62 |

P a g e

TRINIDAD CEMENT LIMITED

SECTION 9: OTHER INFORMATION

(Continued)

9.3 MATERIAL LITIGATION/ CLAIMS

(Continued)

The Company cannot assure you that these or other legal proceedings will not materially affect its ability to

conduct its business in the manner that it expects or otherwise adversely affect the Company should an

unfavorable ruling occur.

As of the date of this Information Memorandum, there are no material product defect claims pending against

the Company. Accordingly, the Company’s existing accruals for claims against the Company do not reflect

any material amounts relating to product defect claims. While the Company’s management is not aware of

any facts that would reasonably be expected to lead to material product defect claims against the Company

that would have a material adverse effect on its business, financial condition or results of operations, it is

possible that claims could be asserted against the Company in the future. Due to the inherent uncertainties

associated with estimating unasserted claims in its business, the Company cannot estimate the amount of any

future loss that may be attributable to unasserted product defect claims related to cement and pre-mixed

concrete.

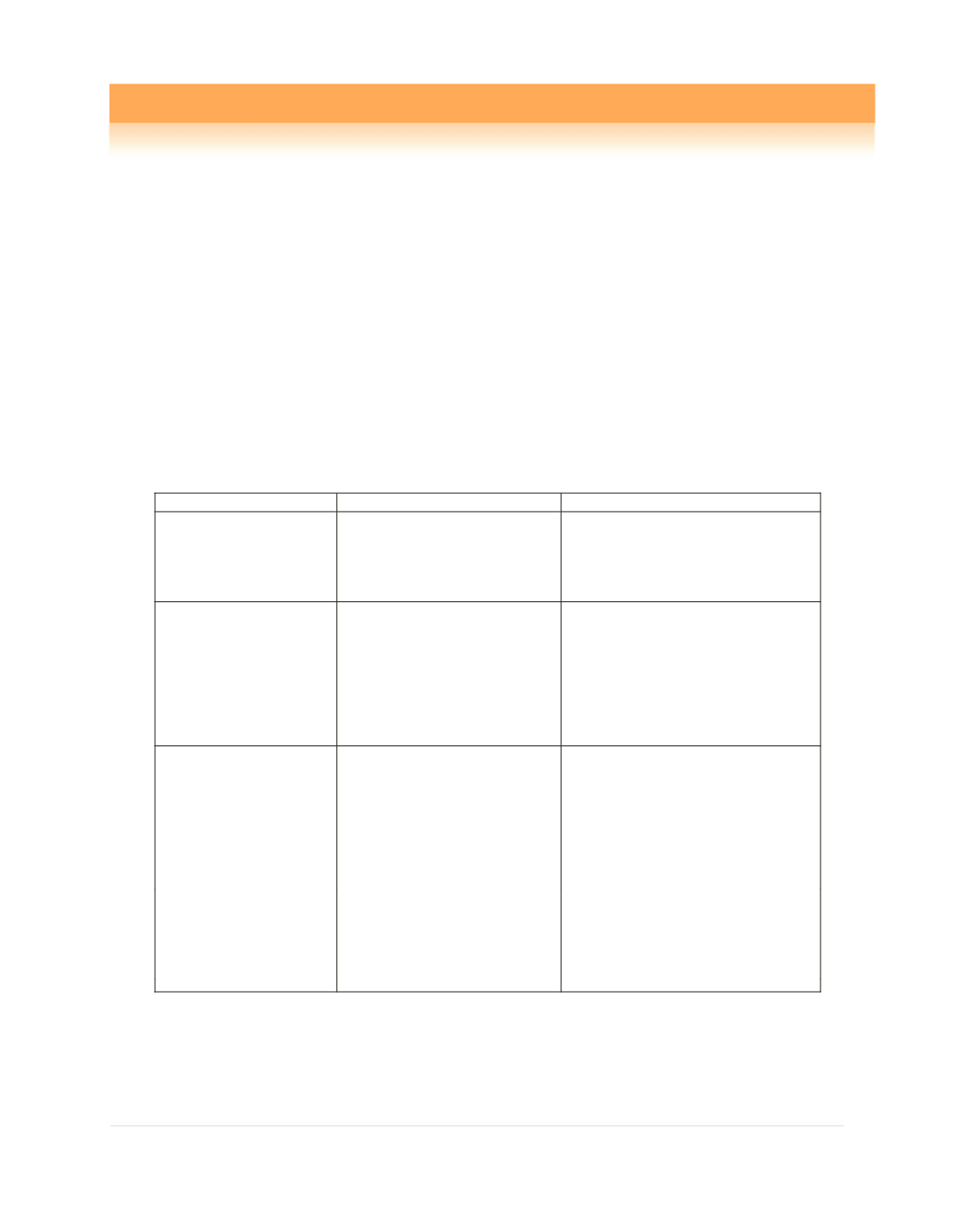

A summary of material ongoing litigation/ claims follows:

Matter

Details and Status

Amount of Claim

Pre-Action Protocol –

Wrongful dismissal of Dr.

Rollin Bertrand

L

egal Rep. Mr. Stuart

Young

Claim for compensation re

wrongful dismissal.

TT$9.5M

TCL Trinidad v the

Board of Inland

Revenue

The Board of Inland Revenue

has audited the Corporation Tax

Returns and raised assessments

adjusting the Tax Losses of the

company by $102.1 M in respect

of Tax Year 2007 and $284.4 M

in respect of Tax Year 2008.

$102.1M and $284.4M - The

Company has lodged objections to

these assessments and awaits a

determination by the Board of Inland

Revenue. The Company is of the view

that its claim is well supported in law

and will continue to defend its

position in the resolution process.

TCL Guyana Inc. v.

Attorney General of

Guyana

Legal Rep. Hughes ,

Fields & Stoby

Dispute re Terms of the MOU -

Corporate Tax Rate of 35%

(reduced to 30% from 1 January

2011) included in the MOU. A

rate of 45% (reduced to 40%

from 1 January 2011) will be

applicable if the concession of

the MOU is repealed.

Maintenance of 35% tax rate up to

2010 and 30% thereafter.

Should the matter be resolved in

favour of the Government, the amount

payable as at December 2014 amounts

to TT$23M (including interest).

CV2012-01912, H.C.A

S-587 of 2000

SHEIK

LISHA v. TCL

Legal Rep. M.G. Daly &

Partners

Negligence / Unfair

Competition.

$26,000 per month since or about the

year 2001, and interest estimated at

$3.7M.

The Company believes that the resolution of all litigation currently pending or threatened against

the Company or any of its subsidiaries will not materially exceed its existing accruals for those

matters.