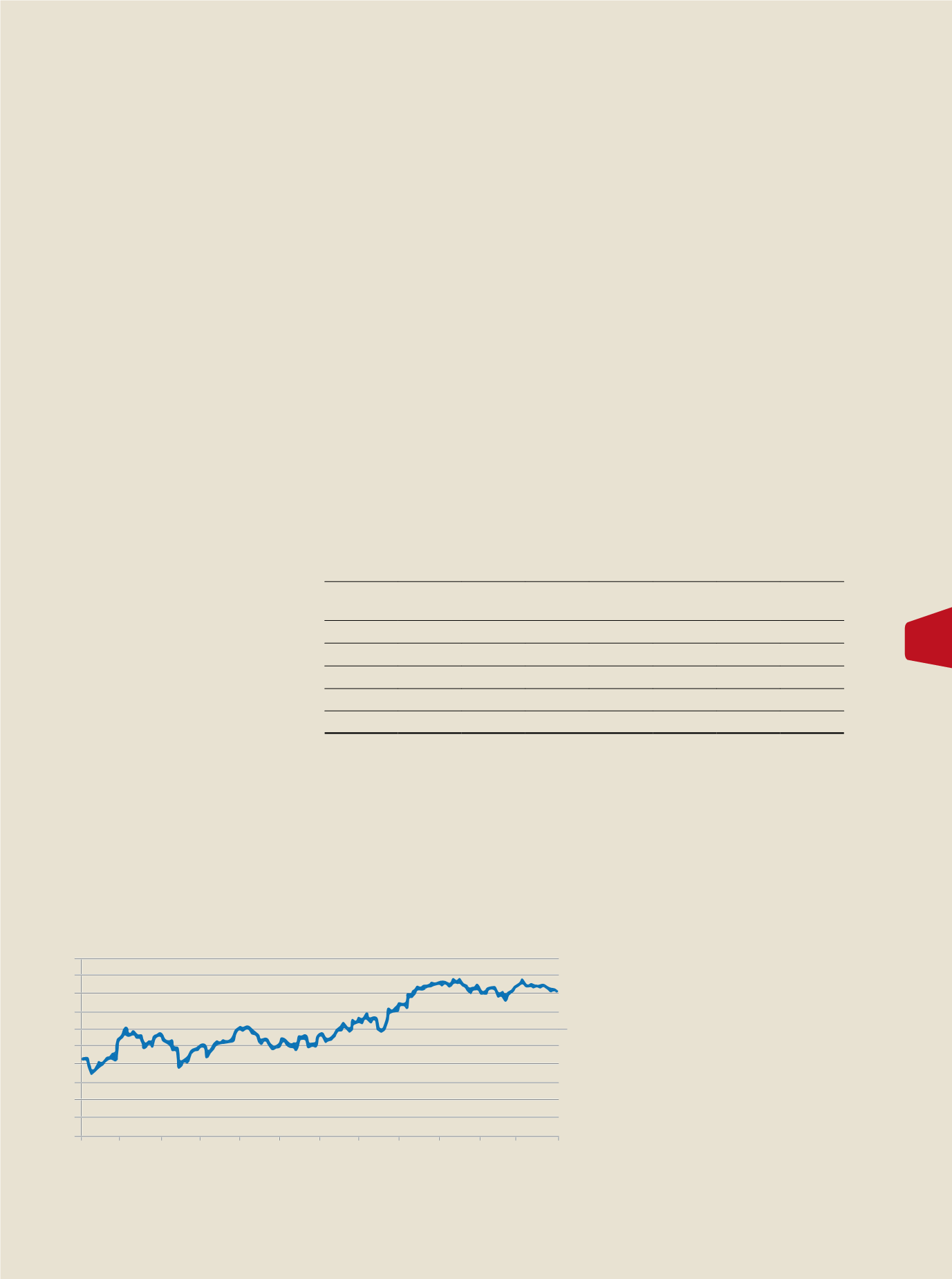

Figure 5:

Global Bond Index - Barclays Capital Global Aggregate Total Return Index

EXECUTIVE DIRECTOR’S LETTER

Unit Trust Corporation

Annual Report 2012

33

whereas the worst industry performer, the S&P

Coal and Consumable Fuels Index, declined

26.13 percent. Canada’s S&P/TSX Composite

Index increased 4.00 percent compared to

2011’s performance of negative 11.07 percent.

The S&P Euro 350 Index soared 13.75 per-

cent while the UK’s stock market increased

5.84 percent, up from negative 10.64 percent

and negative 5.55 percent in the previous

year. Belgium and Denmark outperformed,

advancing 33.99 percent and 28.09 percent

respectively with Europe’s largest economy,

Germany, following closely behind at 25.24

percent. Spain posted the worst performance

in the region of negative 4.76 percent followed

by Greece which returned negative 2.35 per-

cent and Portugal with negative 2.22 percent.

The Emerging Markets also exhibited im-

proved equity performance with the MSCI

Asia Pacific Index providing returns of 13.61

percent, while the S&P Latin America 40

Index posted comparatively weaker returns

of 3.30 percent. These were, however, signif-

icantly better than their 2011 performances

of negative 17.31 percent and negative 20.69

percent respectively. Asian markets were led

by the Philippines, India, Thailand and China

which posted returns of 34.70 percent, 27.86

percent, 26.87 percent and 18.73 percent

respectively. Malaysia showed the region’s

poorest performance at 6.84 percent. Latin

America saw Colombia outperforming the

pack with returns of 19.91 percent, with

Mexico and Peru following, posting 18.24 per-

cent and 15.03 percent. Chile trailed behind

returning negative 2.67 percent followed by

Brazil which grew 5.93 percent. Figures 1-4

below illustrate the movements of the major

global indices during 2012.

(Figures 1,2,3,4)

International Fixed-

Income Market Performance

The international fixed-income markets gen-

erated moderate gains in 2012. The Barclays

Capital Global Aggregate Total Return Index

returned 4.32 percent for 2012. Figure 5 re-

fers. Against the backdrop of low central

bank policy interest rates globally along with

the other accommodative measures imple-

mented in order to keep short-term interest

rates low, US treasuries lagged the market. In

contrast, given the shift in investor appetite

from a “risk-off” to a “risk-on” disposition in or-

der to secure higher yields, speculative grade

bonds significantly outperformed invest-

ment grade bonds. New global corporate

bond issuances climbed to a 3-year high of

over US$3.0 trillion in 2012, while the corpo-

rate default tally also reached a 3-year high

as a total of 82 corporate issuers defaulted

around the world.

Local Fixed-Income

Market Performance

Trinidad and Tobago’s Central Bank main-

tained its accommodative monetary policy

stance in light of sluggish economic activity

and falling inflationary pressures, lowering

the Repo Rate 25 basis points from 3.0 per-

cent to 2.75 percent in 2012. Although excess

liquidity levels declined by 30.23 percent in

2012, they remained relatively high, ending

the year at $3.97 billion. High liquidity has

been fueled by continued weak private sec-

tor credit and relatively high net domestic

fiscal injections. Short-term domestic interest

rates have thus remained very depressed.

In response to the falling liquidity levels, do-

mestic 3-month treasury yields rose by 11 ba-

sis points over the year from 0.28 percent to

0.39 percent, while the yield on the 6-month

treasury rose by 15 basis points from 0.32

percent to 0.47 percent. The yield on the US

3-month treasury closed the year at 0.06 per-

cent, resulting in a widening of the spread

between the 3-month TT and US instruments

from 26 basis points to 33 basis points. There

was an uptick in domestic money market

rates as well, with the yields on short-term

money market instruments rising by 22 basis

points on average. Refer to

Table 1

.

Few new domestic fixed-income opportu-

nities presented themselves in 2012. In light

of the high excess liquidity in the financial

system and the scarcity of investment op-

portunities, over-subscription of public sector

issues persisted, posing continued challenges

for fixed-income investors. As a consequence,

yields declined at the medium to long-term

TREASURY BILLS

MONEYMARKET INSTRUMENTS

Year/Tenor 90 Day

(%)

180 Day

(%)

30 Day

(%)

60 Day

(%)

90 Day

(%)

180 Day

(%)

365 Day

(%)

2008

7.06

7.61

6.18

6.53

6.75

6.99

7.09

2009

1.36

1.52

0.67

0.75

0.95

1.59

1.93

2010

0.37

0.32

0.43

0.58

0.75

0.90

1.06

2011

0.28

0.32

0.15

0.25

0.35

0.43

0.58

2012

0.39

0.47

0.30

0.40

0.55

0.70

0.90

Table 1:

Domestic Money Market Rates (2008-2012)