63

Notes to the Consolidated Financial Statements (continued)

For the year ended 31 December, 2012

(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)

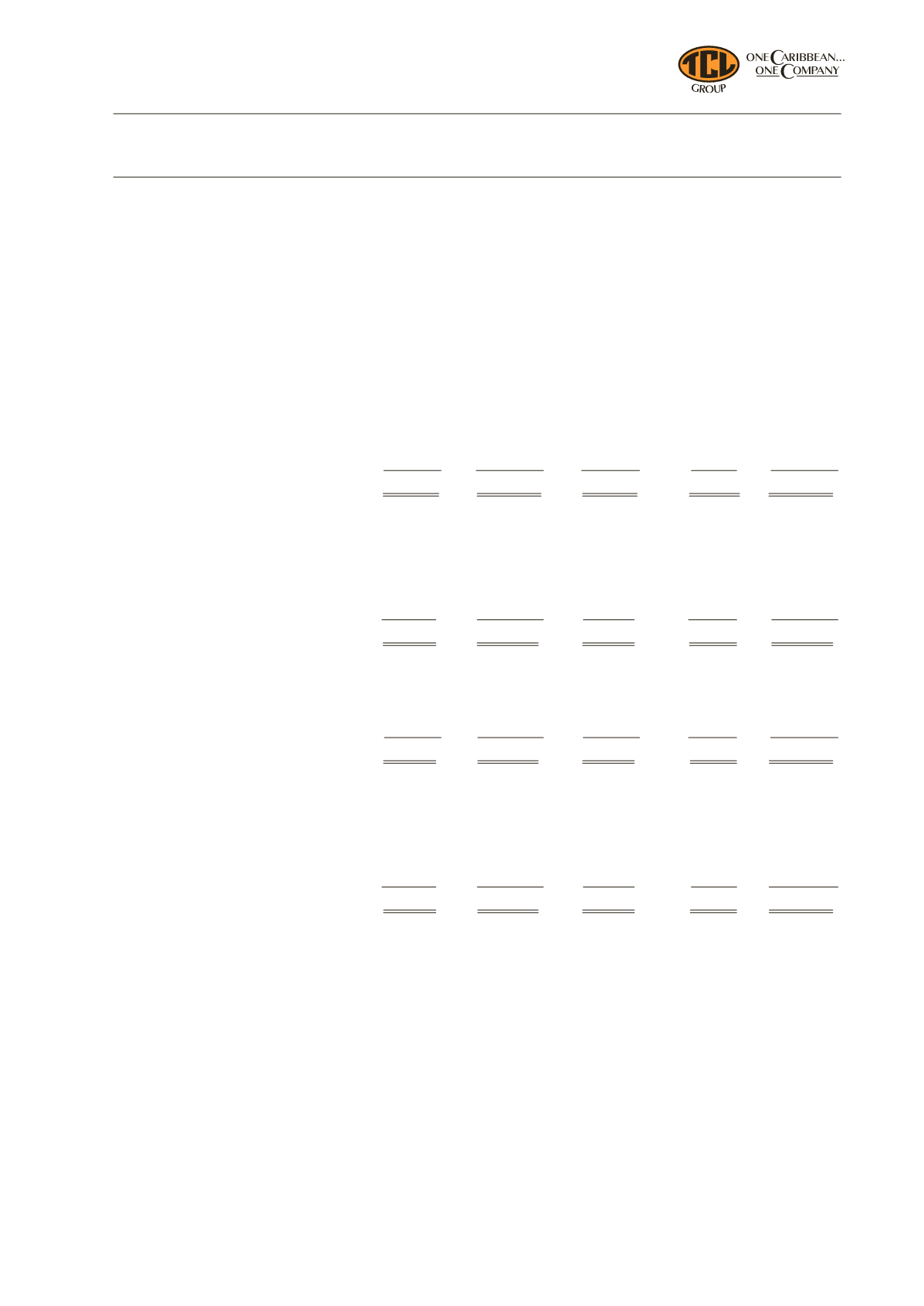

8. Property, plant and equipment

Plant,

machinery

and

Office

equipment

furniture

Capital

Land and

and motor

and

work in

buildings

vehicles

equipment

progress

Total

$

$

$

$

$

At 31 December, 2012

Cost

460,922

3,307,046

96,093

44,634

3,908,695

Accumulated depreciation

and impairment

(170,928)

(1,573,235)

(75,990)

–

(1,820,153)

Net book amount

289,994

1,733,811

20,103

44,634

2,088,542

Net book amount

1 January, 2012

294,542

1,914,109

25,191

43,452

2,277,294

Exchange rate adjustments

(9,637)

(18,521)

(360)

(1,399)

(29,917)

Additions and transfers

6,711

37,056

1,070

33,076

77,913

Disposals and adjustments

9,129

14,314

540

(30,495)

(6,512)

Depreciation charge

(10,751)

(132,397)

(6,338)

–

(149,486)

Impairment charge and write off

–

(80,750)

–

–

(80,750)

31 December, 2012

289,994

1,733,811

20,103

44,634

2,088,542

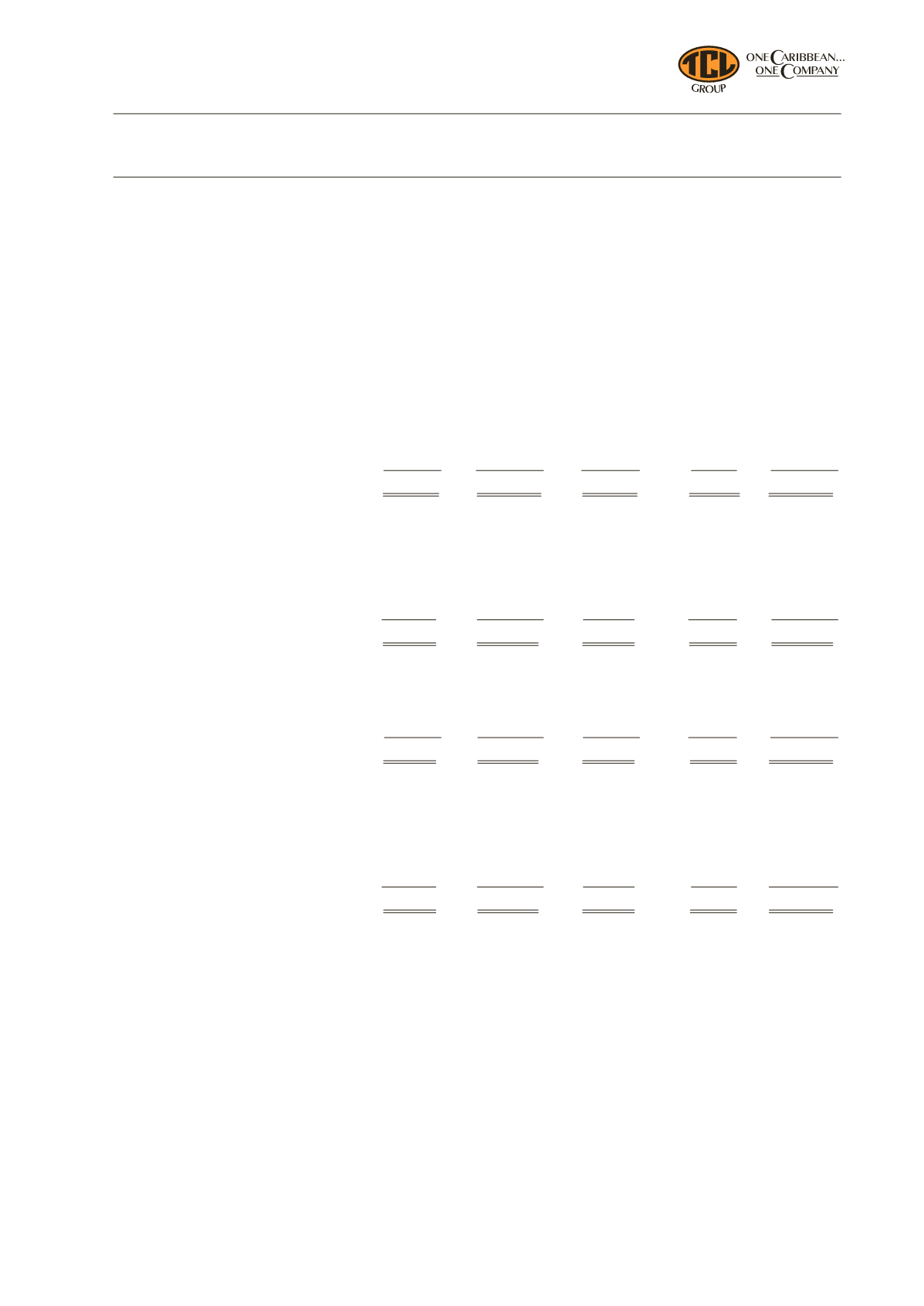

At 31 December, 2011

Cost

459,335

3,315,849

108,568

43,452

3,927,204

Accumulated depreciation

and impairment

(164,793)

(1,401,740)

(83,377)

–

(1,649,910)

Net book amount

294,542

1,914,109

25,191

43,452

2,277,294

Net book amount

1 January, 2011

305,283

2,117,936

34,518

35,469

2,493,206

Exchange rate adjustments

(760)

(1,695)

(45)

(203)

(2,703)

Additions and transfers

1,468

28,893

2,174

8,186

40,721

Disposals and adjustments

(43)

(3,062)

(460)

–

(3,565)

Depreciation charge

(11,406)

(148,577)

(10,996)

–

(170,979)

Impairment charge and write off

–

(79,386)

–

–

(79,386)

31 December, 2011

294,542

1,914,109

25,191

43,452

2,277,294

The net carrying value of assets held under finance leases within property, plant and equipment amounted to $4.9million

(2011: $7.1 million) as at 31 December, 2012. It is the Group’s policy to capitalise interest on borrowings specific to capital

projects during the period of construction. No borrowing costs were capitalised in 2012 (2011: Nil).

In accordance with IAS 36, management tested and as a consequence further impaired the Kiln 4 asset in Jamaica and

recorded an impairment loss of $77.9 million in 2012 (2011: $61.3 million). Additionally, part of the asset was considered

obsolete which was written off by the amount of $2.9 million (2011: $18.1 million) (refer to Note 3).