Trinidad Cement Limited

Annual Report 2012

62

Notes to the Consolidated Financial Statements (continued)

For the year ended 31 December, 2012

(Expressed in Thousands of Trinidad and Tobago Dollars, except where otherwise stated)

6. Taxation

(continued)

2012

2011

$

$

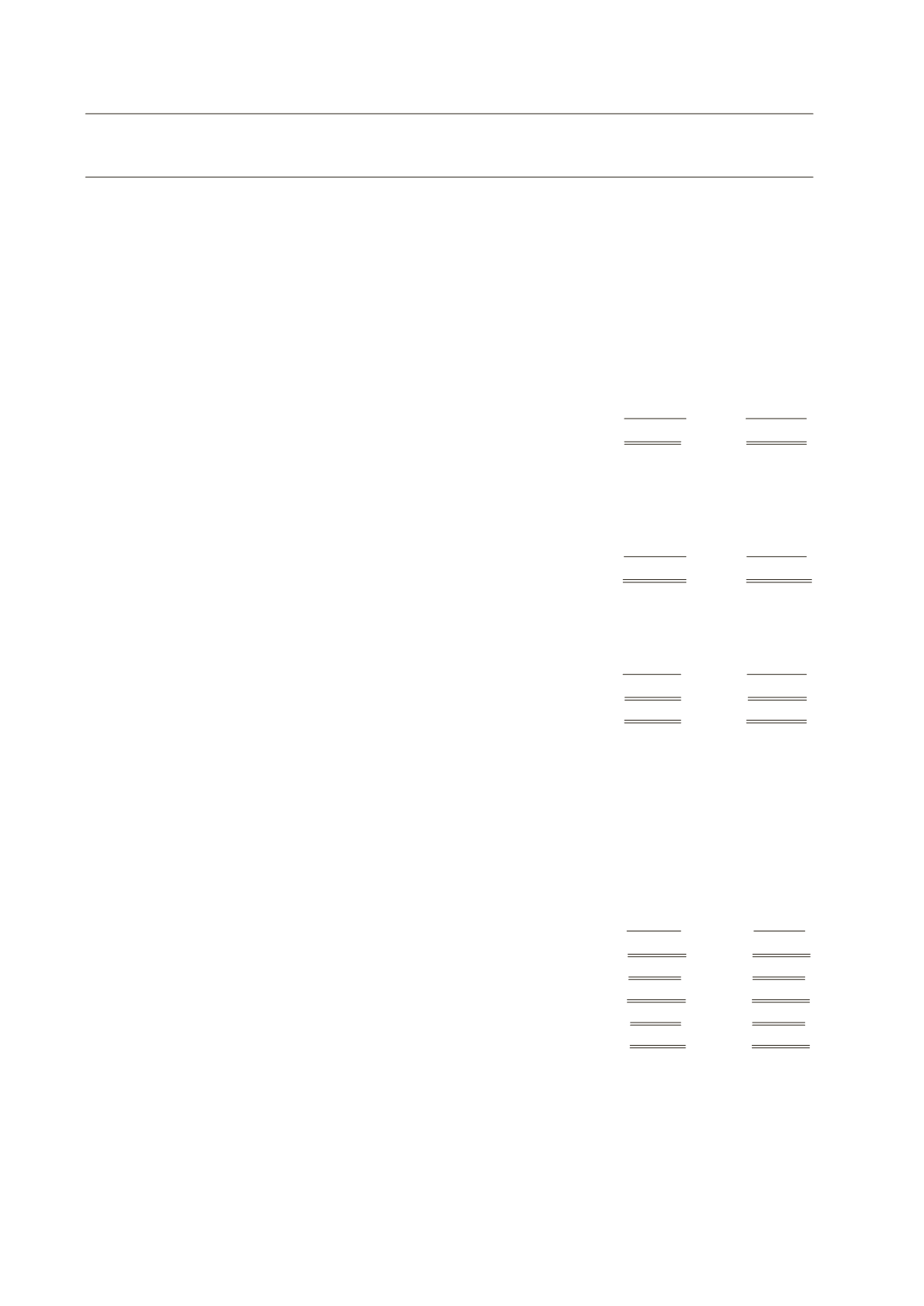

c) Movement in deferred tax net balance:

Net balance at 1 January

54,981

(19,781)

Exchange rate and other adjustment

(1,399)

(154)

Charge to hedging reserve

–

(7,661)

(Charge)/credit to earnings

(3,044)

82,577

Net balance at 31 December (Note 6 (d))

50,538

54,981

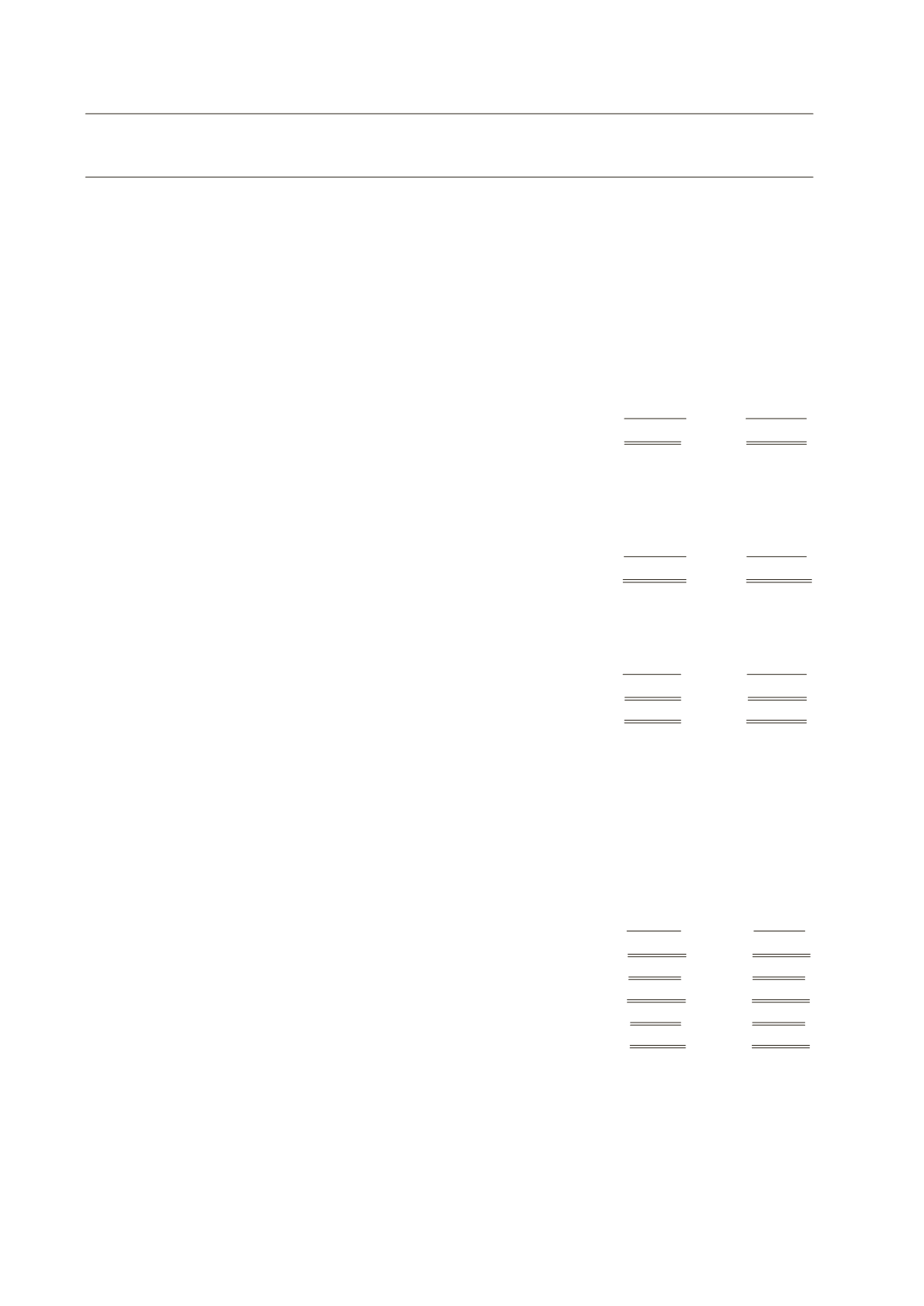

d) Components of the deferred tax assets/(liabilities) are as follows:

Deferred tax liabilities:

Property, plant and equipment

(294,850)

(312,872)

Pension plan assets

(57,461)

(56,821)

Others

(2,294)

–

Balance at 31 December

(354,605)

(369,693)

Deferred tax assets:

Tax losses carry forward

274,333

327,974

Capital allowances carry forward

40,111

34,298

Interest accrual

71,690

32,872

Others

19,009

29,530

Balance at 31 December

405,143

424,674

Net deferred tax asset

50,538

54,981

7. Earnings per share

2012

2011

$

$

The following reflects the income and share data used in the

earnings per share computation:

Net loss for the year attributable to equity holders of the Parent

- continuing operations

(319,949)

(331,997)

Net profit/(loss) for the year attributable to equity holders of the Parent

- discontinued operations

–

6,682

Net loss for the year attributable to equity holders - total Group

(319,949)

(325,315)

Weighted average number of ordinary shares issued (thousands of units)

245,869

245,869

Basic loss per share – continuing operations (expressed in $ per share)

($1.30)

($1.35)

Basic earnings/(loss) per share – discontinued operations (expressed in $ per share)

$0.00

$0.03

Basic loss per share – total (expressed in $ per share)

($1.30)

($1.32)

The balance of the TCL Employee Share Ownership Plan relating to the cost of unallocated shares held by the Plan is

presented as a separate component in equity.The weighted average number of unallocated shares of 3.896million (2011:

3.896million) held by the Plan during the year is deducted in computing the weighted average number of ordinary shares

in issue. The Group has no dilutive potential ordinary shares in issue.