77

Notes to the Consolidated Financial Statements (continued)

For the year ended 31 December, 2012

(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)

24. Financial risk management

(continued)

Credit risk related to receivables

Customer credit risk is managed in accordance with the Group’s established policy, procedures and control relating to

customer credit risk management. Credit limits are established for all credit customers based on internal rating criteria.

Outstanding customer receivables are regularly monitored. At 31 December, 2012, the Group had thirteen customers

(2011: thirteen customers) that owed the Group more than $2 million each and which accounted for 41% (2011: 40%) of

all trade receivables owing.

Credit risk related to cash at bank

Credit risks frombalanceswithbanks andfinancial institutions aremanaged inaccordancewithGrouppolicy.Investments

of surplus funds are made only with approved counterparties and within limits assigned to each counterparty.

Counterparty limits are reviewed by the Group’s Board of Directors on an annual basis. The limits are set to minimise the

concentration of risks and therefore mitigate financial loss through potential counterparty failure.

Liquidity risk

The Group monitors its risk to a shortage of funds by considering planned and probable expenditures against projected

cash inflows fromoperations, from the settlement of financial assets such as accounts receivable and levels of cash sales.

The Group’s objective is to fund its operations and activities within the framework of the terms of the debt restructuring

agreedwith lenders.Working credit lines have been withdrawn and access to longer termcredit funding has been severely

restricted. Accordingly, the Group is dependent on internally generated funds to cover most of its funding needs.

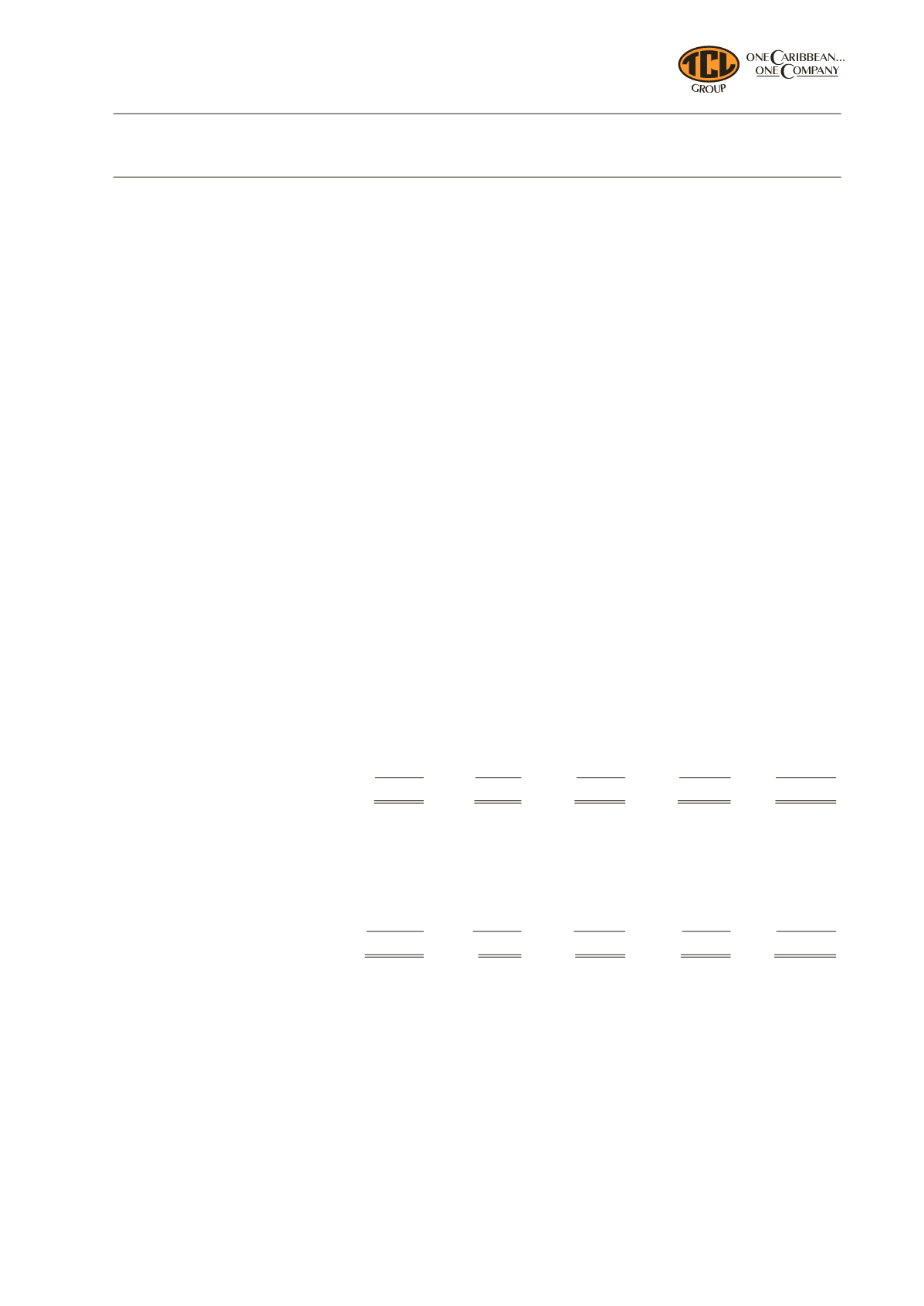

The table below summarises the maturity profile of the Group’s financial liabilities at 31 December:

2012

On

demand

1 year

2 to 5 years

> 5 years

Total

$

$

$

$

$

Bank overdraft and

short-term advances

–

31,902

–

–

31,902

Borrowings

16,675

83,882

824,308

1,121,261

2,046,126

Interest and finance charges

–

1,779

–

–

1,779

Trade payables

–

180,146

–

–

180,146

16,675

297,709

824,308

1,121,261

2,259,953

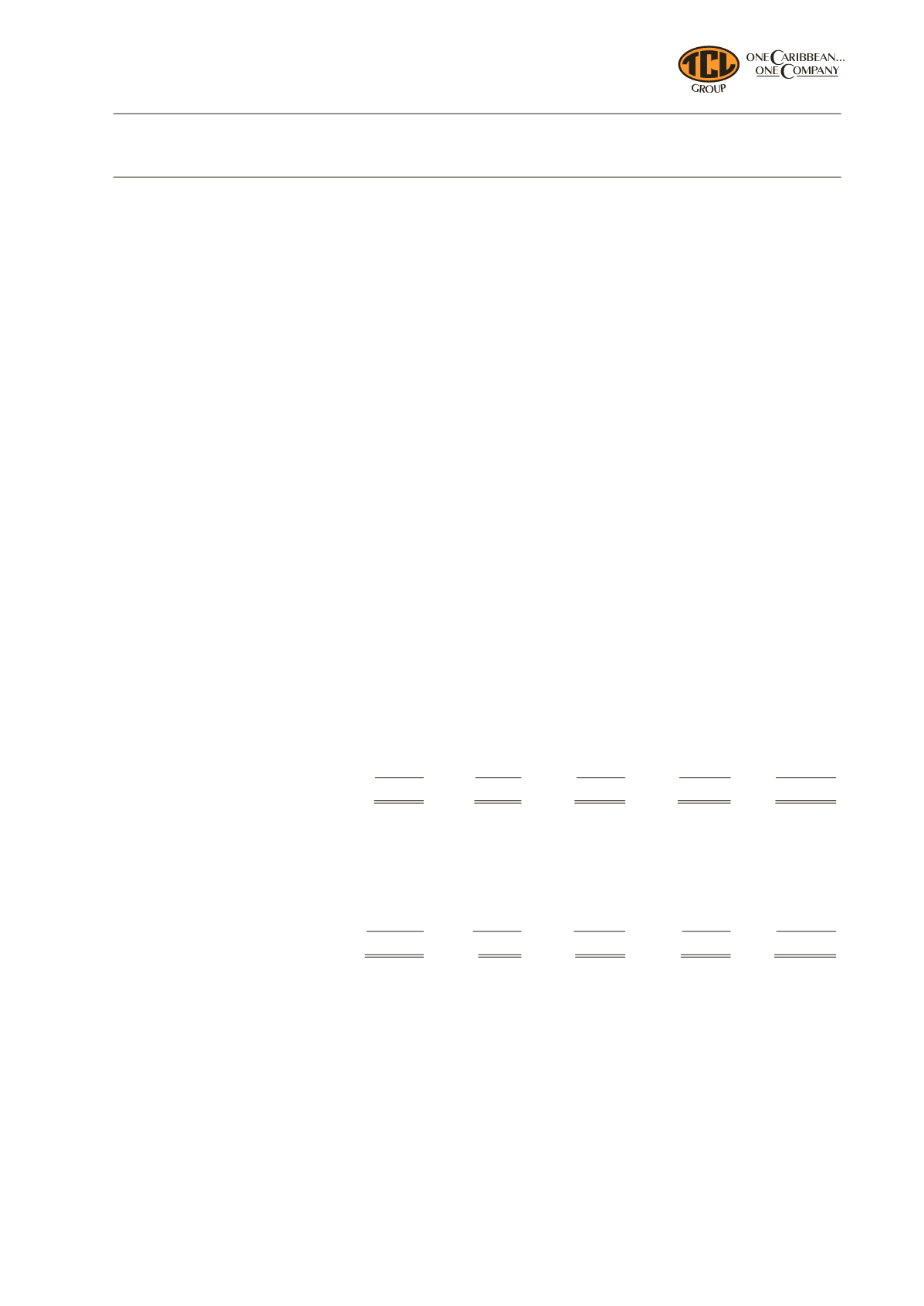

2011

Bank overdraft and

short-term advances

447

–

–

–

447

Borrowings

1,672,690

2,750

2,906

17

1,678,363

Interest and finance charges

231,840

–

–

–

231,840

Trade payables

–

184,399

–

–

184,399

1,904,977

187,149

2,906

17

2,095,049

Capital management

The primary objective of theGroup’s capital management is to ensure that itmaintains a healthy financial position in order

to support its business activities and maximise shareholder value. The Group is required to comply with several financial

ratios and other quantitative targets in accordance with loan agreements. The Group will be required to achieve Leverage,

Debt Service and Net Worth financial ratio targets in accordance with the revised terms of the debt restructuring agreed

with lenders.

Foreign currency risk

Currency risk is the risk that the value of a financial instrument will fluctuate due to changes in foreign exchange rates.

Such exposure arises fromsales or purchases by an operating unit in currencies other than the unit’s functional currency.

Management monitors its exposure to foreign currency fluctuations and employs appropriate strategies to mitigate

any potential losses. Risk management in this area is active to the extent that hedging strategies are available and cost

effective.