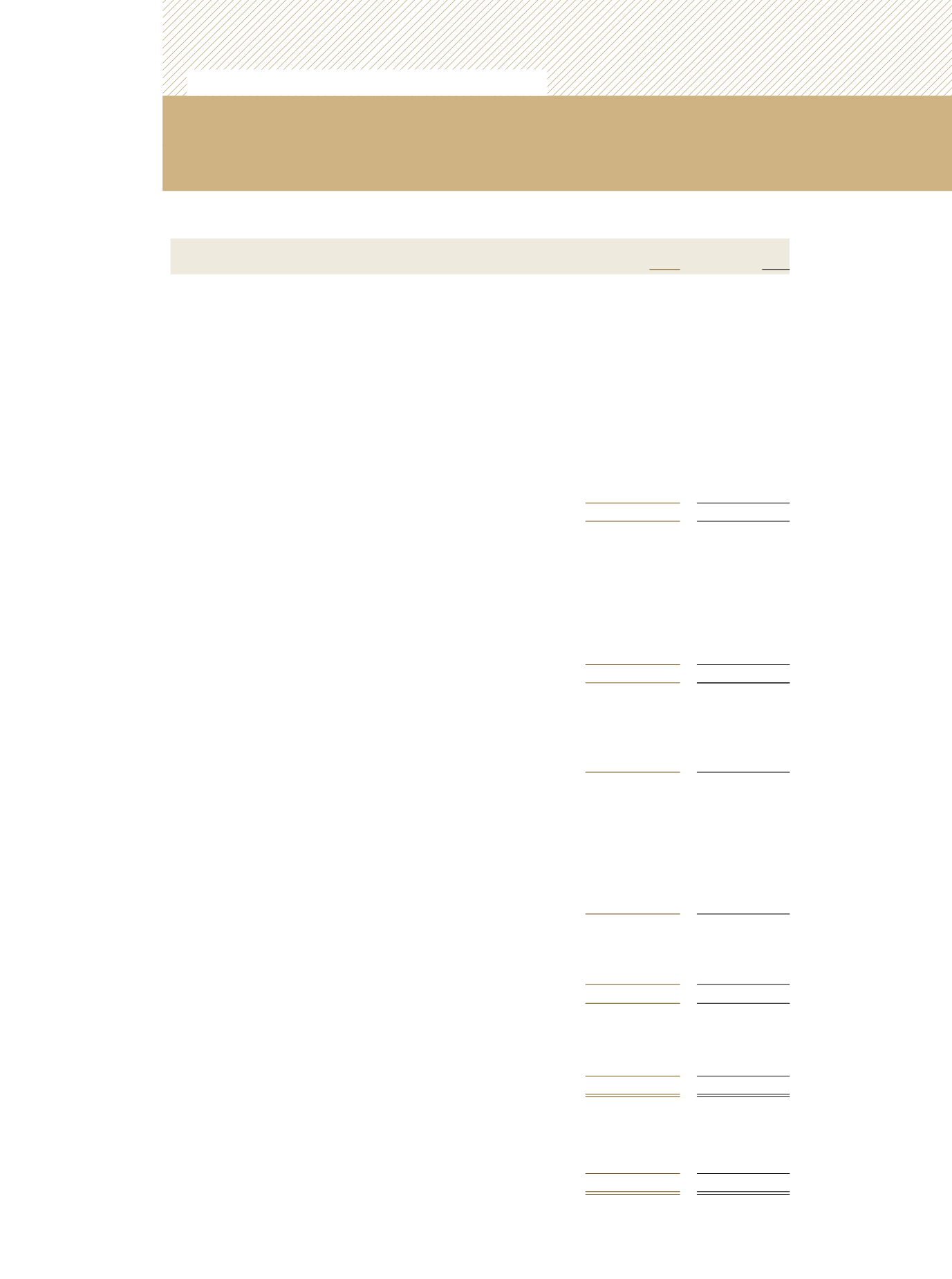

A2

Consolidated Statement of

INCOME

For the year ended 31 December, 2012

Expressed in Trinidad and Tobago dollars

Notes

31-Dec-12

$ ‘000

31-Dec-11

$ ‘000

CONTINUING OPERATIONS

INCOME

Investment Income -

Growth & Income Fund

235,015

176,437

TT$ Income Fund

440,894

360,604

Universal Retirement Fund

12,136

8,292

US$ Income Fund

19

126,949

150,694

Net Investment Income - Group Operations

20

31,299

20,071

Realized Gains Re-classified from Equity

21

154,989

-

Initial Charge

8,818

7,191

Other Income

23,720

13,229

Total Income

1,033,820

736,518

EXPENSES

Commissions

(17,368)

(15,851)

Impairment

23

(314,322)

-

Administrative

24

(222,471)

(201,713)

Depreciation and Amortisation

(20,571)

(20,535)

Provision for Sinking Fund Liability

(5,782)

(7,805)

Total Expenses

(580,514)

(245,904)

Net Income before Finance Charges

453,306

490,614

Finance Charges

26

(235)

(324)

Net Income after Finance Charges

453,071

490,290

Undistributed Income at beginning of year

7,443

1,423

Distributions

27

(258,859)

(354,770)

Transfer from Investment Funds to Reserves

(76,729)

(23,565)

Income Capitalized

(5,883)

(4,475)

Undistributed Income at end of year

(13,522)

(7,443)

Net Income before Taxation from Continuing Operations

105,521

101,460

Taxation

8

(7,287)

(5,802)

Net Income after Taxation from Continuing Operations

98,234

95,658

DISCONTINUED OPERATIONS

Net Loss from Discontinued Operations

28

-

(24,825)

Net Income for the year

98,234

70,833

Net Income Attributable to:

Owners of the Parent

94,442

79,959

Non-controlling Interest

3,792

(9,126)

98,234

70,833

Trinidad and Tobago Unit Trust Corporation

Unit Trust Corporation

Annual Report 2012

The accompanying notes form an integral part of these consolidated financial statements.