Trinidad Cement Limited

Annual Report 2012

78

Notes to the Consolidated Financial Statements (continued)

For the year ended 31 December, 2012

(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)

24. Financial risk management

(continued)

Foreign currency risk

(continued)

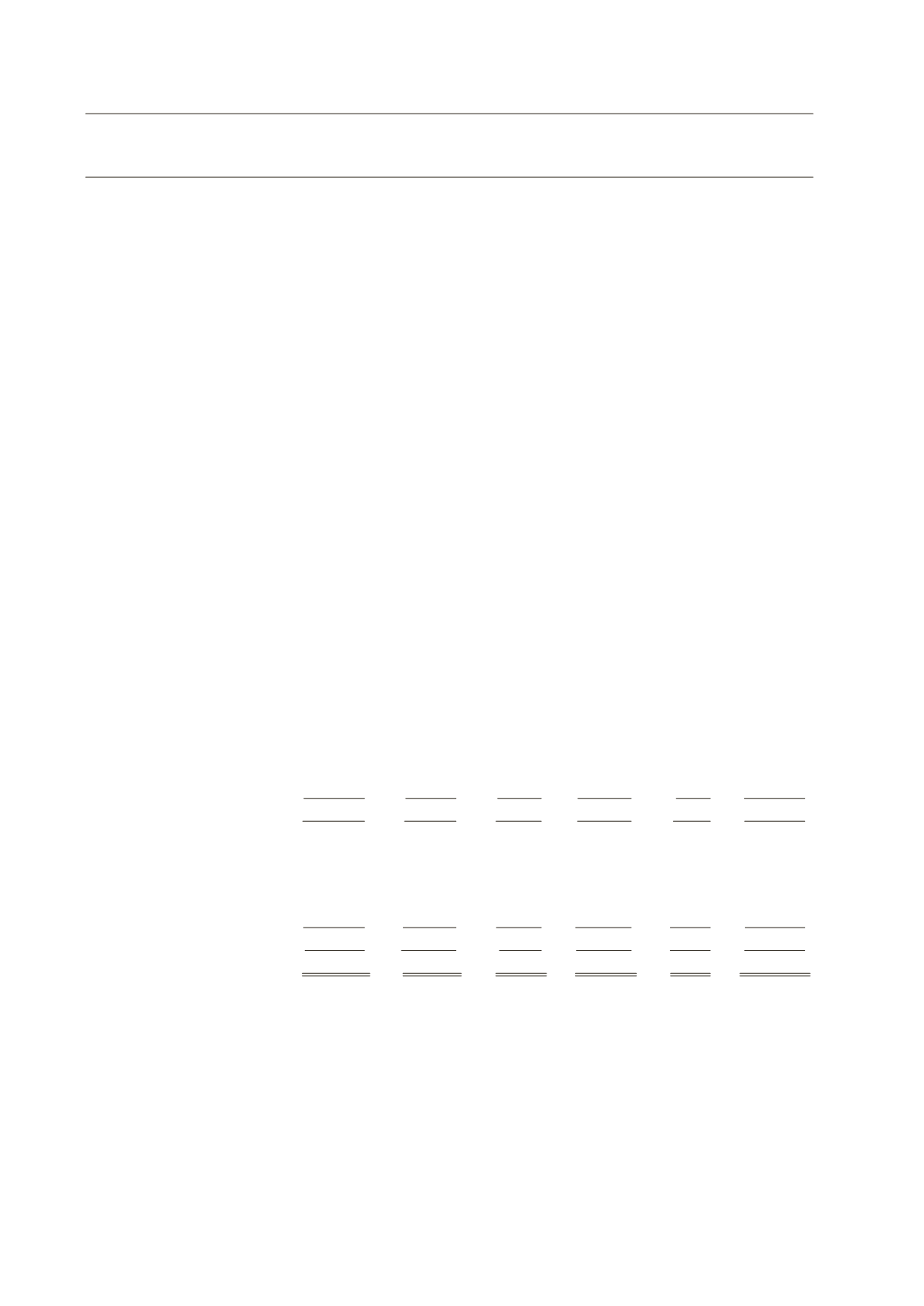

The following table demonstrates the sensitivity to a reasonably possible change in the exchange rates, with all other

variables held constant, of profit before tax (due to changes in the fair value of monetary assets and liabilities) and the

Group’s equity:

Increase/decrease

Effect on

Effect on

in US/Euro rate

profit before tax

equity

$

$

2012

US dollar

+1%

(7,690)

(5,768)

–1%

7,690

5,768

Euro

+1%

(60)

(45)

–1%

60

45

2011

US dollar

+1%

(6,013)

(4,510)

–1%

6,013

4,510

Euro

+1%

(87)

(65)

–1%

87

65

The effect on profit is shown net of US dollar financial assets (2012: $67.5 million, 2011: $70.2 million), and liabilities

(2012: $834 million, 2011: $671.5 million) and EURO net financial liabilities (2012: $6 million, 2011: $8.7 million).

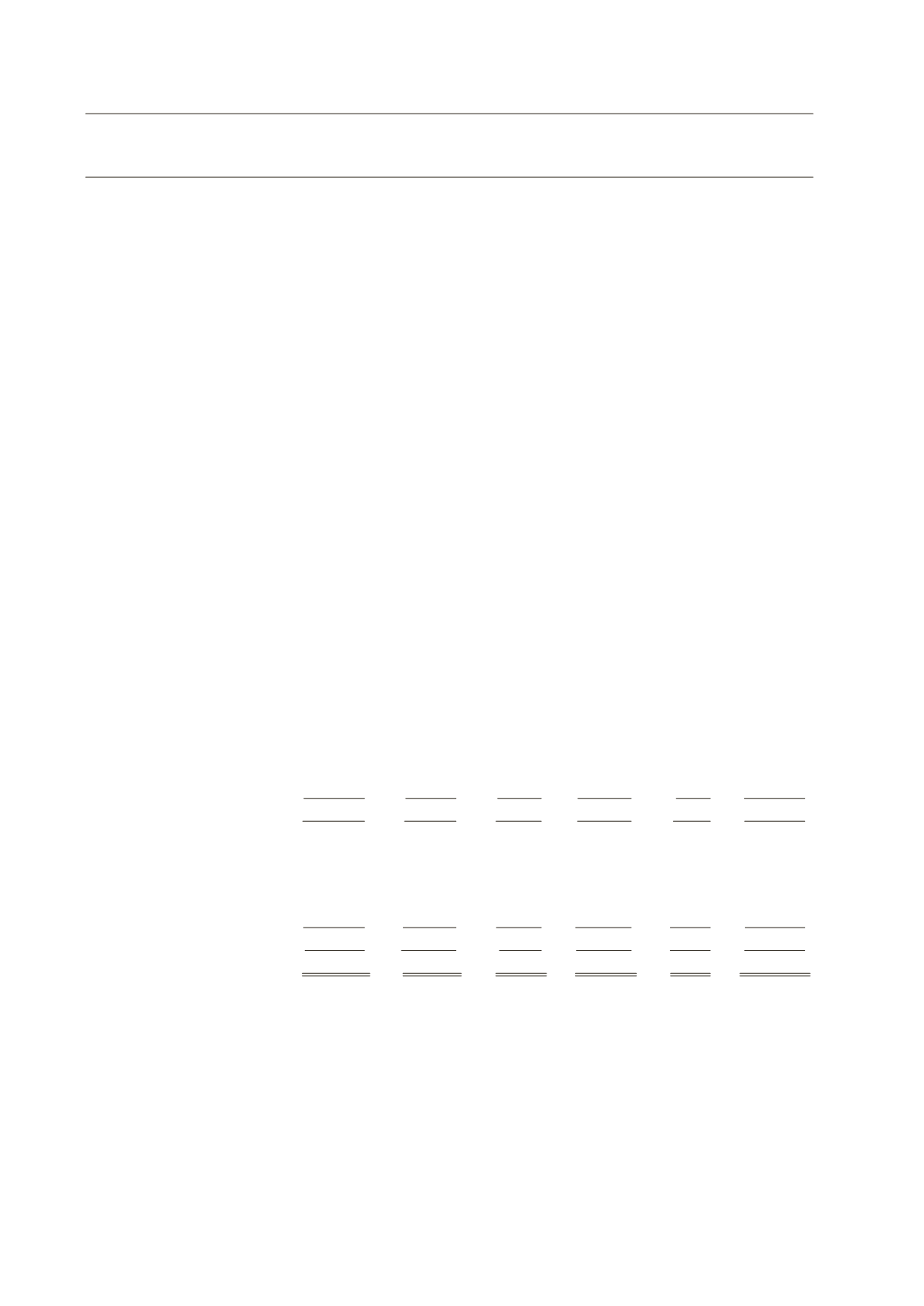

The aggregate value of financial assets and liabilities by reporting currency are as follows:

2012

TTD

USD

JMD

BDS

Other

Total

$

$

$

$

$

$

ASSETS

Cash at bank

11,906

18,385

6,953

555

5,262

43,061

Trade receivables

47,785

49,145

11,869

5,652

6,865

121,316

59,691

67,530

18,822

6,207

12,127

164,377

LIABILITIES

Bank overdraft and short-term

advances

–

31,296

–

606

–

31,902

Borrowings

1,072,226

746,188

52,263

175,449

–

2,046,126

Interest and finance charges

837

367

471

104

–

1,779

Trade payables

18,572

58,716

58,017

35,638

9,203

180,146

1,091,635

836,567

110,751

211,797

9,203

2,259,953

NET LIABILITIES

(1,031,944)

(769,037)

(91,929)

(205,590)

2,924

(2,095,576)