Trinidad Cement Limited

Annual Report 2012

74

Notes to the Consolidated Financial Statements (continued)

For the year ended 31 December, 2012

(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)

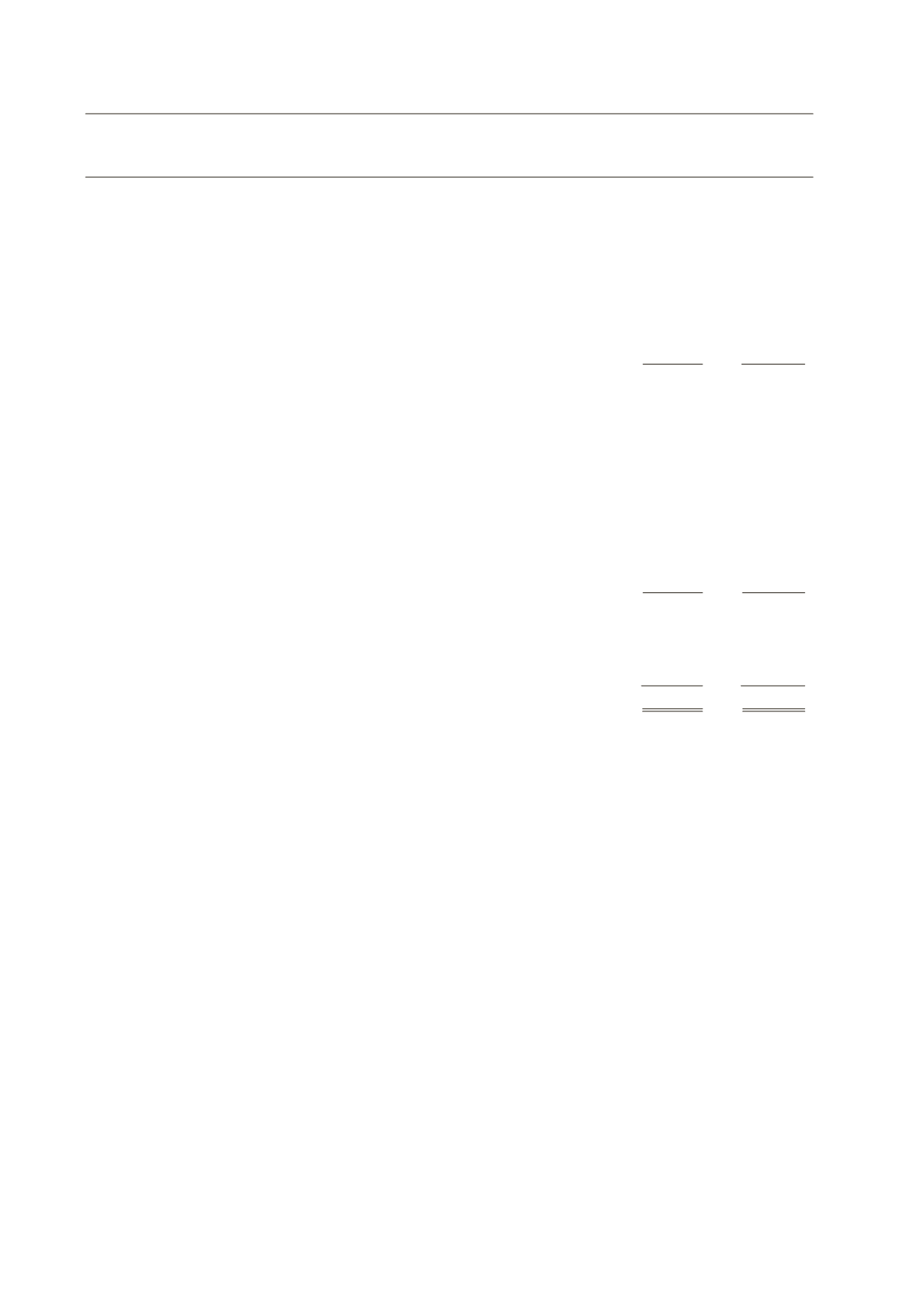

21. Cash from operations

Notes

2012

2011

$

$

Loss before taxation from continuing operations

(378,669)

(457,252)

Profit/(loss) before taxation from discontinued operations

–

9,411

Loss before taxation

(378,669)

(447,841)

Adjustments to reconcile loss before taxation

to net cash generated by operating activities:

Depreciation

8

149,486

170,979

Impairment charges and write offs

3

88,552

79,386

Interest expense net of interest income

5

244,655

187,960

Restructuring expenses

4

49,143

103,201

ESOP share allocation and sale of shares net of dividends

–

3,385

Other post-retirement benefit expense

4,985

3,277

Pension plan expense

8,375

8,815

Loss on disposal of property, plant and equipment

3

6,806

3,429

Gain from disposal of subsidiary

–

(11,092)

Other non-cash items

–

3,907

173,333

105,406

Changes in net current assets

(Increase)/decrease in inventories

(65,642)

12,053

Increase in receivables and prepayments

(2,217)

(22,966)

Increase in payables and accruals

61,004

65,947

166,478

160,440

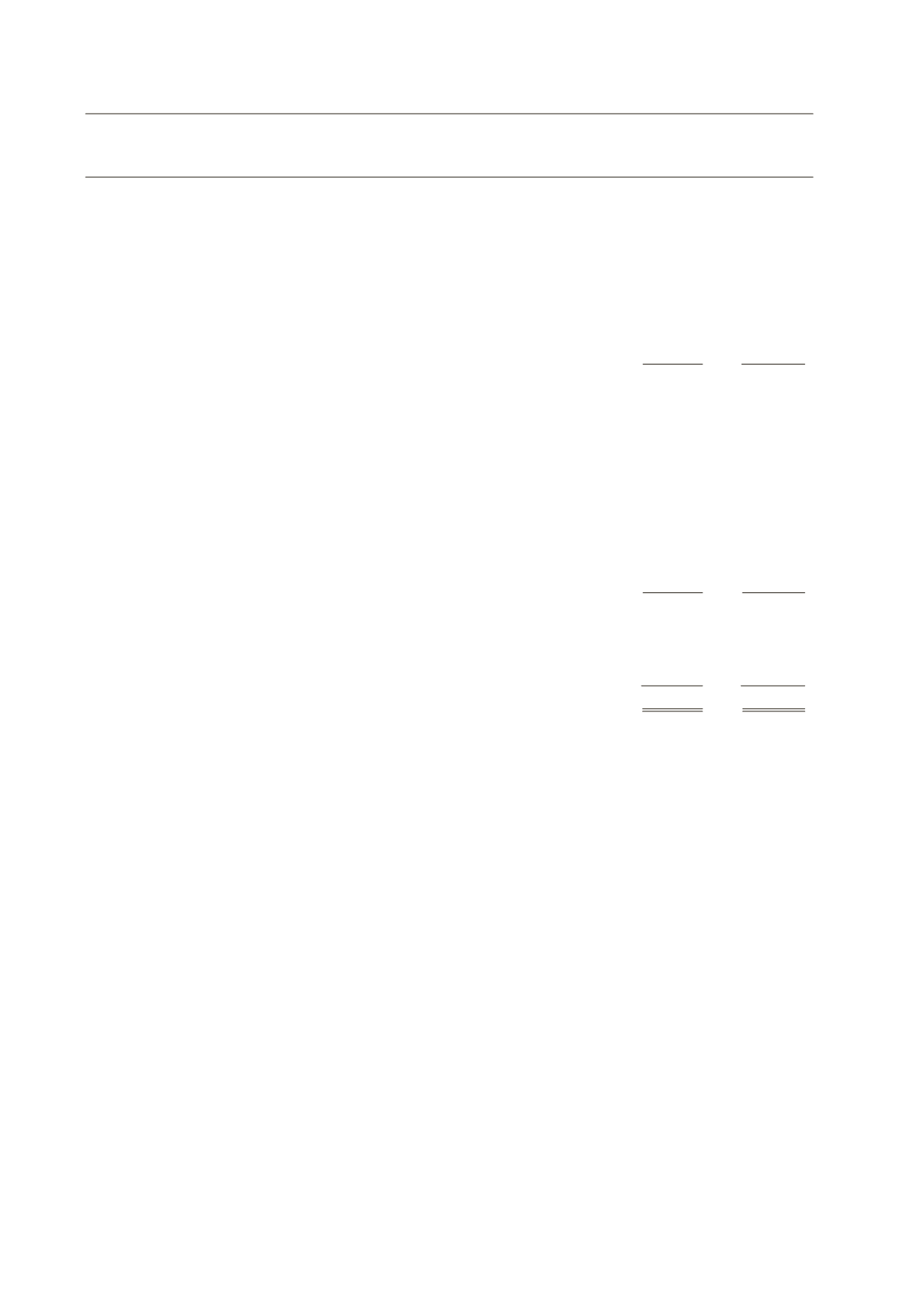

22. Fair value and fair value hierarchies

The fair values of cash at bank and on hand, receivables, payables and borrowings approximate their carrying amounts

due to the short term and/or callable nature of these instruments. The fair values of these instruments and long term

borrowings are presented below:

Carrying amount

Fair value

Carrying amount

Fair value

2012

2012

2011

2011

$

$

$

$

Financial assets:

Cash at bank

43,061

43,061

57,755

57,755

Trade receivables

121,316

121,316

126,434

126,434

Financial liabilities:

Bank overdraft and short-term advances

31,902

31,902

447

447

Borrowings

2,046,126

2,046,126

1,678,363

1,678,363

Trade payables

180,146

180,146

184,399

184,399

Interest and finance charges

1,779

1,779

231,841

231,840