25

Distribution of Shareholding

Individuals

25.51%

Banks/Pension Funds

24.58%

Sierra Trading

20.00%

NIB

10.16%

Baleno Holding

8.21%

Unit Trust

4.49%

Other Foreign Investors

4.03%

Insurance Companies

3.02%

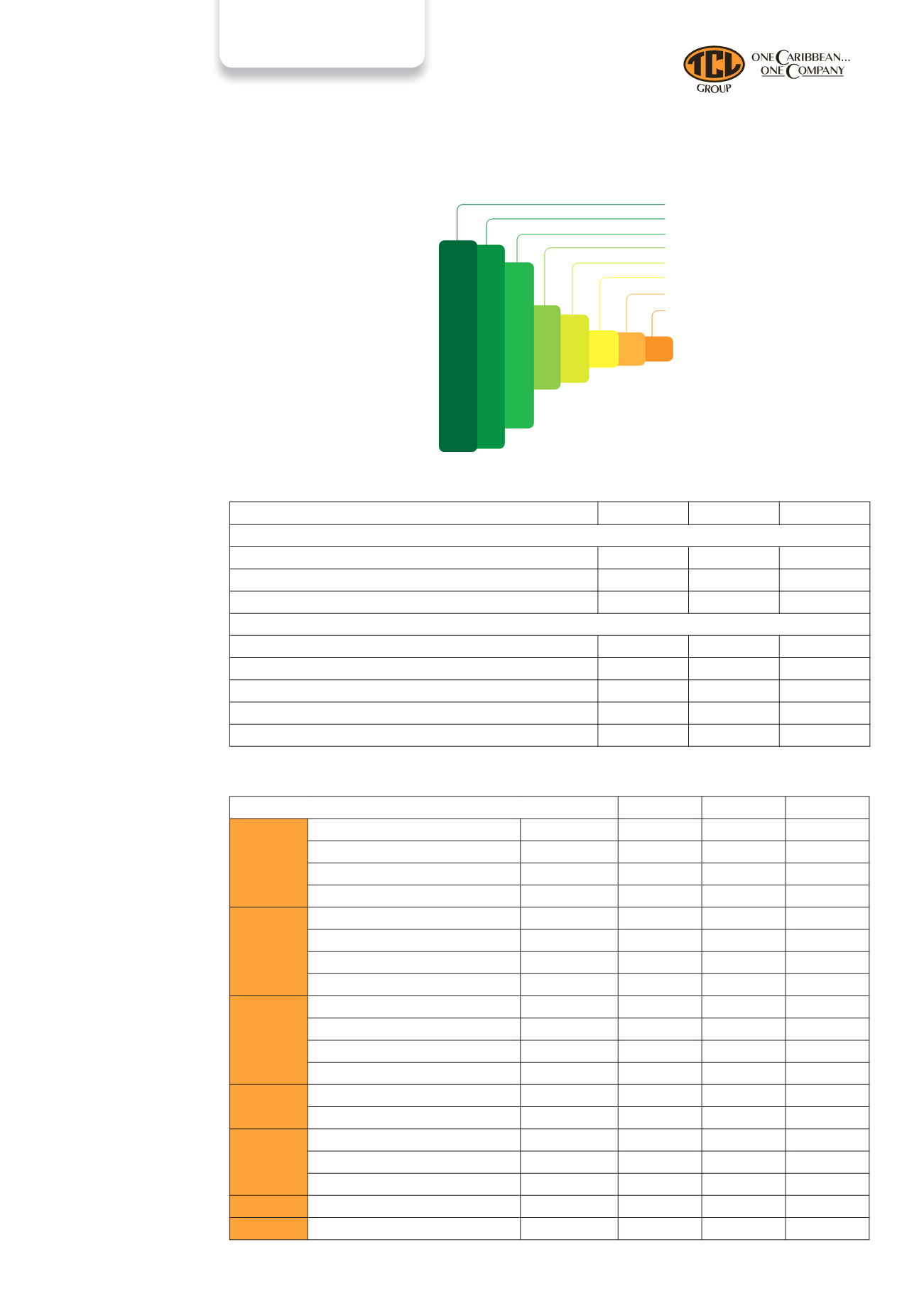

2012

2011 % Change

TCL

Clinker production

‘000 tonnes

494.2

656.4

-24.7%

Cement sales - Local

“

511.6

535.2

-4.4%

Cement sales - Export (3rd party)

“

180.1

292.2

-38.4%

Cement sales - Total

“

691.7

827.4

-16.4%

CCCL

Clinker production

‘000 tonnes

652.6

628.3

3.9%

Cement sales - Local

“

536.3

553.1

-3.0%

Cement sales - Export (3rd party)

“

203.8

216.8

-6.0%

Cement sales - Total

“

740.1

769.9

-3.9%

ACCL

Clinker production

‘000 tonnes

159.7

184.1

-13.2%

Cement sales - Local

“

98.4

110.4

-10.9%

Cement sales - Export (3rd party)

“

69.6

112.2

-37.9%

Cement sales - Total

“

168.0

222.6

-24.5%

TPL

Paper sack production

millions

19.4

31.8

-38.9%

Paper sack sales

“

26.8

32.8

-18.2%

TPM

Sling production

thousands

308.2

393.5

-21.7%

Sling sales

“

325.7

375.4

-13.2%

Jumbo bag sales

“

16.3

33.5

-51.3%

RML Group

Concrete sales – T&T, Barbados

‘000m

3

111.2

108.6

2.4%

JGQ

Gypsum sales

‘000 tonnes

64.8

79.5

-18.5%

2012

2011 % Change

Income Statement

Group Third Party Revenue $m

1,615.90 1,560.86

3.5%

Group (Loss)/Profit attributable to Shareholders $m

(319.95)

(325.32)

1.7%

Foreign exchange earnings $m

279.6

271.9

2.8%

Balance Sheet

Total Assets $m

3,787.81

3,953.05

-4.2%

Shareholders’ Equity $m

807.16

1,125.70

-28.3%

Net Assets per Share $

3.14

4.68

-32.9%

Total Long Term Debt $m

2,046.12

1,678.40

21.9%

Total Long Term Debt to Equity Ratio %

260.75

143.68

81.5%

Operational Highlights

Group Performance Highlights

The Year in Review