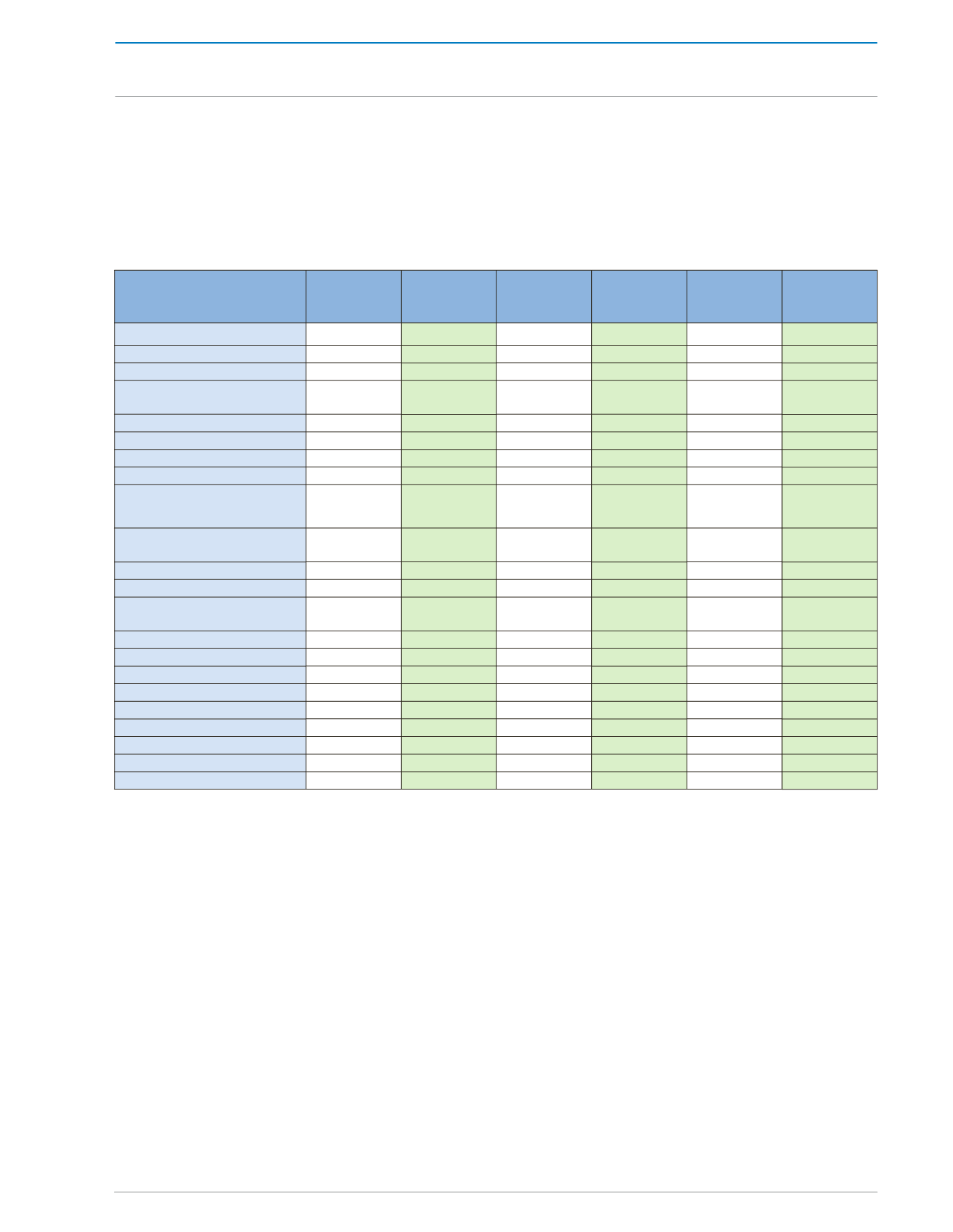

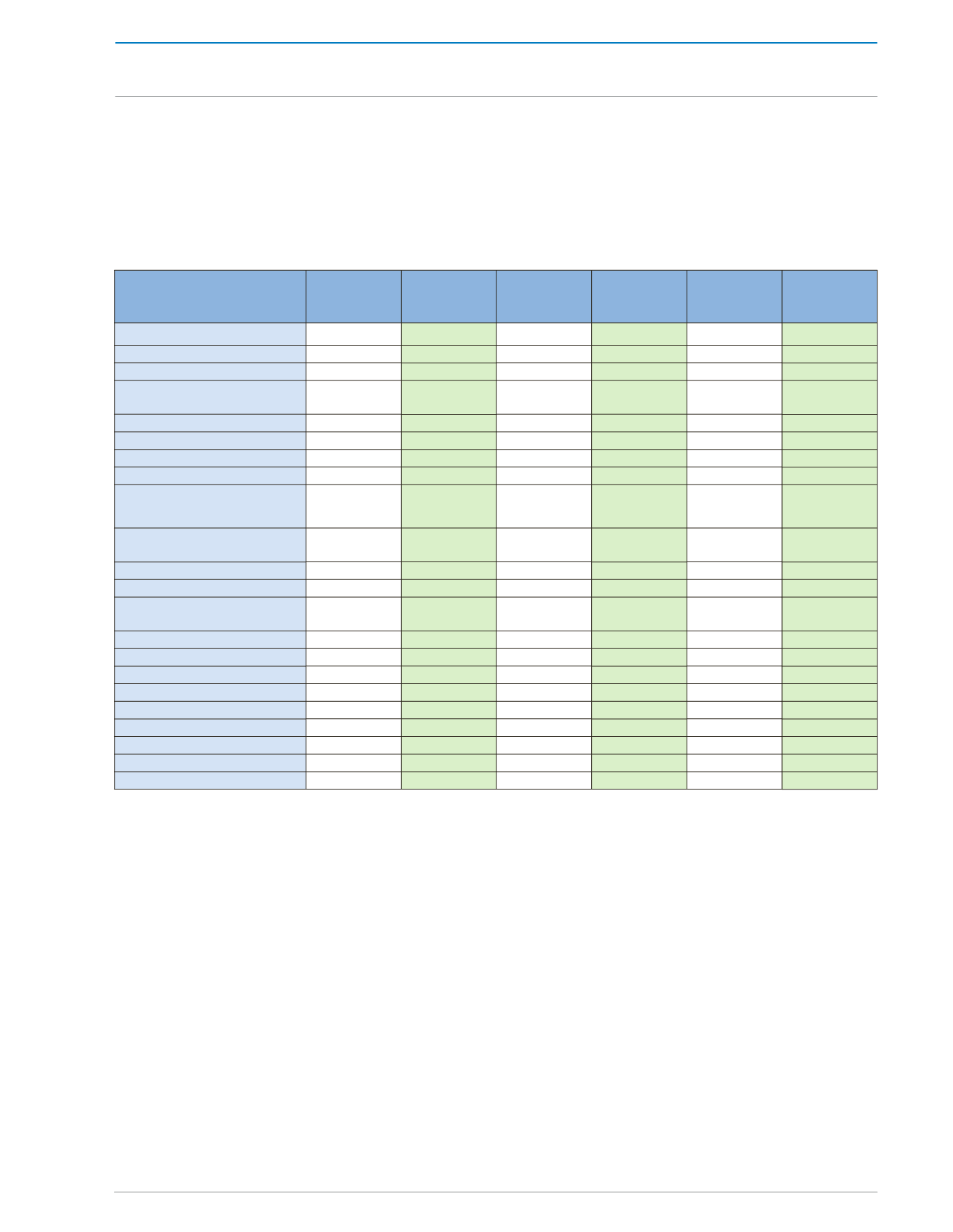

REVIEW OF THE ECONOMY 2013

83

SUSTAINING GROWTH, SECURING PROSPERITY

APPENDICES

APPENDIX 21

CENTRAL GOVERNMENT FISCAL OPERATIONS

/TT$ MILLIONS/

Oct '07/

Sep '08

Oct '08/

Sep '09

Oct '09/

Sep '10

Oct '10/

Sep '11

Oct '11/

Sep '12

r

Oct '12/

Sep '13

p

Total Revenue and Grants

56,847.8 39,044.8 43,862.9 47,500.6 49,277.9 52,984.8

Recurrent Revenue

56,810.3 38,993.4 43,632.0 47,213.6 49,234.5

52,497.3

of which:

Oil Revenue *

29,910.0 15,772.7

17,844.9

20,146.7

19,811.8 20,106.0

Tax Revenue

51,689.5 32,536.6

37,074.4

42,017.3 43,568.8 45,150.6

Non-Tax Revenue

5,120.8

6,456.8

6,557.6

5,196.3

5,665.7

7,346.7

Capital Receipts

22.4

31.0

230.9

45.0

42.2

406.8

Grants

15.1

20.4

0.0

242.0

1.2

80.7

Total Expenditure and Net

Lending

53,873.3 45,730.8 46,701.4 51,492.4 52,806.9 59,470.2

Recurrent Expenditure

43,738.8 36,683.4 40,302.2

43,914.9 45,068.9

50,467.1

Capital Expenditure and

Net Lending

10,134.5

9,047.4

6,399.2

7,577.5

7,738.0

9,003.1

Current Account Balance

13,071.5

2,310.0 3,329.8

3,298.7

4,165.6 2,030.2

Overall Surplus/(Deficit)

2,974.5 -6,686.0 -2,838.5 -3,991.8 -3,529.0 -6,485.4

Financing Requirements

-2,974.5

6,686.0 2,838.5

3,991.8

3,529.0 6,485.4

External Financing (net)

796.7

33.0

-754.1

545.2

1,054.1

2,502.9

Domestic Financing (net)

-3,771.2

6,653.0

3,592.6

3,446.6

2,474.9

3,982.5

Source: Budget Division, Ministry of Finance and the Economy

r : revised

p : provisional

* Oil Revenue consists of Taxes from Oil Companies, 15 percent Withholding Tax, Royalties on Oil and Gas, Shares of Profits from Oil

Companies under Production Sharing Contracts, Oil Imposts, Signature Bonuses- Competitive Bidding and Unemployment Levy (Oil)