Trinidad Cement Limited

Annual Report 2012

60

Notes to the Consolidated Financial Statements (continued)

For the year ended 31 December, 2012

(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)

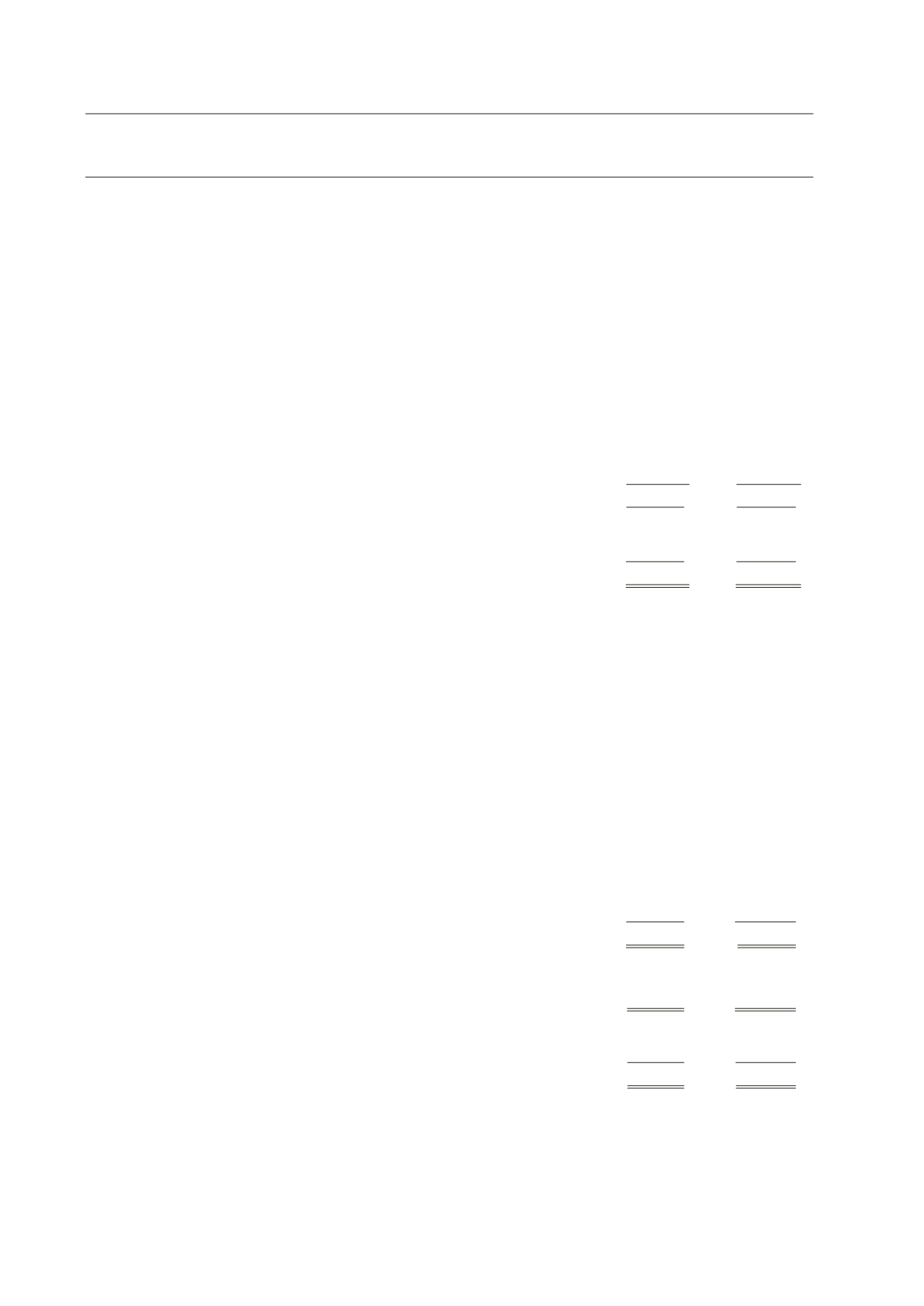

3. Operating profit – continuing operations

2012

2011

$

$

Revenue

1,615,888

1,560,860

Less expenses:

Personnel remuneration and benefits (see below)

435,629

433,698

Raw materials and consumables

234,592

172,989

Fuel and electricity

390,210

412,712

Operating expenses

251,389

213,779

Equipment hire and haulage

142,262

155,400

Repairs and maintenance

95,136

95,933

Changes in finished goods and work in progress

(78,919)

2,332

Other income (see below)

(14,384)

(13,686)

Earnings before interest, tax and depreciation

159,973

87,703

Depreciation

149,486

170,979

Impairment charges and write-offs (Note 8 & 11)

88,552

79,386

Loss on disposal of property, plant and equipment

6,806

3,429

Operating loss

(84,871)

(166,091)

Impairment charges and write-offs

Included under plant and machinery is the Kiln 4 assets which is currently not operating. In accordance with IAS 36:

“Impairment of assets”, management assessed the kiln 4 assets for impairment and determined that an impairment

provision of $77.9 million, (2011: $61.3 million) was necessary to effectively write down the asset to its’ recoverable

amount. In accordance with IAS 2: “Inventories” a write-down of $7.8 million has been recognised as an expense for

spares relating to the idle Kiln 4 asset. The write downs arise from the delay in the projected reactivation of the assets.

Additionally, part of the asset was considered obsolete resulting in the write off of $2.9 million (2011: $18.0 million).

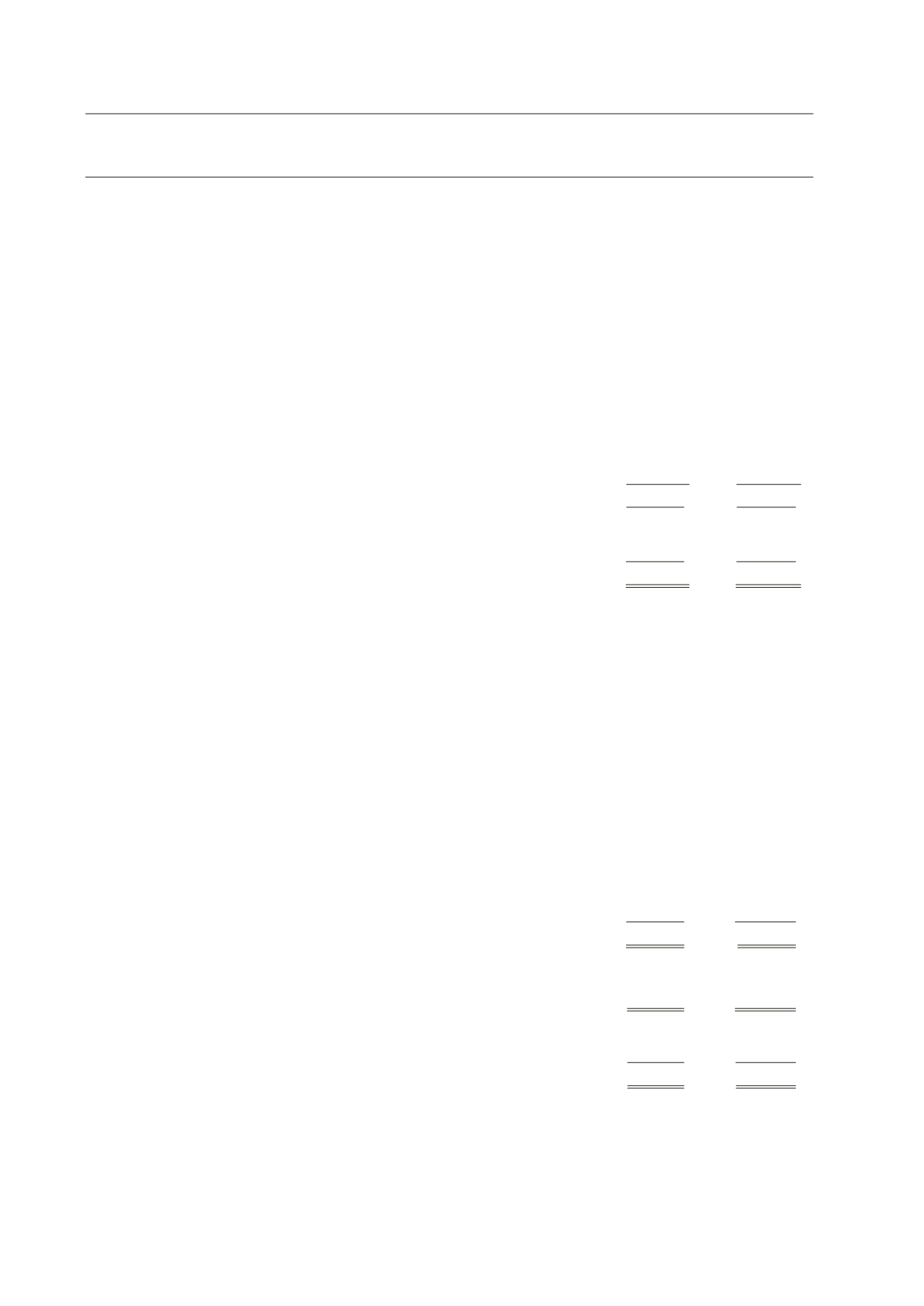

2012

2011

$

$

Personnel remuneration and benefits include:

Salaries and wages

349,049

356,063

Other benefits

47,450

38,972

Statutory contributions

18,927

18,698

Pension costs – defined contribution plan

4,029

3,999

Termination benefits

7,623

7,151

Net pension expense – defined benefit plans (Note 10 (b))

8,551

8,815

435,629

433,698

Operating profit is stated after deducting directors’ fees of:

Directors’ fees

792

790

Other income includes:

Delivery and trucking services

2,209

4,650

Miscellaneous income

12,175

9,036

14,384

13,686

4. Restructuring expenses

The debt restructuring expenses comprise stamp duty of $11.6 million (2011: nil), legal and advisory fees of $24.9 million

(2011: $40.4 million), previously unamortised fees on the original loans of $12.6 million (2011: nil), acceptance fees of nil

(2011: $35.3 million) and swap termination cost of nil (2011: $27.5 million).